Political tension in Germany is dominating the headlines as we start a new week. The EU Immigration deal reached last week gave a short term boost to the risk on side but now that the dust has settled cracks have appeared in the German Coalition. The increase in the number of migrants being accepted by Germany is fracturing the government and the leader of the CSU, Seehofer, has offered to resign if his party splits the coalition.

On the Brexit front a record 75% of companies said they were pessimistic about the outcome of leaving the EU. The UK Government’s Chief Brexit Negotiator, Oliver Robbins, has said that they have no chance of striking a bespoke trade deal with the EU. The trade war rumbles on as US President Trump targeted the EU in his latest speech, saying they were “as bad as China, only smaller”. He highlighted the importing of EU made cars and agricultural produce saying that the trade in these areas in one sided. Chinese equity markets are down and European futures are pointing to a lower open.

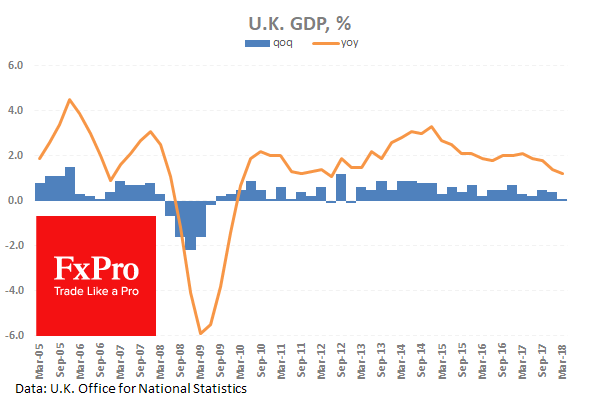

UK Gross Domestic Product (Q1) was out with a reading of 0.2% (QoQ) and 1.2% (YoY) against an expected headline number of 0.1% (QoQ) and 1.2% (YoY) from a reading of 0.1% (QoQ) and 1.2% (YoY) previously with a revision up to 1.3% (YoY). Mortgage Approvals (May) were 64.526K against an expected 62.200K from a previous 62.455K which was revised up to 62.941K. The consensus was for a reading generally in line with expectations after the previous release was down as the economic output slows. The data increased (QoQ) and has remained positive since 2012. GBPUSD moved higher from 1.31214 to 1.31830 after this data release.

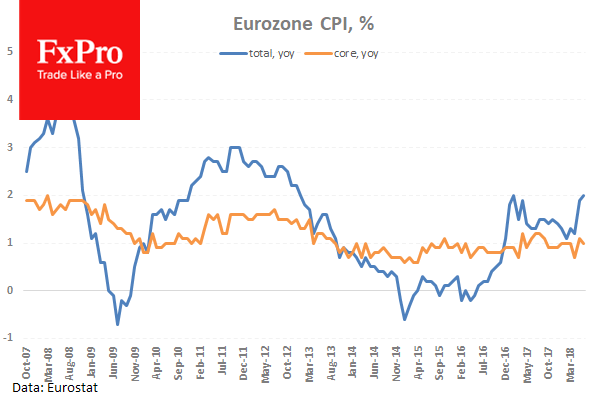

Eurozone Consumer Price Index – Core (YoY) (Jun) was 1.0% against an expected 1.0% from the previous 1.0%. Consumer Price Index (YoY) (Jun) was 2.0% against an expected 2.0% from the previous 1.9%. The data exceeded expectations and matched the 2017 high which was the highest reading since 2013, showing that last month’s beat had some substance behind it. The ECB will be taking note of this increase. EURUSD moved up from 1.16389 to 1.16593 after this data release.

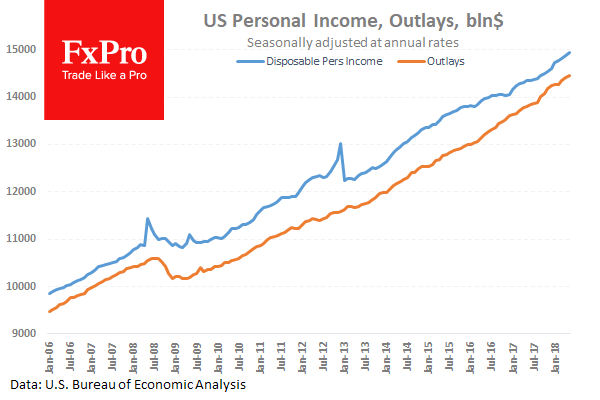

US Personal Consumption Expenditures – Price Index (May) were 0.2% (MoM) and 2.3% (YoY) against an expected 0.2% (MoM) and 2.2% (YoY) from 0.2% (MoM) and 2.0% (YoY) previously. Core Personal Consumption Expenditures – Price Index (May) were 0.2% (MoM) and 2.0% (YoY) against an expected 0.1% (MoM) and 1.9% (YoY) from 0.2% (MoM) and 1.8% (YoY) previously. Personal Income (MoM) (May) was 0.4% against an expected 0.4% from 0.3% previously which was revised down to 0.2%. Personal Spending (May) was 0.4% against an expected 0.4% from 0.6% previously which was revised up to 0.5%. This data came in largely as expected with a slip lower in personal spending along with a lower revision. USDJPY fell from 110.737 to 110.602 as a result of these data points.

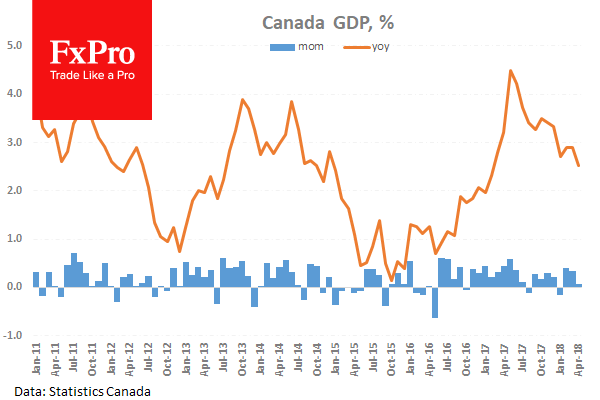

Canadian Gross Domestic Product (MoM) (Apr) was 0.1% against an expected 0.0% from 0.3% prior. This showed that growth has flat lined and is has managed to remain above the zero mark but is vulnerable to a drop in negative territory. USDCAD fell from a high of 1.32592 to 1.31360 after the release.

EURUSD is down -0.36% overnight, trading around 1.16395.

USDJPY is unchanged in the early session, trading at around 110.677

GBPUSD is down -0.22% this morning trading around 1.31738

Gold is down -0.25% in early morning trading at around $1,249.33

WTI is down -1.31% this morning, trading around $72.55