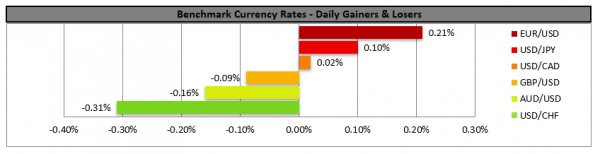

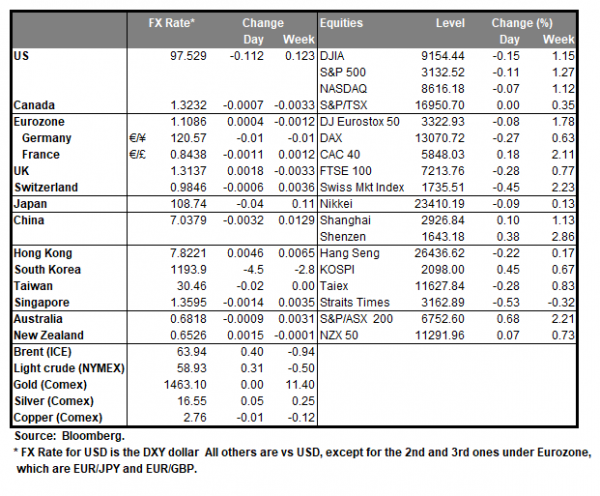

Today during the late American session (19:00, GMT), the FOMC will be releasing its interest rate decision. Market expectations are high especially after the release of the US employment data for November on Friday. The market widely expects the bank to remain on hold at +1.75% and currently Feds Funds Futures imply a probability of 95.4% for such a scenario. Should the bank remain on hold as expected we could see attention turning to the accompanying statement, the new dot-plot, the renewed economic projections and J. Powell’s press conference (19:30 GMT) later on. The accompanying statement could have a neutral tone, yet optimistic hints could be included as the bank switches from cutting rates to remaining on hold. Please note that, it is the last meeting of the bank for 2019, hence future projections tend to get more attention. In the new dot plot should the bank maintain rate levels unchanged through 2020, market expectations for a possible rate cut could be challenged. As for the economic projections, we could see them implying a slight improvement as recent financial data seem to allow it. Please bear in mind that the release could have market moving effects for the USD and the stock-markets, which could be extended during Powell’s press conference later on. EUR/USD rose yesterday aiming for the 1.1105 (R1) resistance line. We expect the direction of the pair to be mainly dependant on the release of the FOMC interest rate decision today and volatility could rise. Based on today’s US financial releases and the forecasts for the FOMC interest rate decision, we could see the pair reversing course, as the USD may strengthen. Should the pair’s long positions be favoured by the pair, we could see it breaking the 1.1105 (R1) resistance line and aim for the 1.1170 (R2) resistance level. Should the pair come under the selling interest of the market we could see it breaking the 1.1050 (S1) support line and aim for the 1.1000 (S2) support level.

…while cable spikes on election hopes…

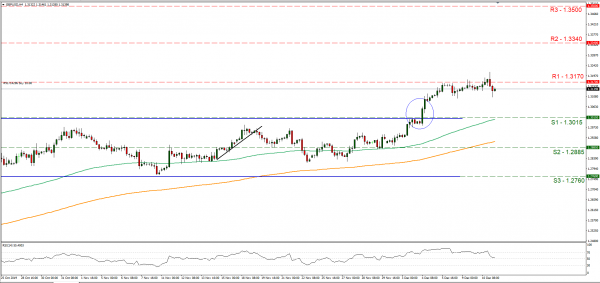

The pound strengthened against the USD reaching a 7-month high before retreating, as market’s expectations seem to be cementing about the UK election result providing the Conservatives a stable majority. The last YouGov poll seems to support such an outcome as it provides the Tories with a majority of 28 seats according to media. It should be noted though that the Torie lead seems to be shrinking if compared to prior polls and that could have caused the pound to correct lower. Also, we tend to note the danger of a hung Parliament as Boris Johnson warned that such an outcome could be disastrous for the country. It is characteristic of how election driven the pound actually is, as financial data yesterday providing mixed data had little effect on its direction. As the stakes are high for the pound, we could see volatility rising substantially at the release of the exit polls as well as results will be coming in. Cable maintained a sideways motion yesterday testing at some point the 1.3170 (R1) resistance line. We expect the sideways movement to continue, yet volatility could arise during the release of the FOMC interest rate decision and should there be any impressive headlines about the UK elections. Should the pair find fresh buying orders along its path we could see it breaking the 1.3170 (R1) resistance line and aim for higher grounds. Should the pair’s short positions be favored by the market, we could see it aiming if not breaking the 1.3015 (S1) support line.

Other economic highlights today and early tomorrow

Today, during the European session we get Sweden’s CPI rates for November. In the American session we get the US headline and core inflation rates for November and the EIA crude oil inventories figure. During tomorrow’s Asian session we get from Japan the machinery orders growth rate for October, while late on BoJ’s Deputy Governor Amamiya speaks.

Support: 1.3015 (R1), 1.2885 (R2), 1.2760 (R3)

Resistance: 1.3170 (S1), 1.3340 (S2), 1.3500 (S3)

Support: 1.1050 (S1), 1.1000 (S2), 1.0950 (S3)

Resistance: 1.1105 (R1), 1.1170 (R2), 1.1230 (R3)