The price of crude oil remained at 15-year lows after data from the American Petroleum Institute (API) showed increased inventories. The stocks rose by 3.45 million barrels after having a drawdown of more than 10 million barrels a week ago. Investors are currently concerned that the supply cuts announced by OPEC+ did not go far enough and that American production is continuing. Later today, the Energy Information Administration (EIA) will release its inventory numbers for the week. Investors expect a drawdown of 2.45 million barrels.

The Japanese yen strengthened slightly against the USD in overnight trading. This happened even after data from Japan showed a softening export market. In November, exports rose by 0.1%, which was lower than the estimated 1.8% growth. At the same time, imports increased by 12.5%, which was higher than the estimated 11.5%. Because of this, the country’s trade deficit increased to ¥737 billion, which was higher than the ¥600 billion traders were expecting. Traders will continue to focus on the Bank of Japan, which is expected to make its interest rates decision tomorrow.

Sterling rose slightly today ahead of important inflation numbers. Investors expect the headline CPI to increase by 2.3%, which will be lower than the previous month’s CPI of 2.4%. On a MoM basis, the CPI is expected to rise by 0.2%. The core CPI, which excludes volatile products like food and energy, is expected to rise by an annualized rate of 1.8%. This will be lower than the previous month’s 1.7%. Inflation in the UK has eased a bit this year after reaching a high of 3.1% in December last year.

EUR/USD

The EUR/USD pair rose to a high of 1.1390 in the Asian session. This was higher than the 25-day and 50-day EMA. The RSI and the Relative Vigor Index have all moved up during the pair’s upward trend. Today, the pair will likely move higher as hopes of a rate hike reduce. To calm the markets, the Fed will likely issue a dovish statement, which will likely take the pair higher.

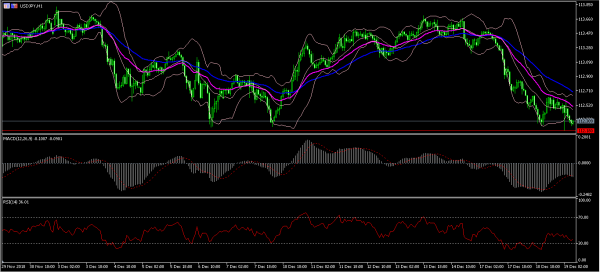

USD/JPY

The USD/JPY pair continued the downward trend in overnight trading, reaching a low of 112.18. This was the lowest level the pair has reached since October this year. The current price is below the 25-day and 50-day EMA. The price is also along the Bollinger Bands. The MACD remains at the negative territory while the RSI has fallen to 36. The pair will likely remain volatile today ahead of the Fed and BOJ monetary policy decisions.

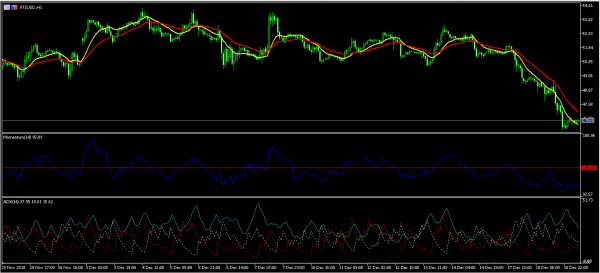

XTI/USD

The price of West Texas Intermediate (WTI) crude rose slightly in the Asian session. Still, the pair remained closer to the 15-month lows. The current price of 46.74 is slightly above the 28-day double EMA but lower than the 50-day double EMA. The momentum indicator remains lower than 100 while the Average Directional Index (ADX) has fallen to 27. Today, the movements will likely be influenced by the EIA inventory data.