The Bank of Japan (BoJ) will announce its monetary policy decision during the Asian trading session on Tuesday. The yen has gained lately on speculation the Bank may alter its policy in a more hawkish direction. That said, the BoJ still seems somewhat unlikely to adjust its policy for now, with core inflation remaining miles away from its target. This renders the yen vulnerable to a downside correction should Kuroda & Co disappoint those looking for a hawkish twist.

Back in September 2016, the BoJ introduced its so-called “QQE with yield curve control” framework. Under this regime, the Bank has committed to keeping the yield on longer-dated Japanese Government Bonds (JGB) fixed “around 0%”. In essence, the Bank has pledged to keep long-term interest rates very low in an effort to stimulate borrowing and investment. Every time that yields on 10-year JGBs have attempted to cross above the 0.10% mark, the BoJ steps into the market, buying as many bonds as needed to push yields back down.

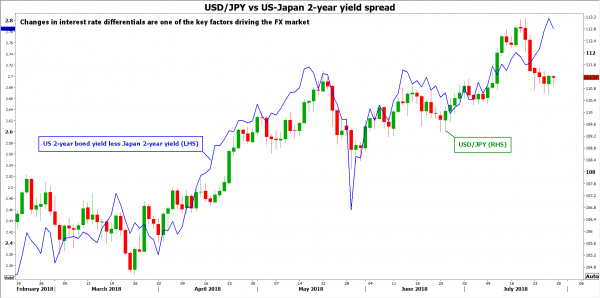

This is an extreme form of easing, which indirectly has helped to keep the yen weak against other currencies. Since the BoJ is keeping Japanese yields fixed around 0% while other central banks like the Fed are raising rates, interest rate differentials are widening between Japan and the rest of the world, which renders the yen less attractive relative to currencies like the dollar from a rates perspective.

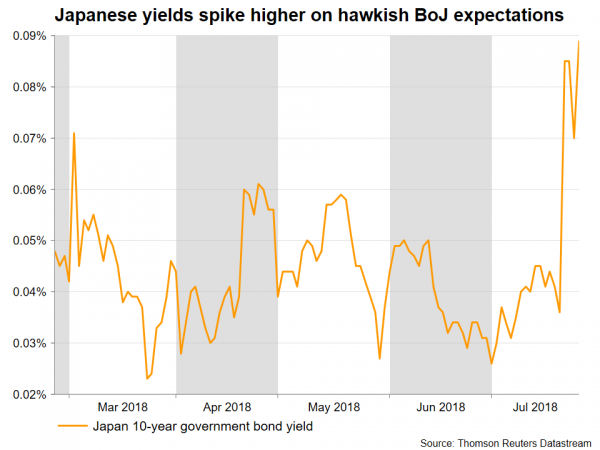

Turning to next week’s meeting, recent media reports suggest the BoJ may tweak its ultra-loose framework in a more hawkish direction, perhaps by raising the implicit yield target “ceiling” a little. Although this would only be a baby step in the grand scheme of things, it would still likely be perceived as a harbinger of things to come, laying the groundwork for more similar steps in the future.

The key question is whether the BoJ will pull the trigger on such a change at this meeting. Markets certainly seem to have positioned for some hawkish twist, evident by the latest spike higher both in Japanese bond yields and the yen. Yet, one would be forgiven to remain skeptical. While it’s true that the Bank has reasons to adjust its policy – most notably to ease the pain on commercial banks whose profitability has taken a hit in this environment – the current economic landscape makes any hawkish change difficult to justify.

Inflationary pressures are still muted. The nation’s headline CPI rate has remained stuck below 1.0%, while the measure that excludes fresh food and energy items is currently at a mere 0.2% in yearly terms. Many suggest the Bank may even downgrade its inflation forecasts at this gathering, indirectly admitting it will probably take longer to hit its 2% inflation target. Yes, wages are showing some signs of life, but they are still far from healthy levels. Meanwhile, the economy contracted in Q1, and consumers appear unwilling to spend, with household spending falling by 3.9% y/y in May. On top of everything, the outlook for exports remains clouded amid ongoing trade tensions.

Not to mention that any move could trigger an outsized surge in the yen on expectations for further normalization, much like the euro’s rally in 2017, when speculation for ECB normalization surfaced. A stronger currency lowers the price of imported products and hence, weighs down on inflation – something the BoJ will surely be keen to avoid. It would also make Japanese exports abroad less competitive.

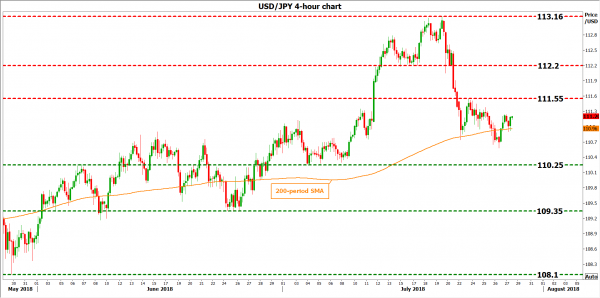

All in all, there seems to be little reason for the BoJ to rush into anything, for now. The economy is decent, but not strong, and taking a hawkish step whilst simultaneously lowering inflation forecasts would be almost unprecedented. Should the Bank disappoint those looking for an immediate move, the yen is likely to tumble as Japanese yields come back down. Taking a technical look at dollar/yen, advances could encounter immediate resistance near the 111.55 barrier, marked by the July 23 top. An upside break could open the way for 112.20, the inside swing low of July 16. Higher still, the seven-month high of 113.16 could come into play.

On the downside – and in case the Bank does raise its yield target – preliminary support to declines may come around 110.25, defined by the trough of July 4. A downside break could see scope for declines towards 109.35, this being the June 25 low, before the 108.10 territory comes into view, defined by the trough of May 29.