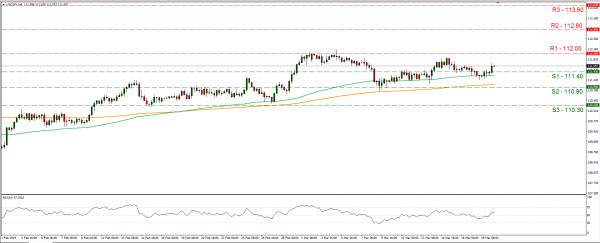

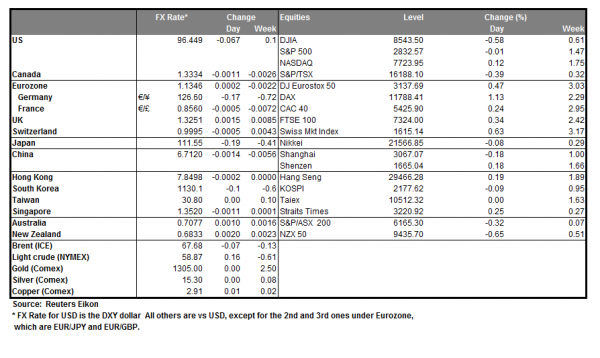

The FOMC will be releasing its interest rate decision later today (18:00, GMT) and is expected to remain on hold at +2.50%. Feds Funds Futures imply a probability for the bank to remain on hold of 99.0%. Market Attention is expected to shift towards the accompanying statement and we expect the bank to maintain its cautious tone, including “patience” about the bank’s future rate hike path. The second important issue would be the dot plot and should the bank show that even one rate hike is necessitated in 2019 for the US economy, it could be a hawkish sign for the USD. On the other hand should the renewed projections of the bank increase arguments for a possible slowdown of the US economy we could see the USD weakening. We expect volatility for USD pairs to be extended throughout Fed Chair Powell’s press conference later on. USD/JPY rose during today’s Asian session breaking the 111.40 (S1) resistance line (now turned to support). We could see the pair having some bearish tendencies, should the Fed dovishly surprise the markets later today. Should the bears take over the pair’s direction, we could see it breaking the 111.40 (S1) support line once again and aim for the 110.90 (S2) support barrier. Should on the other hand the bulls take over we could see the pair breaking the 112.0 (R1) resistance line and aim for higher grounds.

USD gets some support from trade tensions

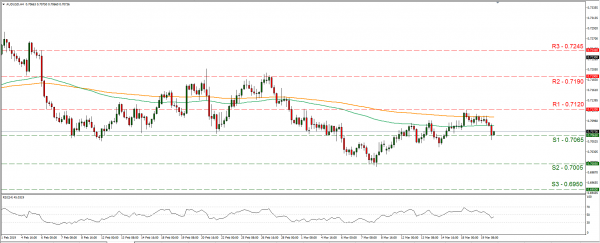

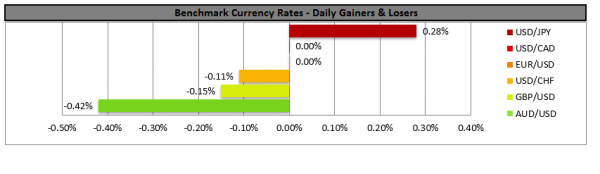

The USD rose against the JPY and the AUD yesterday as renewed tensions were reported to the US-Sino relationships. The gains for the USD were supported by safe haven bids however were contained due to expectations of the Feds meeting. Media reported that US officials expressed concerns about that China is pushing back against US demands in the trade negotiations. US trade representative Lighthizer and US Treasury Secretary Mnuchin are expected to visit China next week for another round of negotiations next week. Currently, we expect the effect of any US-Sino headlines to be temporary as the market tends to focus on the Fed today. AUD/USD dropped yesterday, testing and for a short period during today’s Asian session, breaking the 0.7065 (S1) support line. If the USD side of the pair weakens due to a dovish Fed later today, we could see the pair presenting some bullish tendencies. Should the pair’s long positions be favoured by the market, we could see it breaking the 0.7120 (R1) resistance line and aim for higher grounds. Should on the other hand the pair come under the selling interest of the market, we could see it breaking the 0.7065 (S1) support line aiming for the 0.7005 (S2) support line.

Other economic highlights, today and early tomorrow

In today’s European session we get Germany’s PPI rate for February as well as UK’s inflation rates for February and the CBI Industrial trend orders for March. In the American session, we get from the US the EIA crude oil inventories figure and just before tomorrow’s Asian session starts, we get from New Zealand the GDP growth rate for Q4. During tomorrow’s Asian session, we get Australia’s employment data for February.

USD/JPY

Support: 111.40 (S1), 110.90 (S2), 110.30 (S3)

Resistance: 112.00 (R1), 112.80 (R2), 113.60 (R3)

AUD/USD H4

Support: 0.7065 (S1), 0.7005 (S2), 0.6950 (S3)

Resistance: 0.7120 (R1), 0.7190 (R2), 0.7245 (R3)