For the 24 hours to 23:00 GMT, the EUR declined 0.45% against the USD and closed at 1.1375.

Data indicated that the Euro-zone’s flash consumer confidence index rose to a level of -7.2 in March, compared to a reading of -7.4 in the prior month. Market participants had envisaged the index to climb to a level of -7.1.

In the US, data showed that the US Philadelphia Fed manufacturing index advanced to a level of 13.7 in March, surpassing market expectations for a rise to a level of 4.8. In the previous month, the index had recorded a reading of -4.1. Moreover, the nation’s leading indicator rebounded 0.2% on a monthly basis in February, compared to a revised flat reading in the prior month. Also, the seasonally adjusted initial jobless claims dropped to a level of 221.0K in the week ended 16 March 2019, following a revised reading of 230.0K in the prior week. Markets participants had anticipated the initial jobless claims to fall to a level of 225.0K.

In the Asian session, at GMT0400, the pair is trading at 1.1376, with the EUR trading slightly higher against the USD from yesterday’s close.

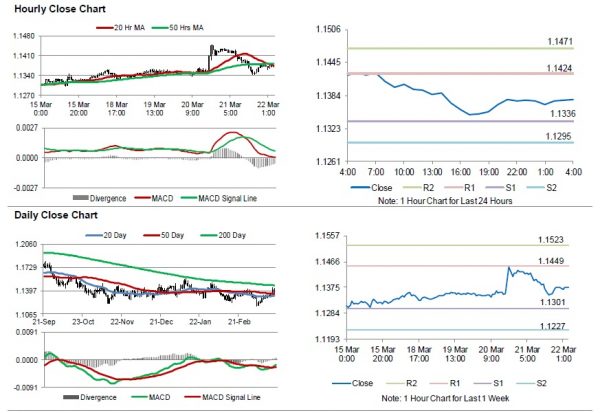

The pair is expected to find support at 1.1336, and a fall through could take it to the next support level of 1.1295. The pair is expected to find its first resistance at 1.1424, and a rise through could take it to the next resistance level of 1.1471.

Going ahead, traders would await the Markit manufacturing and services PMIs for March, scheduled to release across the euro-bloc. Later in the day, the US Markit manufacturing and services PMIs for March and existing home sales for February, will keep traders on their toes. Additionally, the US monthly budget statement for February, will be on investors radar.

The currency pair is showing convergence with its 20 Hr moving average and trading below its 50 Hr moving average.