The Canadian dollar fell on Thursday as the US dollar rebounded after US tariffs on Chinese goods came into effect and the Trump administration threaten action against South Africa. There were signs that China and the US will meet, but for the time being the duties are in effect.

NAFTA negotiations seem to be finally moving with some momentum, but the choice of the US to deal with Mexico first still leaves a lot of question marks regarding how it will affect the Canadian economy. Earlier today Foreign Affairs Minister Chrystia Freeland said she was encouraged by optimism and ready to rejoin the talks.

Mexican Economy Minster has made statements that he will only reach a deal if Canada is present. There were some reports that a deal was imminent, but Guajardo came out saying they will continue to work into next week.

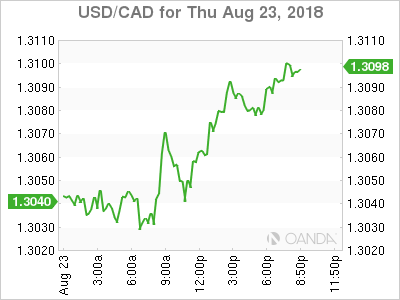

The USD/CAD gained 0.63 percent on Thursday. The currency pair is trading at 1.3079 as the US tariffs on Chinese goods came into effect triggering risk aversion.

The loonie is now in the red on a weekly basis after the resurgence of the US dollar as trade concerns have once again cemented the position of the greenback as a reserve currency.

U.S. Federal Reserve Chair Jerome Powell will host a talk titled Monetary Policy in a Changing Economy as part of the Jackson Hole Symposium in Wyoming. The Fed has been under siege by the Trump administration who has openly criticized its monetary policy decisions.

The Fed has lifted interest rates twice in 2018 and two more rate hikes are forecasted. Fed members have issued comments defending the independence of the central bank and that the statements from the Trump administration do not influence in their decisions.

Bank of Canada (BoC) Governor Poloz will speak on Saturday at the same summit. The market is already pricing in a rate hike in October as solid economic indicators and the need to close the gap with US interest rates.

The speech given by Poloz will be a source of direction for the currency although the market will tend to react with with a bigger price movement if he makes a dovish assessment of current conditions.

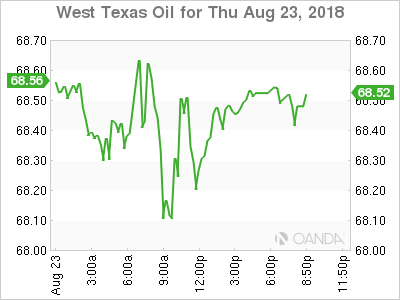

West Texas Intermediate prices are stable around the $68.53 level on Thursday. The release of the crude inventories data by the Energy Information Administration (EIA) pushed prices from $66.81 to around current levels and the strength of the dollar has capped the price recovery of oil.

Saudi authorities are trying to set the record straight on the Saudi Aramco IPO by saying it will happen when conditions are optimum but definitely not cancelled as some of the early reports were claiming.