Dollar ended the week as the strongest major currency on optimism that Republicans are on track to get the tax bill passed by the end of the year. However, there was certain indecisiveness in Dollar’s rally. In particular, the greenback lost momentum as wage growth in non-farm payroll report disappointed. That added to concerns of lack on inflationary pressure, and thus could slow down Fed’s tightening pace. But there are two sides of every coin as the greenback just lost momentum, but not reversed. Dollar will look into this week’s FOMC rate hike and economic projections for guidance.

Meanwhile, Sterling ended as the second strongest one as after a lot of drama, there was finally a breakthrough in Brexit negotiation. The EU summit on December 14/15 will now be formality only. The negotiation teams got the approval for moving to the next phase of trade talks already. The Pound, however, also lost much momentum after the news as they became facts. Swiss Franc ended the week as the weakest one on risk appetite. Canadian Dollar followed as the second weakest as the cautious BoC statement ruled out any chance of January rate hike. Australian Dollar closed as the third weakest after RBA gave no hint of any intention to tighten.

Four central banks will meet this week, including Fed, SNB, ECB and BoE. FOMC will be the major focus and the other three will likely be non-events.

Dollar rally lacks decisiveness, looks forward to FOMC

Technically developments in the Dollar were positive but not decisive. The greenback hesitated again after non-farm payroll remain showed lower than expected wage growth. CPI and FOMC rate decision on the coming Wednesday will now be the keys to Dollar’s rally. Fed is widely expected to high the federal funds rate by 25bps to 1.25-1.50%. There is little chance that Fed will disappoint. The vote split will be the first thing to watch as it could signal how worried policy makers are on inflation. Minneapolis Fed President Neel Kashkari would very likely dissent the hike again. Chicago Fed President Charles Evans could be another dissenter. The vote split could be seen a hawkish if only Kashkari dissents, and dovish in three or more dissent.

New economic projections will be watched next. Back in September, Fed projected GDP to growth 2.4% in 2017, 2.1% in 2018 and 2.0% in 2019. Unemployment rate was projected to be at 4.3% in 2017, 4.1% in 2018 and 4.1% in 2019. It’s with little doubt that Fed will lower unemployment rate forecasts and possibly upgrade GDP forecasts too.

For inflation, PCE was projected to be at 1.6% in 2017, 1.9% in 2019 and 2.0% in 2019. Core PCE was forecast to be at 1.5% in 2017, 1.9% in 2018 and 2.0% in 2019. Headline PCE slowed from 1.7% to 1.6% in October while core PCE was unchanged at 1.4% yoy. There is no clear sign so far that inflation will pick up in 2018 to meet Fed’s own projections. And there are risks of downward revisions in the forecasts, and that could be dollar negative.

FOMC September Projections

Markets unconvinced of two hikes by June

Meanwhile, Fed’s own interest rate projections showed federal funds rate to hit 2.1% in 2018 and 2.7% in 2019. That is, a little less than three more hikes in 2018. Fed funds futures are pricing in more than 60% chance of another rate hike in March, clearly higher than around 40% chance a month ago. But they’re much less convinced of another hike by June. Futures are pricing in less that 40% chance of that. Any changes to Fed’s own rate projection would trigger sharp volatility in the greenback.

Dollar index to take on 94.16 resistance

Technically, Dollar index’s rebound last week affirmed the view that pull back from 95.15 has completed at 92.49 after hitting 61.8% retracement of 91.01 to 95.15 at 92.59. The index also closed above flat 55 day EMA, with daily MACD stayed above signal line. These were positive developments. However, the rally was not decisive enough to break through 94.16 resistance to confirm the bullish turn. This 94.16 level, together with 1.1712 support in EUR/USD will be the key levels to watch this week. Firm break of 94.16 will likely resume the rise fro 91.01 through 95.15 to 38.2% retracement of 103.82 to 91.01 at 95.90. However, rejections from these levels will put DXY’s focus back to 91.01, and EUR/USD’s focus back to 1.1960.

TNX struggled in consolidations

10 year yield also showed indecisiveness as it struggled in recently established range below 2.475. Nonetheless, price actions from 2.475 are clearly corrective in nature. TNX managed to hold above 55 day EMA and well above 2.273 key near term support. Hence, outlook stays cautiously bullish for another rise. Break of 2.475 will extend the rise from 2.034 to retest 2.621 key resistance.

Gold confirmed trend reversal

Nonetheless, the sharp fall in gold last week could be seen as a hint of some underlying dollar strength. The firm break of 1260.80 support confirmed resumption of fall from 1357.50. More importantly, the decisive break of medium term channel support also suggests a trend reversal. That is, medium term rise from 1122.81 has completed with three waves up to 1357.50. Near term outlook is bearish for next hurdle at 1205.02 and 61.8% retracement of 1122.81 to 1357.50 at 1212.46. A rebound could be seen from there. But sustained break will bring deeper fall, possibly through 1122.81 low.

Trading strategy

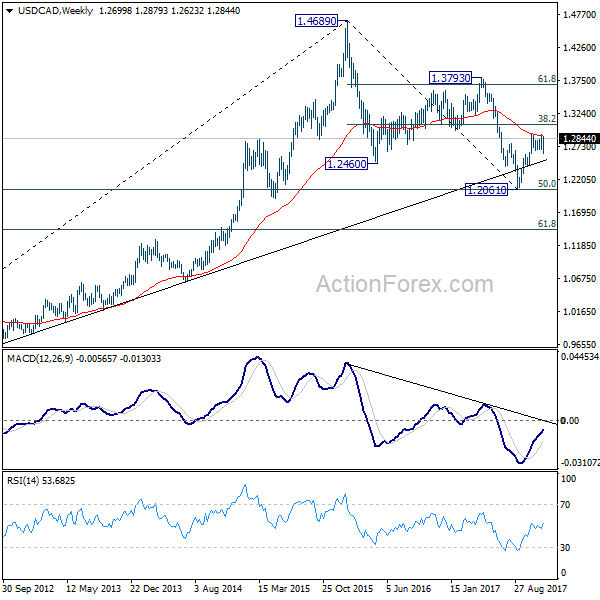

Our sell EUR/GBP at 0.8880 was not filled as the cross just recovered to 0.8867. We’ll cancel the order first. Nonetheless, subsequent downside breakout did affirm our bearish view. In the prior week, Canadian Dollar was lifted by strong employment data which revived speculations of a BoC hike early next year. But such speculation faded after BoC’s cautious statement during the week. We’d expect the Loonie to be back under some selling pressure this week. In particular, USD/CAD is technically ready for another rise should FOMC delivers nothing bearish.

Hence, we’ll buy USD/CAD on break of 1.2916 resistance this week. Technically, our view is that medium term correction from 1.4689 has completed with three waves down to 1.2061. Rise from there would likely target 1.3793 resistance before taking a breath.

USD/JPY Weekly Outlook

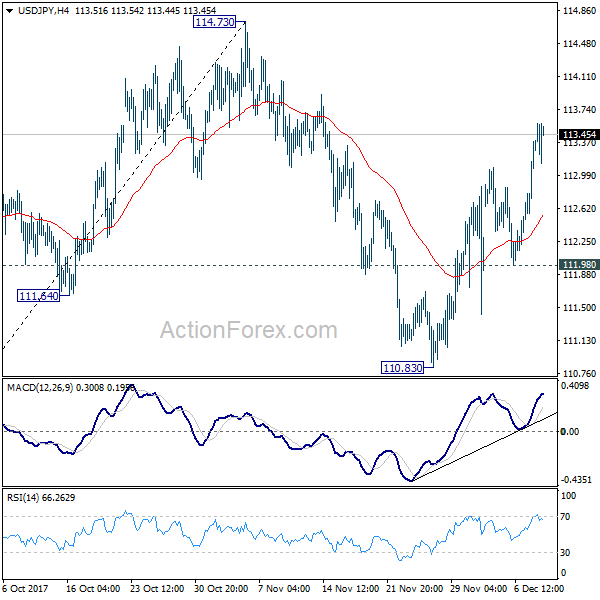

USD/JPY’s rally last week suggests that pull back from 114.73 has completed at 110.83 already. Initial bias stays on the upside this week for 114.73 key resistance. Decisive break there will resume whole rise form 107.31. More importantly, that will confirm completion of medium term correction from 118.65 at 107.31. In that case, retest of 118.65 should be seen next. However, break of 111.98 will extend the correction from 114.73 with another fall, possibly to 61.8% retracement of 107.31 to 114.73 at 110.14 before completion.

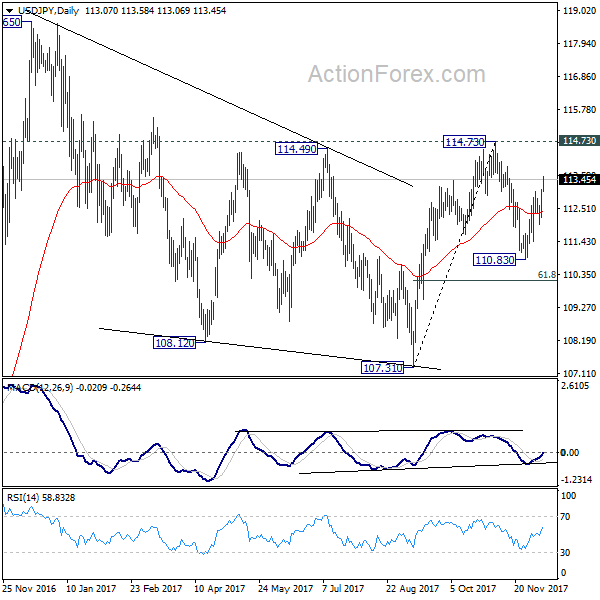

In the bigger picture, we’re holding on to the view that correction from 118.65 is completed a 107.31. And medium term rise from 98.97 (2016 low) is resuming. Sustained break of 114.73 should affirm our view and send USD/JPY through 118.65. However, break of 107.31 will dampen this will and extend the medium term fall back to 98.97 low.

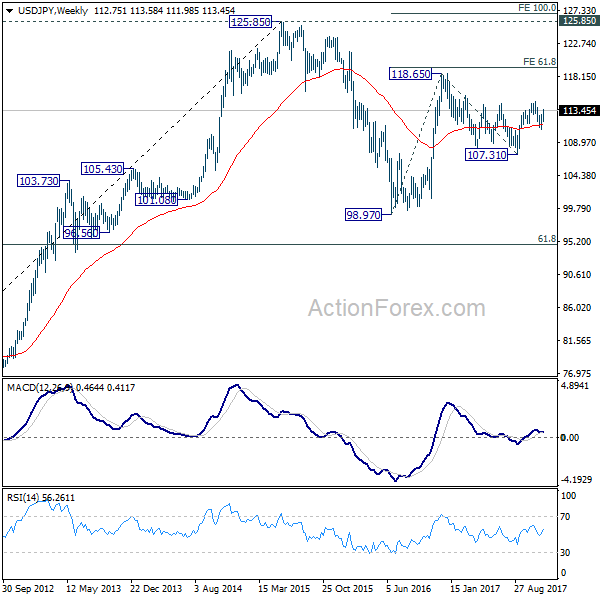

In the long term picture, the rise from 75.56 (2011 low) long term bottom to 125.85 top is viewed as an impulsive move, no change in this view. Price actions from 125.85 are seen as a corrective move which could still extend. In case of deeper fall, downside should be contained by 61.8% retracement of 75.56 to 125.85 at 94.77. Up trend from 75.56 is expected to resume at a later stage for above 135.20/147.68 resistance zone.