The volatility in US stocks continued in the American and Asian sessions. Yesterday, the Dow and the Nasdaq rose by more than 5% as investors cheered the latest actions by the Fed and the US government. However, this changed after the markets closed as futures moved lower. Futures tied to the two indices are down by more than 2% and 3% respectively. The Fed has taken several actions to cushion the economy. It has lowered interest rates, launched a large-scale asset purchase, and provided liquidity in the repurchase (Repo) markets. Yesterday, the Fed announced that it would start lending against stocks and bonds in a bid to shore up liquidity in financial markets.

The Trump administration is also looking ahead to a large fiscal stimulus program. The administration is asking for a trillion dollars to spend on various programs. Part of the money will go to rescuing troubled companies like airlines and hotels. Other funds will go directly to Americans, who will receive checks if congress agrees on it. Other western governments are also preparing for a large-scale rescue plan. The UK unveiled a £330 billion package of emergency loan guarantees to business and £20 billion fiscal support. Spain has launched a €100 billion package of state loan guarantees while France has approved a €45 billion rescue package. The country will also guarantee €300 billion of bank loans to businesses. In total EU members have collectively offered €1 trillion in such guarantees.

Today, we will receive important details from Europe. We will receive car registration data from the UK, Italy, Germany, and other European countries. We will also receive the January industrial sales data from Italy. Most importantly, we will receive the CPI data from the European Union. Economists expects the February CPI and core CPI to have remained unchanged at 1.2%. Later on, we will receive the CPI data from Canada, building permits and housing starts from the US, and inventories data from the US.

EUR/USD

The EUR/USD pair rose slightly to a high of 1.1028, which was slightly higher than yesterday’s low of 1.0953. On the hourly chart, the price is slightly above the 14-day exponential moving average and slightly below the 28-day EMA. The RSI has moved from the oversold level of 20 to the current level of 46. The signal line of the MACD has started moving upwards and crossed-over the histogram. This implies that the pair could move higher today.

XBR/USD

The XBR/USD pair dropped to a low of 29.55, which is the lowest level since December 2015. This price is below last week’s high of 40.05. On the 30-minute chart, the price is along the 14-day and 28-day exponential moving averages. The price is slightly above the dots of the Parabolic SAR indicator. The price will likely move lower unless a supply solution is made.

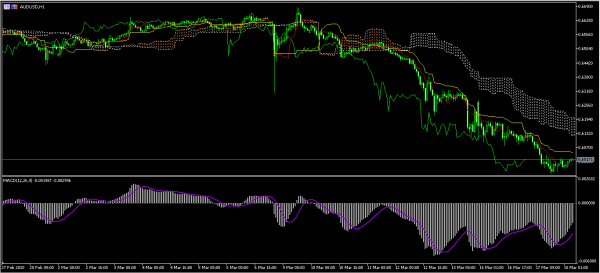

AUD/USD

The AUD/USD was little moved during the Asian session as traders reflected on the fiscal and monetary policies. The pair is trading at 0.6015, which is slightly above yesterday’s low of 0.5955. The price is between the tankan-sen and kijun-sen and below the Ichimoku cloud. The signal line of the MACD has started moving upwards. The pair may continue moving upwards on hopes of the stimulus.