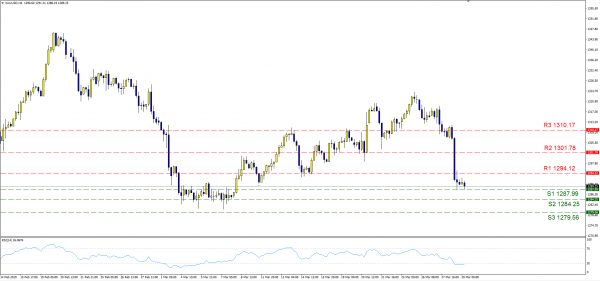

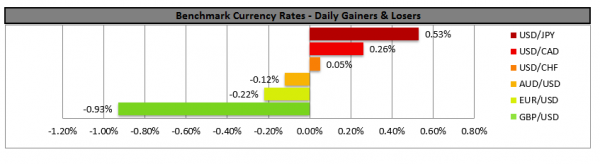

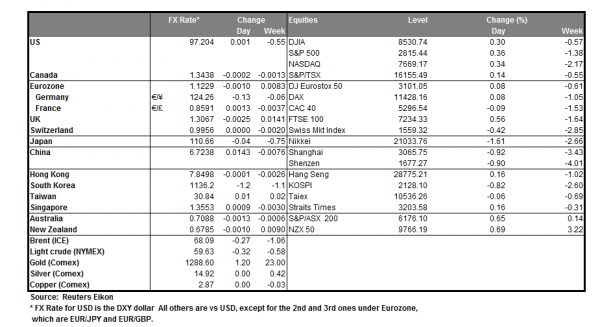

Encouraging talks are said to be taking place on the US Sino issue in the latest days. Various reports indicate the US has made demands for China to change and improve conduct of U.S. intellectual property. Nothing has been confirmed yet, but the fact that both sides are willing to hold meetings and discuss shows some willingness to find a solution. Meanwhile in the US the GDP growth rate dropped to 2.2% for the last quarter of 2018 which raised economic concerns. On the contrary, the dollar strengthened yesterday and today in the Asian session while other major currencies struggled on weak domestic financial data or dovish comments from their central banks. Gold dropped significantly after the US dollar may its equal dominating rally. The inverse relationship the two instruments carry is very obvious. Gold dropped below the 1300 psychological threshold and could be aiming even lower. If the selling interest is to continue we may see Bullion heading even lower and breaking the (S1) 1287.99 support level. Even lower we could see the (S2) 1284.25 and the (S3) 1279.56 support lines. In the opposite direction a rally could send the precious metal towards the 1294.12 resistance level and even surpass it. Above that level we could see the (R2) 1301.78 and he (R3) 1310.17 resistance barrier.

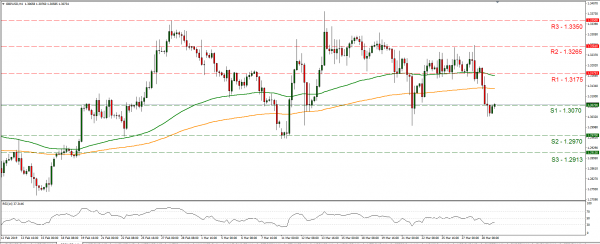

UK: Another vote on divorce deal to be held

Parliament will be asked to vote in for a stripped-down version of the deal, consisting of only the withdrawal agreement. Approving this vote is a necessary for the EU to provide a short extension of the Article 50 process. The idea could be rejected as the Democratic Unionist Party (DUP) along with various lawmakers and party rebels have already signalled opposition. GBP may come under strong volatility during the vote. Cable dropped yesterday as further uncertainty is rising could be rising on Brexit but also a very strong run from the US dollar. If the bearish momentum is to continue we may see cable dropping below the 1.3070 support level and heading towards the 1.2970 support line or even the 1.2913 support barrier. If Cable comes under a buying interest we could see it heading towards the (R1) 1.3175 resistance level. Even higher we could see the pair moving to the (R2) 1.3265 resistance level, with the 1.3350 resistance level being even higher.

Other economic highlights, today and early tomorrow

In today’s European session, we get German Unemployment Change and Rate for March, while form the UK we get the GDP figures for Quarter 4. In the American session we get the Canadian GDP for January and from the US the New Home Sales for February. As for speakers, we have FOMC members Williams, Kaplan and Quarles.

XAUUSD 4 Hour Chart

Support: (S1) 1287.99, (S2) 1284.25, (S3) 1279.56

Resistance: (R1) 1294.12, (R2) 1301.78, (R3) 1310.17

GBPUSD 4 Hour Chart

Support: (S1) 1.3070, (S2) 1.2970, (S3) 1.2913

Resistance: (R1) 1.3175, (R2) 1.3265, (R3) 1.3350