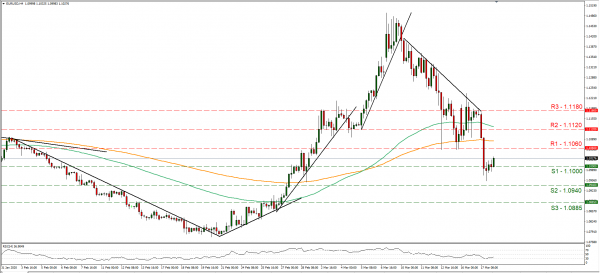

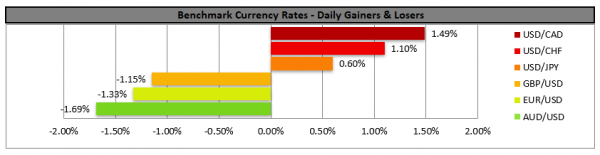

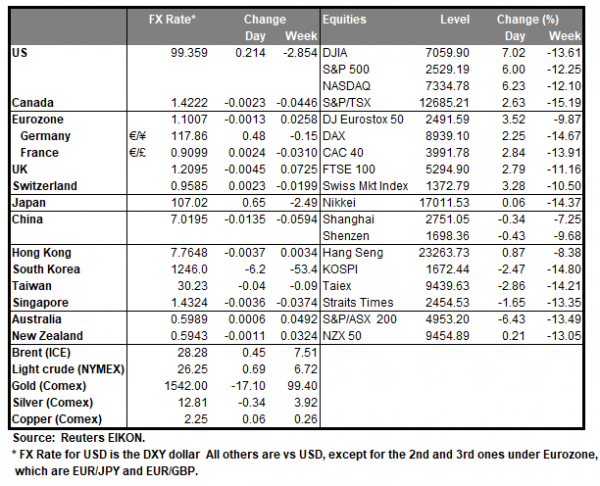

The common currency tumbled yesterday against the USD, as European investors rushed to the relative safety of the greenback, which tended to strengthen against most of its main counterparts. It should be noted that financial releases worsened the situation for the EUR as Germany’s ZEW economic sentiment indicator dropped widely, marking its lowest reading since 2012, reflecting the pessimism among investors and analysts about Eurozone’s largest economy in March. On the flip side, the USD got a boost as the industrial output growth rate outperformed its forecast and US Treasury yields had a substantial surge of 30 basis points, yet worries are still present as the retail sales growth rate showed a contraction for February, implying a hesitant US average consumer. Also, there may have been some support for the USD as the US government pressed for the enactment of an over 1 trillion USD fiscal stimulus package, including helicopter money with possible direct payments to individual US citizens according to media. US Stock futures seemed to slide down after the rally and the USD seems to have stabilized somewhat yet wide volatility could still be present today. EURUSD tumbled yesterday breaking consecutively the 1.1120 (R2) support line, the 1.1060 (R1) support level (both now turned to resistance) and continued to test the 1.1000 (S1) support line which was broken for a while, yet the pair bounced above it later on. Albeit a correction higher after the pair’s steep drop could be in the cards and some stabilisation during today’s Asian session being present, we tend to maintain a bearish outlook for the pair as the RSI indicator seems to underscore the strength of the bears while at the same time may also imply that there is still room for the pair to fall. Should the pair remain under the selling interest of the market we could see it breaking the 1.1000 (S1) support line once again and aim for the 1.0940 (S2) support level. Should the pair’s long positions be favoured by the market, we could see it breaking the 1.1060 (R1) resistance line and aim for 1.1120 (R2) resistance level.

AUD continues its journey south

The Aussie continued to weaken against the USD, reaching during today’s Asian session a 17-year low, as worries for a possible recession intensify. The pair came under extensive pressure also due to the strengthening of the USD, while analysts tend to note that there is still room lower for the pair. According to media, RBA has been flooding the market with cash to ease the strain on bond markets. Also, the Australian government according to various reports, prepares another round of fiscal stimulus in order to fight off a possible recession. On the other hand, analysts worry that the package may be too little and too late to save the Australian economy and tend to foresee the economy contracting. Fundamentally we maintain a bearish outlook for the AUD as market sentiment for a possible recession seems to be strengthening. The Aussie tumbled yesterday, breaking consecutively the 0.6075 (R2) support line and the 0.6025 (R1) support level, both now turned to resistance, before hitting a halt at the 0.5980 (S1) support barrier. We maintain a bearish outlook for the pair as the downward trendline incepted since the 11th of March continues to guide the pair’s price action. Should the bears remain in charge we could see the pair breaking the 0.5980 (S1) support line and aim for the 0.5925 (S2) support level. On the other hand, should the pair be guided by the bulls, we could see it breaking the 0.6025 (R1) resistance line and aim for the 0.6075 (R2) resistance level.

Other economic highlights today and early tomorrow

Today during the European session, we get Eurozone’s final HICP rates for February. In the American session we get the US construction data for February, Canada’s inflation rates for February, and the US EIA crude oil inventories figure. Just before the Asian session starts we get New Zealand’s GDP rate for Q4, while later on Japan’s inflation rates and Australia’s employment data both for February, are due out.

Support: 1.1000 (S1), 1.0940 (S2), 1.0885 (S3)

Resistance: 1.1060 (R1), 1.1120 (R2), 1.1180 (R3)

Support: 0.5980 (S1), 0.5925 (S2), 0.5870 (S3)

Resistance: 0.6025 (R1), 0.6075 (R2), 0.6120 (R3)