EURCHF Outlook

EUR/CHF Daily Outlook

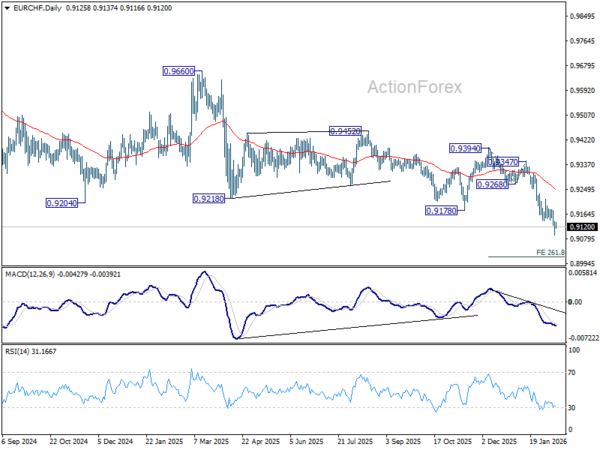

Daily Pivots: (S1) 0.9109; (P) 0.9138; (R1) 0.9163; More....

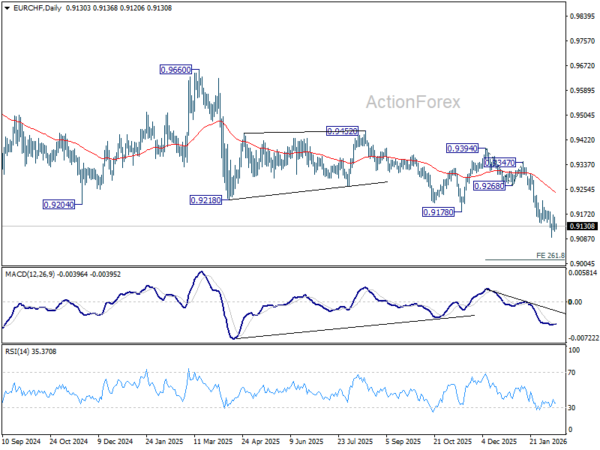

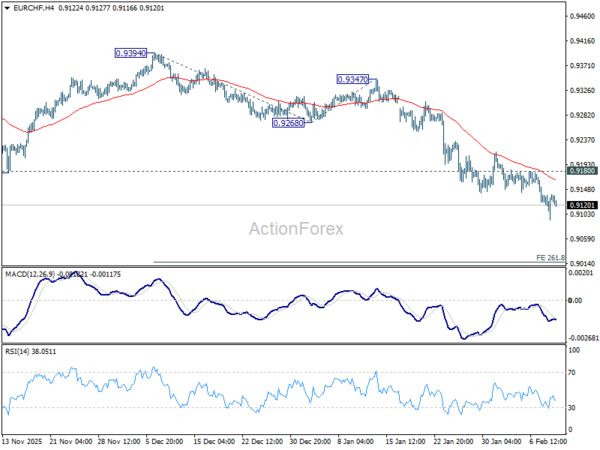

Intraday bias stays neutral in EUR/CHF for consolidations above 0.9092. Further decline is expected as long as 0.9180 resistance holds. Below 0.9092 will resume larger down trend to 261.8% projection of 0.9394 to 0.9268 from 0.9347 at 0.9017 next. However, considering bullish convergence condition in 4H MACD, firm break of 0.9180 will indicate short term bottoming, and bring stronger rebound towards 55 D EMA (now at 0.9242).

In the bigger picture, down trend from 0.9928 (2024 high) is still in progress with falling 55 W EMA (now at 0.9334) intact. Next target is 61.8% projection of 1.1149 to 0.9407 from 0.9928 at 0.8851. Outlook will stay bearish as long as 0.9394 resistance holds, in case of recovery.

EUR/CHF Daily Outlook

Daily Pivots: (S1) 0.9129; (P) 0.9150; (R1) 0.9181; More....

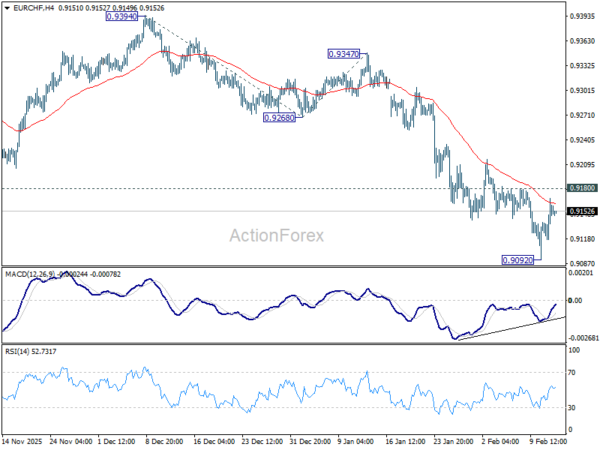

Intraday bias in EUR/CHF is turned neutral first with current recovery. Further decline is expected as long as 0.9180 resistance holds. Below 0.9092 will resume larger down trend to 261.8% projection of 0.9394 to 0.9268 from 0.9347 at 0.9017 next. However, considering bullish convergence condition in 4H MACD, firm break of 0.9180 will indicate short term bottoming, and bring stronger rebound towards 55 D EMA (now at 0.9246).

In the bigger picture, down trend from 0.9928 (2024 high) is still in progress with falling 55 W EMA (now at 0.9334) intact. Next target is 61.8% projection of 1.1149 to 0.9407 from 0.9928 at 0.8851. Outlook will stay bearish as long as 0.9394 resistance holds, in case of recovery.

EUR/CHF Daily Outlook

Daily Pivots: (S1) 0.9105; (P) 0.9125; (R1) 0.9155; More....

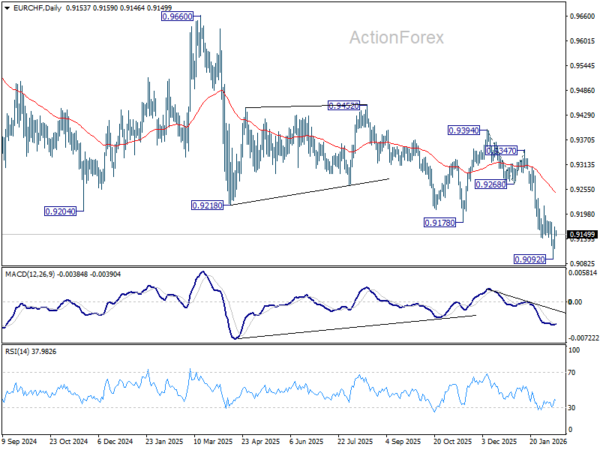

Intraday bias in EUR/CHF remains on the downside at this point. Current down trend should extend to 261.8% projection of 0.9394 to 0.9268 from 0.9347 at 0.9017 next. On the upside, however, break of 0.9180 resistance will now indicate short term bottoming, and bring lengthier consolidations.

In the bigger picture, down trend from 0.9928 (2024 high) is still in progress with falling 55 W EMA (now at 0.9334) intact. Next target is 61.8% projection of 1.1149 to 0.9407 from 0.9928 at 0.8851. Outlook will stay bearish as long as 0.9394 resistance holds, in case of recovery.