EURGBP Outlook

EUR/GBP Weekly Outlook

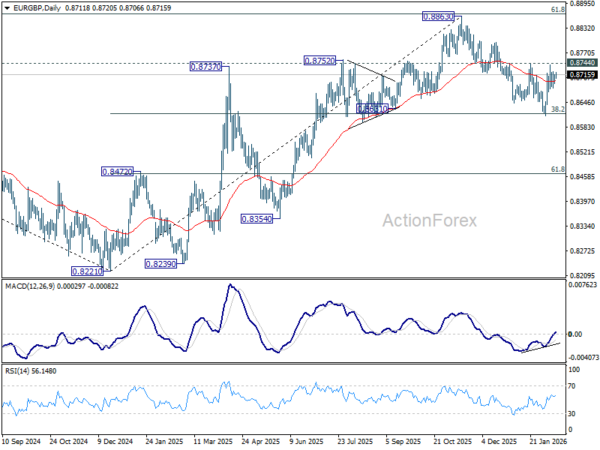

EUR/GBP edged higher last week but failed to break through 0.8744 resistance. Initial bias remains neutral this week first. Firm break of 0.8744 will indicate that fall from 0.8863 has completed as a correction. Further rally should then be seen back to retest 0.8863 high. On the downside, sustained break of 38.2% retracement of 0.8221 to 0.8663 at 0.8618 will carry larger bearish implications and turn outlook bearish.

In the bigger picture, rise from 0.8221 medium term bottom (2024 low) is seen as a corrective move. Upside should be limited by 61.8% retracement of 0.9267 to 0.8221 at 0.8867. Sustained trading below 55 W EMA (now at 0.8629) should confirm that this corrective bounce has completed. In this case, deeper fall would be seen back to 0.8201/21 key support zone. However, decisive break of 0.8867 will suggest that EUR/GBP is already reversing whole decline from 0.9267 (2022 high). That should pave the way back to 0.9267.

In the long term picture, price action from 0.9499 (2020 high) is seen as part of the long term range pattern from 0.9799 (2008 high). Range trading should continue between 0.8201 and 0.9499, until there is clear signal of imminent breakout.

EUR/GBP Daily Outlook

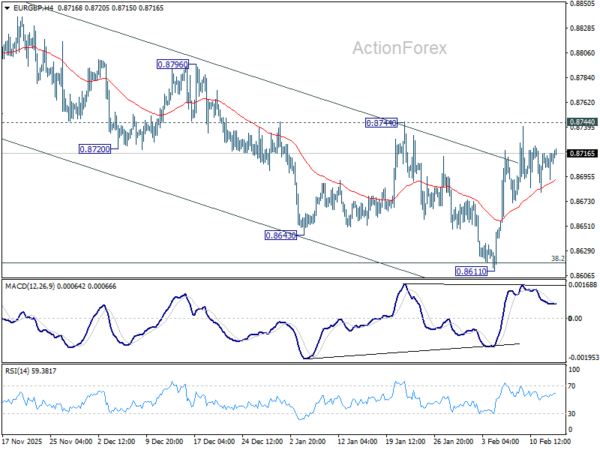

Daily Pivots: (S1) 0.8697; (P) 0.8711; (R1) 0.8727; More…

Intraday bias in EUR/GBP stays neutral and outlook is unchanged. On the upside, firm break of 0.8744 resistance will argue that fall from 0.8863 has completed at 0.8611 as a correction. Further rally should be seen back to retest 0.8863 high. On the downside, sustained break of 38.2% retracement of 0.8221 to 0.8663 at 0.8618 will carry larger bearish implications and turn outlook bearish.

In the bigger picture, rise from 0.8221 medium term bottom (2024 low) is seen as a corrective move. Upside should be limited by 61.8% retracement of 0.9267 to 0.8221 at 0.8867. Sustained trading below 55 W EMA (now at 0.8629) should confirm that this corrective bounce has completed. In this case, deeper fall would be seen back to 0.8201/21 key support zone. However, decisive break of 0.8867 will suggest that EUR/GBP is already reversing whole decline from 0.9267 (2022 high). That should pave the way back to 0.9267.

EUR/GBP Daily Outlook

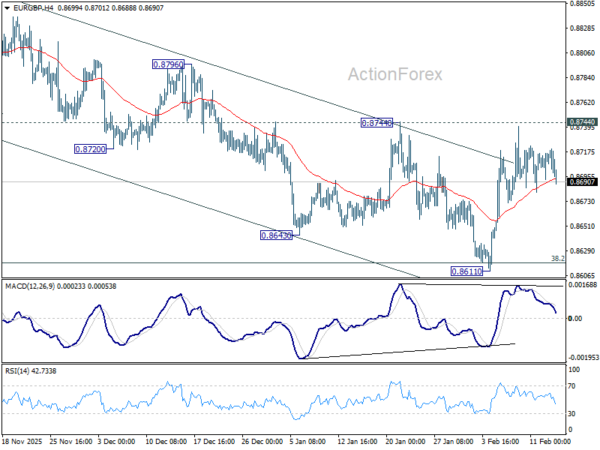

Daily Pivots: (S1) 0.8688; (P) 0.8706; (R1) 0.8729; More…

No change in EUR/GBP's outlook and intraday bias stays neutral at this point. On the upside, firm break of 0.8744 resistance will argue that fall from 0.8863 has completed at 0.8611 as a correction. Further rally should be seen back to retest 0.8863 high. On the downside, sustained break of 38.2% retracement of 0.8221 to 0.8663 at 0.8618 will carry larger bearish implications and turn outlook bearish.

In the bigger picture, rise from 0.8221 medium term bottom (2024 low) is seen as a corrective move. Upside should be limited by 61.8% retracement of 0.9267 to 0.8221 at 0.8867. Sustained trading below 55 W EMA (now at 0.8629) should confirm that this corrective bounce has completed. In this case, deeper fall would be seen back to 0.8201/21 key support zone. However, decisive break of 0.8867 will suggest that EUR/GBP is already reversing whole decline from 0.9267 (2022 high). That should pave the way back to 0.9267.