Intra-day trading is a set of Forex day trading strategies that demand opening and closing trades on the same day. Considering that markets can only move so far within one day, intra-day traders use relatively riskier trading techniques to accumulate their desired profits. Day trading Forex strategies are more action packed and require traders to be present at the trading station throughout the session.

It’s widely accepted that the narrower a time frame a trader works within, the more risk they are likely to be exposed to. That’s why Forex day trading can be described as one of the riskiest approaches to the currency markets.

It’s not really the different Forex trading strategies that day traders have to use that increases the risk. In fact, the overall logic is the same for almost any interval out there. Rather, it is that Forex day trading rules are more harsh and unforgiving to those who don’t follow them. Mistakes are more costly and they have the potential to occur more frequently, since the act of trading itself is of a higher frequency.

Learn to trade step-by-step with our brand new educational course, Forex 101, featuring key insights from professional industry experts.

Strategies

The two factors that no intra-day trader can do without – irrelevant of the Forex day trading strategy he intends to use – are volatility and liquidity. It might seem like a good thing for any kind of a trader, but short-term traders are far more dependent on them.

Volatility is the magnitude of market movements. When trading short-term, solid volatility is a must. This basically reduces the selection of instruments to the major currency pairs and a few cross pairs, depending on the sessions. Speaking of sessions, since volatility is session dependant, knowing when to trade is as important as knowing what to trade.

Liquidity is equally important. Intra-day trading is very precise. A long-term trader can afford to throw in 10 pips here and cut 10 pips there. A short-term trader can’t, because 10 pips could be the whole profit projected for a trade.

This precision in Forex comes from the trader’s skill of course, but rich liquidity is important too. If there is no liquidity, the orders will simply not close at the desired price, no matter how good the trader is. This once again limits intra-day traders to a particular set of trading instruments and trading times.

Here are the most popular day trading strategies in Forex.

Scalping

This is a day trading Forex strategy that aims to make many small profits on the minimal price changes. Scalpers really go for quantity trades, opening almost ‘on a hunch’ because there is no other way to navigate through the market noise.

Scalping can be exciting and at the same time very risky. Scalpers must achieve high trading probability to balance out the low risk to reward ratio. Probably the hardest part of scalping is closing losing trades in time. A scalper simply can’t afford to wait for the market to come back.

If you are looking to become a scalper, consider developing a sixth market sense – look for volatile instruments, good liquidity, and perfect execution speed. If mastered, scalping is potentially the most profitable strategy in any financial market. It is only the adjacent risks that prevent it from being the best Forex day trading strategy.

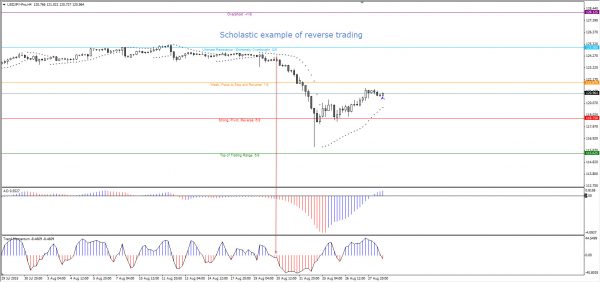

Reverse trading

This is arguably the worst trading strategy in the world, especially when used by unskilled traders. Reverse trading is also known as pull back trading, counter trend trading and fading.

This is arguably the worst trading strategy in the world, especially when used by unskilled traders. Reverse trading is also known as pull back trading, counter trend trading and fading.

The risk comes from the basic principle of trading against the trend. A reverse trader has to be able to identify potential pullbacks with a high probability, as well as to be able to predict their strength. Although not impossible, it does require a lot of market knowledge and practice.

‘Daily Pivots’ strategy can be considered a special case of reverse trading strategy, as it specialises in trading the daily low and daily high pullbacks/reverse.

Momentum trading

This is a pretty simple day trading Forex strategy that specialises in looking for strong price moves paired with high volumes and trading in the direction of the move. A high level of human discipline is required in momentum trading to be able to wait for the best opportunity to enter a position, and solid control to keep focus and spot the exit signal.

Day trading is often advertised as the quickest way to make a return on your investment in Forex trading. However, what the the adverts fail to mention is that it’s the most difficult strategy to master. As a result, many beginner traders try and fail.

Through years of learning and gaining experience, a professional trader may develop a personal strategy for Forex day trading.

Forex day trading tips

The practice of day trading is the least popular among professional traders and the most popular among rookie traders.

If you are a rookie, here is the most important Forex day trading tip of all: stay away from day trading altogether. First try to prove yourself consistently profitable on a live account for at least a year, using long-term trading strategies. The more experienced you become, the lower the time frames you will be able to trade successfully. If however, you still decide or even unconsciously slip into day trading, here are a few Forex day trading tips that might help you out.

Day trading for beginners usually starts with research. They look out for different ways to improve their trading and dedicate a vast amount of time to search for the Holy Grail. The Holy Grail in Forex is what traders call a perfect indicator or a trading system that provides setups with a 100% success rate. Even some experienced traders do it from time to time. Unfortunately, perfect systems don’t exist, and the only real Holy Grail is proper money management.

The best day trading software for beginners is clearly MT4 platform as it offers trading with micro-lots.

- Open a demo account using MT4 day trading platform.

- Choose one of our strategies shown in webinars.

- Trade that system on a demo account until you are consistently profitable.

- Trade the demo account exactly like you would trade live account.

- The habits you develop in the demo should subconsciously carry over into your live trading.

Develop a strict trading plan and follow it strictly to manage your risks properly. As mentioned above, day trading Forex is riskier than long-term trading, mostly because of the higher pace and frequency of trades. Day traders experience more pressure and have to be able to make decisions quickly and accept full responsibility for the results. A trading plan is an absolute must for a day trader.

Keep an eye out for averaging down. Simply put, averaging down is keeping a losing trade open for too long. To avoid it, cut losing trades in accordance with pre-planned exit strategies. Remember, averaging down when day trading Forex eats up not only your profits but also your trading time.

What about a stop-loss? There are two kinds a day trader must consider using.

A physical stop-loss order placed at price level in accordance with the risk tolerance, which you should know from your trading plan. Approximately 1-2% is a good level. Basically, this is the most you can afford to lose in one trade. The other kind is a mental stop-loss – and this one is enforced by the trader when they get the feeling that something is going wrong.

Have you ever entered a trade and watched the market make an unexpected turn and then suddenly realised that the trade is no good and it’s time cash out? That’s a mental stop. The trick is not confusing it with just panic. That’s why both physical and mental stops need to be thought through before entering a trade and not after.

Retail day traders, specifically those who manage their own rather than somebody else’s money, have another rule their stop-losses must comply to. They set a maximum loss per day that they can withstand financially and mentally. If that point is ever reached they remove themselves from the market for the day altogether. They know that no good comes from emotional trading. Inexperienced traders, in contrast, don’t know when to get out. They often feel compelled to make up losses before the day is over, which leads to ‘revenge trading’, which never ends well for them.

Exceptions to all these rules are possible, but must be managed with specific care and the results must be accepted with full responsibility. Good results must not serve to reinforce regular exceptions. Bad results should be considered as a good reminder as to why these rules exist.

The trend might be able to sustain itself longer than you can stay liquid. Let’s consider volatility spikes mixed in with drops in liquidity.

When news releases are due, traders should refrain from trading altogether, unless these are the specific market conditions that their trading strategy requires. Do not trade around the major news releases as the results could be disastrous.

The bottom line is this – even if you somehow manage to know what the news will be, there is no way to predict how the market is going to react in the first couple of hours. Bullish news can cause a bearish market jerk and vice versa. Eventually, the market will return to its trend, but until it does, the environment isn’t safe enough to trade.

Also keep in mind that a trader might not be able to protect his account with stop orders around the news. If there is no liquidity on the market, the order won’t close. It will continue sleeping until the first available counterparty is willing to trade. So basically, it is only at their price that you will trade. However, the best day trading strategy in Forex is always to trade at your price.