Here are the latest developments in global markets:

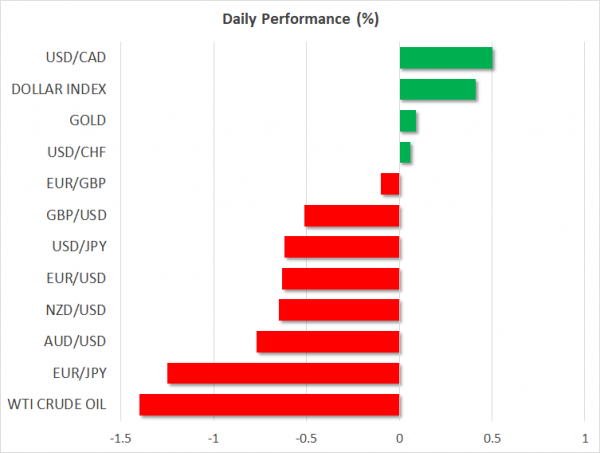

FOREX: During the early European afternoon, the dollar was pushing hard to recover losses made on the face of rising trade uncertainties as the US President was looking to impose additional trade tariffs on China, with dollar/yen inching up to 109.87 but remaining down on the day (-0.67%). The dollar index, though, which tracks the strength of the greenback against six major currencies managed to jump to an 11-month high of 95.26 (+0.47%) as the euro and the pound remained under pressure. Following comments by ECB chief, Mario Draghi, who said that the end of the QE program doesn’t necessarily imply that the central bank will not use it again for support, pushed euro/dollar sharply down from an intra-day high of 1.1644 to 1.1545 (-0.65%). Draghi also admitted that interest rates will likely remain steady until at least the third quarter of 2019. Euro/yen faced a stronger downside, slipping to 126.63 (-1.27%), the lowest level reached since the start of June. Pound/dollar hit a seven-month trough of 1.3165 as besides trade risks, growing noise around Brexit did not allow the pair to gain ground. Note that yesterday, the House of Lords rejected an amendment to the Prime Minister’s withdrawal bill, sending the plan back to the House of Commons for a debate on Wednesday. In antipodean currencies, aussie/dollar and kiwi/dollar were struggling, with the former dropping to a one-year low of 0.7352 (-0.63%) and the latter easing to 0.6904 (-0.53%). Dollar/loonie broke above the 1.3200 key-level to touch an almost 1-year peak at 1.3262 (+0.45%), while dollar/krona rallied towards 8.93 (+1.35%).

STOCKS: The continuing tit-for-tat between the US and China weighed significantly on European stocks on Monday. The pan-European STOXX 600 and the blue-chip Euro STOXX 50 declined by 0.96% and 0.88% respectively to 1 ½-month lows at 1140 GMT, with all sectors involved in the indices flashing red. The German DAX 30 dived by 1.66%, the French CAC 40 tumbled by 1.32%, while the Italian FTSE MIB declined by 0.65%. UK’s FTSE saw a softer loss of 0.63%. In Asia, equities closed in negative territory, while in the US, futures tracking stock indices were pointing to a negative open.

COMMODITIES: Oil prices were erasing yesterday’s gains as investors were concerned that escalating trade tensions between the US and China could harm global oil demand. Worries over a potential supply hike at the OPEC’s policy meeting on June 22-23 was also pressuring the market, though the suggestion first made by Saudi Arabia and Russia was not well received by Iran, Venezuela, Iraq, and Algeria. WTI crude and Brent were last seen at $64.75/barrel (-1.67%) and at $74.74/barrel (-0.80%) respectively. In precious metals, the safe-haven gold lost ground, retreating to $1,273/ounce (-0.38%).

Day Ahead: US-China trade war in focus; US housing data and global dairy prices on the agenda

These days the focus remains on US-China trade threats as the calendar will be light in terms of economic releases on Tuesday. Late on Monday, the US President Donald Trump threatened to impose 10% tariff on $200 billion of Chinese goods, a few days after China retaliated to Washington’s approval to set a 25% import tariff on Chinese products by targeting $50 billion of US imports. The move intensified the tit-for-tat US-China trade game, driving the US dollar sharply lower against the yen.

In Germany, the Bavarian allies of Chancellor Angela Merkel, who threatened to defy her by implementing a plan to limit immigration at the border and risk destabilizing her three-month-old coalition, agreed to wait until after the EU summit at the end of June to give Merkel time to seek a solution with other EU leaders about the migration crisis.

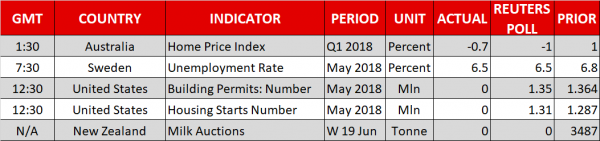

Having a look at the calendar, at 1230 GMT, investors will keep a close eye on US housing starts, with analysts predicting that the number of building permits will slow down to 1.350 million in May from 1.364 million in the previous month. Housing starts, though, delivered at the same time are expected to rebound by 1.4% m/m in May from -3.7% m/m in the preceding period o reach an annualized number of 1.310 million.

In other data, global dairy prices are highly anticipated to bring some volatility to the kiwi today. The data will come at the end of the bi-weekly dairy auction but has no specific time of release.

In energy markets, investors will be waiting for the API weekly report to indicate the change in US crude oil stocks for the week ending June 11,

Overnight, the Bank of Japan (BOJ) will release minutes of its latest policy meeting held on June 15. Recall the central bank left steady its ultra-loose monetary policy on Friday and downgraded its view on inflation, suggesting that it will lag well behind its US and European peers in normalizing policy.