There was only one dominant talk over the weekend and it was about Bitcoin. The crypto king blasted the level of $10,000 and made a new high for 2019 which stands at $11,251. Although, it has retraced from that level now and currently trading at 10,757. Nonetheless, this is a strong comeback, everyone has been waiting for this for a long time. From a price perspective, bitcoin has recovered more than 50% off its losses from its all-time high of $20,000. The strong resurgence in the bitcoin price is mainly due to the renewed mainstreaming interest in crypto currencies and the technology which underlines it. Projects like Facebook’s Libra has provided much needed tailwind for this space.

In our previous research, we mentioned that the move to the upside could be highly volatile and the reason for that was speculators holding large number of short bets as per the CFTC data released last Friday. Large number of short bets give birth to short squeeze. The below chart shows large number of short bets for Bitcoin: Non-commercial net contract bets confirmed increase in short interest while the price was up nearly 214% from its 2018 low.

Nonetheless, the most important thing was the 24 hour volume for bitcoin, It was at its highest level since December 2007 when the price was trading at $20,000. This shows that the game is on because of the mainstream enterprises jumping in this space. This is because investors didn’t lose their interest when the first bubble busted, they simply moved on the side-line waiting for the next bull run to start.

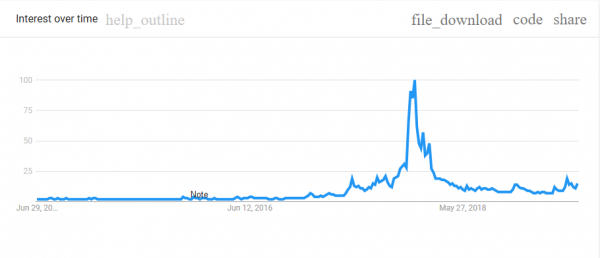

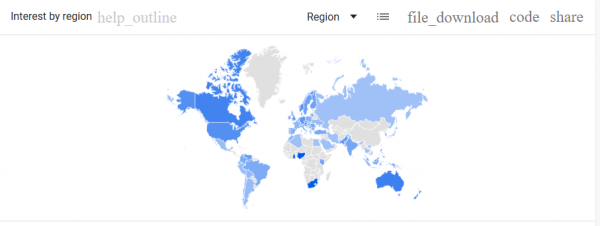

Google trend search for “Buy Bitcoin” shows that the largest number of searches are coming from mostly African country with Nigeria taking the top place followed by South Africa and Ghana. However, the overall the trend is still well below the level seen back in May 2009, This confirms that the surge in the Bitcoin price is mainly due to the institutional participation.

In terms of volatility, the beast is unleashed once again. Back in October 2018, Bitcoins 10-day volatility was lower than the S&P 500 index and the Nasdaq, it did drop below the S&P500’s 10-day volatility in March 2019 again, but since then, it has been increasing.

To concolude, I do think the next rally is going to be a lot more stronger than the previous one, one can call it a bubble, but this time the range could very well be between $60,000 to $100,000