For the 24 hours to 23:00 GMT, the USD rose 0.23% against the CAD and closed at 1.3391.

Macroeconomic data revealed that Canada’s seasonally adjusted Ivey PMI declined to a level of 57.2 in November, compared to a level of 61.8 in the previous month. Additionally, the nation’s merchandise trade deficit widened more than expected to C$1.17 billion, compared to a revised deficit of C$0.89 billion.

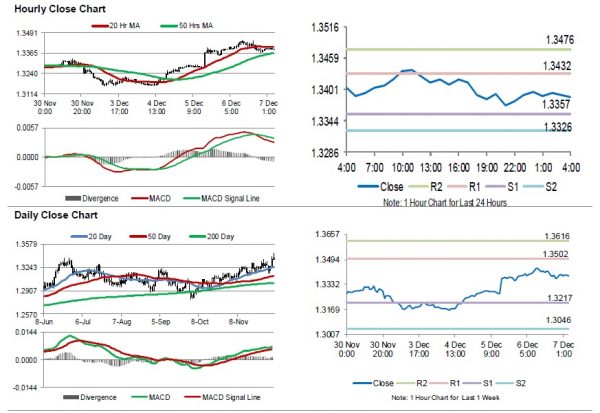

In the Asian session, at GMT0400, the pair is trading at 1.3388, with the USD trading a tad lower against the CAD from yesterday’s close.

The pair is expected to find support at 1.3357, and a fall through could take it to the next support level of 1.3326. The pair is expected to find its first resistance at 1.3432, and a rise through could take it to the next resistance level of 1.3476.

Trading trend in the Loonie today is expected to be determined by Canada’s unemployment rate for November, scheduled to release later in the day.

The currency pair is trading between its 20 Hr and 50 Hr moving averages.