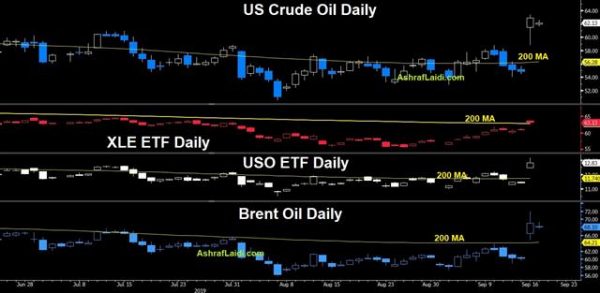

The latest rise in oil prices may jeopardize the already complicated balancing act at the Fed (between containing manufacturing deterioration from the trade war) and Trump’s managing of Saudi and Iran without provoking further price ascent. Yet, the US administration continues to send signals about reprisals against Iran and that helped crude to its 4th best day on record Monday. US crude oil is currently trading at $62 (from an earlier $63.38), while Brent is at $68.10 (from $71.95 earlier). CAD loses half of its gains as US equity futures head into the red. EUR is the strongest of the day after better than expected ZEW sentiment survey. Data points on Tuesday include US industrial production and homebuilder sentiment. The Premium JPY trade was stopped out, leaving only 1 trade in progress. A new trade shall be issued ahead of the US opening bell.

Oil finished Monday with an astounding $8 rally in the largest percentage climb since 2009 and fourth-highest on record. The attack on Iran sets in motion a wild amount of possibilities, including war between Iran and Saudi Arabia.

Trump’s response has pointed the finger at Iran but stopped short of anything definitive. So far in his Presidency, he has largely ignored the drums of war and his firing of John Bolton underscored that just a week ago. Not to mention the fact, Congress is will unlikely authorise a strike on Iran.

This time, he’s hinting that action may be in order but his tepid response so far suggests it may be limited. That may mean a further escalation down the line but if so, the market will revert to a focus on fundamentals and the ability of Aramco to bring production back online. On that front, reports vary widely with some suggesting nearly all of it could be restored in two weeks while others say it could be months.

Oil Complicates Fed Odds

Expect oil headlines to be a major factor in the days ahead but the Fed remains a key input. The odds of a cut fell to 95% from 100% a week ago. The oil jump complicates the decision because it creates a series of pros and cons. Higher gasoline prices for consumers and geopolitical uncertainty are negatives, but higher inflation and more investment/profits from US oil firms are positives. Ultimately, it’s more of a reason to cut 25 bps as anticipated while sticking with a wait-and-see statement and message. Also, pay attention to the dissent and whether St Louis Fed president Bullard shall stick to his position of demanding a 50-bp rate cut after the oil spike.