US stocks, Chinese yuan, and crude oil price rose sharply after the US retreated on some Chinese tariffs. The Dow Jones Industrial Average rose by 1.45% while the Nasdaq and S&P 500 rose by 1.5% and 1.95% respectively. In the announcement, the US said that it plans to impose a 10% tariff on Chinese goods worth $156 billion. The statement said that the move was driven by concerns about the impact of the trade war during the holiday season. The remaining tariffs will go into effect on December 15. Tariffs on important goods such as tools, apparel and footwear will go into effect on September 1. In addition, the two countries are set to continue trade talks as the leaders try to resolve the key issues on trade. Therefore, it is likely that European stocks will rally today.

The price of crude oil rose sharply after the US eased on trade. The gains were also driven by the reduction in US inventories. According to the American Petroleum Institute (API), the weekly oil stocks declined by more than 2.19 million barrels. This was a slightly lower decline than last week’s decline of 3.4 million barrels. Later today, the Energy Information Administration (EIA) will release its inventories data. Numbers are expected to show that inventories declined by 2.77 million barrels. Gasoline inventories are expected to have increased by 985k.

The Japanese yen rose slightly against the USD in the Asian session today. This was after Japan released its machinery order data for the month of June. In the month, the core machinery orders rose by an annualized rate of 12.5%. This was much higher than the expected decline of 0.6%. On a MoM basis, orders rose by 13.9%, which was better than the consensus estimates of a 1% decline. In China, the impacts of the trade war were evident after the country released key data. In July, the fixed asset investment rose by 5.7%, which was lower than the previous increase of 5.8%. The industrial production rose by 4.8%, which was lower than the previous 6.3%. Retail sales rose by 7.6%, which was lower than the previous growth of 9.8%.

Today, the focus among investors will be on the trade and Hong Kong issues. Investors will also receive the economic data from Germany, where the economy is expected to have declined by -0.3% in the second quarter. On a QoQ basis, the economy is expected to have declined by 0.1%. From Sweden, consumer prices are expected to have increased by 1.5% in July. In the U.K., the CPI is expected to have increased by 1.9% while the core CPI is expected to have remained unchanged at 1.8%. From the EU, the economy’s growth is expected to have remained unchanged at 1.1%.

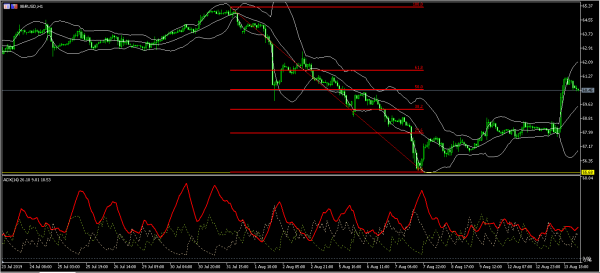

EUR/USD

The EUR/USD pair declined sharply in the overnight session. The pair is now trading at 1.1176, which is a few pips higher than the overnight low of 1.1170. On the hourly chart, the price is trading between the lower and middle lines of the Bollinger Bands. The RSI has remained slightly above the oversold level of 30. Still, the pair is between the weekly range of 1.1162 and 1.1250. Today, the pair could move below the lower side of the channel depending on data from the EU.

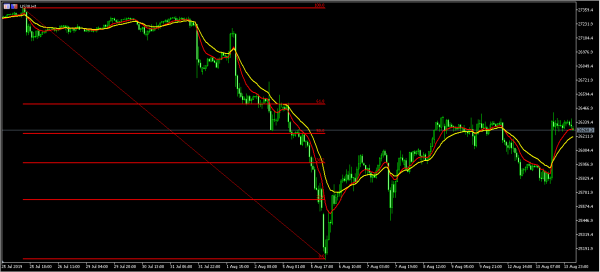

US30

The Dow Industrial Average rose to a high of $26,430, which was the highest level since Monday this week. The index ended the day at $26,279. On the hourly chart below, the price is along the 10-day moving average and slightly above the 20-day EMA. The price is also slightly above the 50% Fibonacci Retracement level. With trade tensions easing, there is a likelihood that the index will continue moving higher to test the $26500 resistance level.

XBR/USD

The XBR/USD pair rose sharply to a high of 61.18. This was the highest level it has been since August 5. On the hourly chart below, the price is trading at 60.47, which is along the 50% Fibonacci Retracement level. It is also slightly below the upper line of the Bollinger Bands. The ADX remains relatively unmoved at the current level of 26. The pair could continue moving higher ahead of the US inventory numbers.