China and the United States agreed to cease additional tariffs for 90 days. Tariffs worth of $200 billion Chinese imports at 10% remain in place for the beginning of the new year, but the two sides agreed to not raise them to 25%. Leaders of the 20 nations agreed to restructure to the World Trade Organization amid growing global trade tensions. On another front, the Saudi Crown Prince was pressed by various important leaders at the meeting, to enact a full investigation into the murder of journalist Jamal Khashoggi. At the same time, the crown prince talked over potential investments and economic partnerships with Indian Prime Minister Narendra Modi and Chinese President Xi Jinping. Moreover, US President Donald Trump cancelled his meeting with Russia’s President Vladimir Putin but in the end held a brief talk. It was said, the US opposes Russia’s dispute with Ukraine, keeping in mind the recent tensions between them. Further developments of the meeting could create volatility for the USD and safe havens like Gold.

XAU/USD strengthened during Mondays Opening, as it headed towards the 1230.00 (R1) resistance level. The Precious metal still has some distance to cover in order to break the pre mentioned level and it could be influenced by any further headlines regarding the G20 Summit or updates on the trade tensions. Should the bears take over, we could see the shiny metal moving towards the 1,220 (S1) support line and even breach it aiming for the 1210.00 (S2) support barrier. Should on the other hand the bulls take over we could see the metal reaching our 1230.00 (R1) resistance level. If the (R1) is breached then XAU/USD could be moving into a new price range.

Oil prices jump ahead of OPEC meeting

Oil prices surged on Monday ahead of the OPEC meeting this week, which is expected to result in a supply cut. On another front and during the weekend, it was publicized that Iran had tested some new ballistic missiles, creating further tensions between Persia and the US. Oil prices are very sensitive to geopolitical issues and any action taken against Iran could affect Oil prices. In general, further updates on the above matters could significantly increase volatility for Oil Prices.

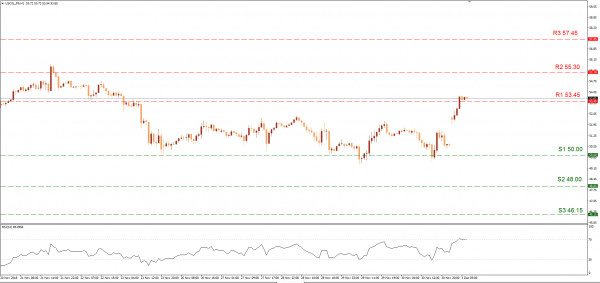

Crude Oil opened with a positive gap during Monday’s Asian session, indirectly hinting this week could be of crucial importance for the Oil market. The black gold was able to reach are 53.45 (R1) resistance level, even though it barely surpassed it, only to remain very close it later on. If the commodity remains in a bullish momentum we could see it reach the 55.30 (R2) resistance barrier and even breach it aiming even higher. On the opposite, if Oil prices move in a bearish sentiment, the commodity could move to the 50.00 (S1) support level and with that breach, the next level could be our 48.00 (S2) support barrier. However Oil prices could be under strong volatility towards the end of the week as we get closer to the OPEC meeting on the 6th of December.

XAU/USD H4

Support: 1220.00(S1), 1210.00 (S2), 1196.50 (S3)

Resistance: 1230.00 (R1), 1239.50 (R2), 1252.15 (R3)

Crude Oil 1 Hour

Support: 50.00 (S1), 48.00 (S2), 46.15 (S3)

Resistance: 53.45 (R1), 55.30 (R2), 57.45 (R3)