Plotting support and resistance levels is often a challenging and subjective task. It is also commonly one of the first areas of price action new traders attempt to tackle.

Support and resistance can be established in numerous ways, such as: trendlines, moving averages, pivot point levels, Fibonacci levels, key high/low points etc. A common complaint with a lot of these methods though is subjectivity.

This is why we believe psychological levels are appealing, as the numbers are effectively embedded within market structure and are entirely objective, as you’ll see going forward.

What are psychological levels?

Say that you’re the proud owner of new car, and a buddy down the pub asks how much it cost. Assuming it set you back $10,999, it’s unlikely that you would tell him that exact figure. Instead, to keep things simple, you’d probably round the number to the nearest thousand i.e. $11,000. And this is exactly what happens in the financial markets! It is far more likely that a trader will select 1.2500 over 1.2493, for example.

Take a look at the EUR/USD H1 chart below.

The red line signifies a key psychological boundary: 1.2000. Personally, we label these numbers ‘full levels’. Apart from parity, they’re the biggest round numbers in the market. For those who do not know what parity is, it is simply when 1 unit of a base currency equals 1 unit of the quote, or counter, currency. The EUR/USD trading at 1.0000 would be parity, for example.

The blue lines highlight additional key levels in the market: 1.2100/1.1900/1.1800. While these barriers do garner attention, they, in our humble view, do not pack as much of a punch as the ‘full levels’ noted above. Traders often label these numbers as ‘whole levels’ or ‘double zeros’.

The green lines show mid-level numbers: 1.2050/1.1950/1.1850. Although price action does respond to these lines, we tend to give them less weight than their bigger brothers mentioned above.

How can I trade psychological levels?

There are a number of techniques that employ these levels, with the most obvious leaning toward either fading or attempting to trade a breakout. Although there are traders out there that do make this work successfully, we found it incredibly challenging.

How we make use of these levels is simple. They form part of our ‘confluence toolbox’ used to confirm an area’s weight. For instance, the H1 demand area shown on the USD/CHF chart below boasts fantastic momentum to the upside (green arrow), thus easily noticeable for the majority of price action traders. But before labelling this as a valid trading zone, it’s essential that the base be confirmed with additional technical tools. As you can see, a few pips above the area there is a psychological level. This, along with the eye-catching demand, increases the odds of a successful trade. With that being said, however, we would not stop there. Further confirming the area using: Fib levels, trendlines and Harmonic patterns add to an area’s tradability.

Be wary of fakeouts around psychological price points

We personally have found no currency to respect round numbers any more than others. What we have seen over time though is how price whipsaws through these levels time and time again.

We’ve all been there (especially in the early stages of our journey) – a large round number approaches and the urge to trade it is strong. We remember back to the countless times these levels held and reversed price 100s of pips. So, we place a pending order with stops pegged 10-15 pips beyond the number. Price then steamrolls its way into the order and then takes our stop. Following this, price painfully reverses and trades in favour, typically leaving the trader frustrated.

You see, these levels are a magnet for orders! It is our belief that the big players in the market know this and, at times, use it to their advantage.

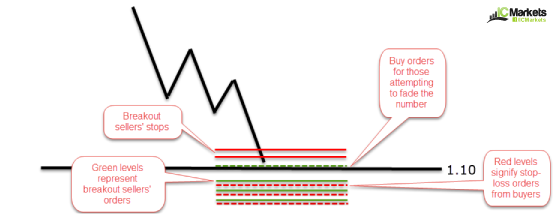

Imagine you’re an institutional trader with deep pockets. Price is approaching a large round number support (1.1000). You know that there are often both buyers looking to fade the level, and sellers looking to sell the breakout. Now say that you and a few other banks collectively begin selling at 1.1020. This forces the market to cross swords with 1.10, which fills buy orders.

Remember, it is at this point that the banks have only sell orders in the market, and in this scenario they need to be long. So, a well-known method in this situation is to run stops below the psychological level, also known as ‘stop hunting’.

With that, upon connecting with 1.10 more bank shorts are pumped into the market to push price into the stop losses, which are in fact sell orders. As these stops are being filled, the banks can then begin unloading shorts (closing a sell position requires liquidity in the form of buy orders: buyers’ stops). Do bear in mind though that there’s not only stops from the buyers below the round number, there’s also sell orders from the breakout sellers! Once bank short positions are liquidated, they can then begin buying.

Depending on how much liquidity is available (buyer stops and breakout sells) this could see price exceed the round number by several pips before the big boys have all, or at least some of their orders filled for a move north, which will at some point also fill the breakout sellers’ stops (buy orders).

We know this is a bit of mouthful to digest, so here is a basic pre-drawn chart for reference:

Just to be clear, we are certainly not saying that this is how price action moves each time a psychological level is in play. It is merely our reasoning behind why fakeouts occur at these price points.

In closing…

Put simply, psychological levels are a wonderful addition to a technician’s toolbox. Using the numbers to add weight to an area has a great deal of value. However, as highlighted above, do keep in mind that the levels are prone to fakeouts, and therefore should not be located near one’s stop loss.