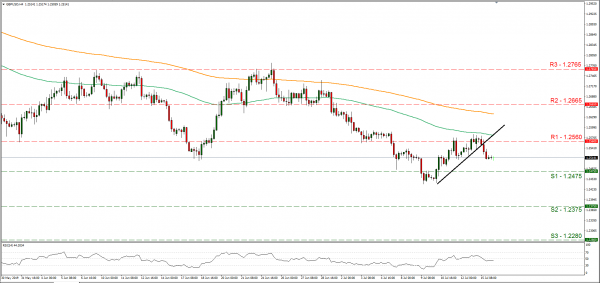

GBP/USD dropped yesterday as Brexit weighed on the pound once again yesterday, keeping any gains temporary and in check. On the monetary front, poor data and the possibility of the BoE cutting rates instead of raising them (as was previously expected) seems to also, weigh on the pound. We expect the release of May’s UK employment data today to be closely watched and could affect the pound’s direction. In the UK political scene the prospect of Boris being UK’s next Prime Minister does not seem to be thrilling the markets as the 22nd of July nears. Analysts have also noted that Brexit may also act as a deadweight of the EUR as well as the issue drags on. Media mentioned that Brexit talks seem to get more hostile and note that a meeting between negotiators last week was one of the worst since 2016. Cable dropped yesterday the European session, not able to clearly break the 1.2560 (R1) resistance line. As the pair broke the upward trendline incepted since the 10th of July, dropped and later stabilized, we maintain a bias for a sideways motion, yet the release of the UK employment data for May could provide some volatility. Under certain circumstances the pair could rise somewhat as the US financials to be released today, could weaken the USD side. Should the cable’s long positions be favored by the market, we could see it breaking the 1.2560 (R1) resistance line and aim for the 1.2665 (R2) resistance hurdle. Should the pair come under the selling interest of the market on the other hand, we could see it breaking the 1.2475 (S1) support line and aim for the 1.2375 (S2) support barrier. Please note that should the pair reach (S2) that would be the lowest level for over two years.

Oil prices drop as production in the Gulf of Mexico resumes

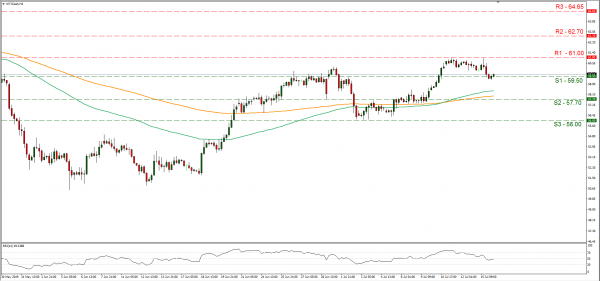

Oil prices dropped somewhat on yesterday as oil production in the Gulf of Mexico area has resumed according to media. Oil producers have started to restore of the output that was cut at U.S. Gulf of Mexico platforms ahead of tropical storm Barry. In addition, US shale oil production is expected to rise to record levels boosting supply further. U.S. oil output from seven shale formations is expected to rise to a record 8.55 million bpd, the EIA stated in its monthly drilling productivity report. The increase of the US oil production levels seems to be undermining efforts of Saudi Arabia and Russia to raise prices. We expect market participants to be closely watching the release of the US API weekly crude oil inventories figure. WTI prices dropped yesterday and during yesterday’s late American session tested the 59.50 (S1) support line, without successfully breaking it. As the commodity’s prices bounced on the prementioned support line, we maintain a bias for a sideways scenario for the commodity’s price action. Should the bulls dictate the pair’s direction we could see WTI prices breaking the 61.00 (R1) resistance line and aim for higher grounds. Should the bears finally get the upper hand over WTI’s direction, we could see the commodity’s prices breaking the 59.50 (S1) and aim if not break the 57.70 (S2) support level.

Other economic highlights, today and early tomorrow

Today, during the European session, we get UK’s employment data for May and Germany’s ZEW economic sentiment indicator for July. In the American session we get the US retail sales growth rates for June, as well as the US industrial production growth rate for June. Late in the American session, as already mentioned the API weekly crude oil inventories figure is to be released. Please note that Fed Chair Powell is scheduled to speak today in Paris, at the “Bretton Woods: 75 years later”, however we would not be surprised to see some comments about monetary policy slipping. Also, please note that ECB member Villeroy de Galhau, Atlanta Fed President Bostic, Dallas Fed President Robert Kaplan, Fed Chairman Jerome Powell, Chicago Fed President Charles Evans are also scheduled to speak. On second note, EU Parliament is to vote to confirm Ursula von der Leyen as the new EU Commission president, which under some circumstances could provide some uncertainty for the common currency.

Support: 1.2475 (S1), 1.2375 (S2), 1.2280 (S3)

Resistance: 1.2560 (R1), 1.2665 (R2), 1.2765 (R3)

Support: 59.50 (S1), 57.70 (S2), 56.00 (S3)

Resistance: 61.00 (R1), 62.70 (R2), 64.65 (R3)