US stocks are looking to open higher despite increased tensions between US and Iran. Markets are clinging to the belief that despite all the hard talk and threats, that President Trump will not take the US to war. Iran has been very calculated with their attacks and appears they are not likely to deliver an attack that will cause the loss of US life. Trump would be forced to deliver a retaliatory strike if Iran attacked a warship or shot down a US plane, but that still seems to be a remote risk.

Today, the US is expected to announce new sanctions against Iran. President Trump tweeted on Saturday that “We are putting major additional sanctions on Iran Monday.” At the end of last week Trump called off retaliatory attack for the downing of a $130 million US drone. Trump however is willing to hold talks with Iran, so we could see the recent pattern of escalation ease up at the start of the week.

Markets will also focus on the G20 which kicks off in Osaka from June 28th-29th. Trump and Xi are expected to meet and while trade remains the markets focal point, many will look to see if the recent Hong Kong protests will become a key issue. Over the weekend, China announced a hard line that they will not allow Hong Kong to be discussed at the G20.

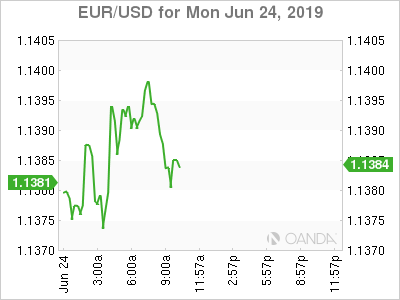

The dollar is mixed in early trade with gains against Japanese yen and British pound, while trading lower to the euro, franc, and commodity currencies.