Anxiety remains as markets pare losses

Turbulence in stock markets is fast becoming the norm, with the sell-off in the US and Asia killing any hopes that the worst of the storm has passed.

European markets have managed to find their feet in early trade, having been pressured lower at the open, only to recover the lost ground and trade in positive territory late in the morning. I don’t think anyone is going to get carried away with the rebound at this stage, a collective sense of relief is probably a more accurate reflection of the mood on Thursday.

This is certainly helping to buoy US futures ahead of the open after another miserable day on Wall Street, which saw the S&P 500 and Dow fall into negative territory for the year and took the NASDAQ into correction territory. I think we really need to see some expectation-beating earnings reports about now to remind investors why we got to these levels in the first place. Unfortunately, third quarter earnings growth is expected to soften a little after the first two seriously raised the bar.

Safe havens pare gains but appetite remains strong

Safe havens have naturally been the outperformers recently, with Gold regaining its place among the favoured instruments. As soon as US stocks fell victim to the run on risk that had already taken down its Asian and European counterparts, appetite for Gold returned which saw it break back above $1,200 and trade back at levels not seen since July.

I wonder whether the Fed is watching the way everything is unfolding and questioning whether it can afford to take a slightly more gradual approach to its tightening plans. You don’t have to agree with Trump’s view that the central bank has “gone loco” to acknowledge that anticipation of where interest rates are heading and how fast is rattling investors. The slight decline in US Treasury yields over the last couple of weeks will in a way reflect their safe haven appeal but also may suggest that investors are making an assumption on the path of interest rates, after reflecting on recent moves.

ECB unlikely to respond to recent turmoil

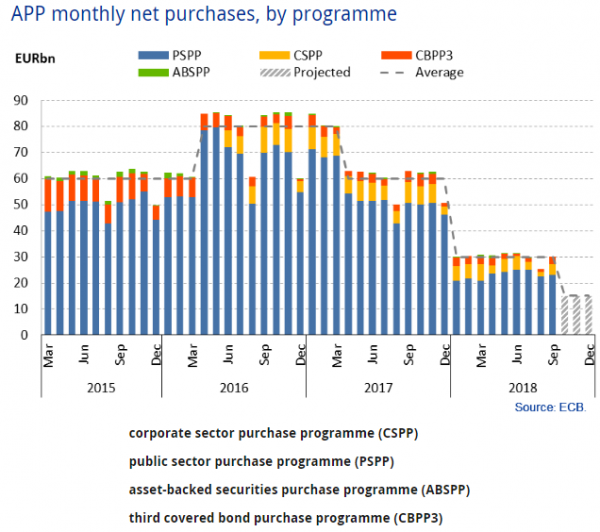

The ECB meeting will be an interesting distraction today, not because we’re expecting a shift in policy – as we’re not – but because recent market instability combined with Brexit uncertainty and Italian budgetary concerns may force the central bank to ease the transition in the not too distant future. It will be interesting to see how the central bank – and Draghi during the press conference – reflect on recent events and whether they see it as already being a significant headwind that could derail plans.

The ECB is still in the process of moving away from unconventional monetary policy measures and towards normal rate hikes, with QE only set to end this year. Given the very cautious approach it’s taken so far and the slowdown the economy has experienced, it wouldn’t be outrageous to assume that it won’t take too much for them to delay that first rate hike beyond the latter part of next summer. Under the circumstances though, I don’t expect Draghi to say much today and do anything to alleviate the pressure on Italian bonds at a time when it’s tangling with the European Commission over its 2019 budget.