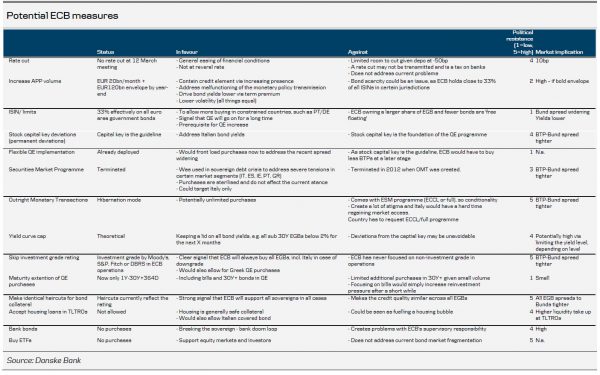

- With the current credit widening and particularly Italian surge in yields, we believe we need a forceful response from the ECB to act as a circuit breaker. Last year, we discussed the ECB toolbox in the event of a severe downturn (see ECB Research – Guns (and not bazookas) dominate ECB’s crisis arsenal, 9 January 2019). In our view, what we need now is not a general easing of monetary policy (which is why our baseline is still not a rate cut) but a package/measure that addresses the credit risk and high volatility in bond markets.

- We expect the ECB to announce a targeted response, in particular to Italy, which has seen a large fragmentation in the monetary policy transmission. We expect the ECB to step up its QE, ISIN limits and even more deviations from capital key, with a total envelope of at least EUR500bn (or reactivate the SMP programme) when the BTP-Bund spread hits 350-400bp, which we expect in coming days.

Targeting the measures

The ECB was quite clear in its targeted response last week, focusing on the liquidity and credit element in markets, as it did not cut rates. While we still do not rule out a rate cut, this is not our base case. However, with the recent miscommunication from the ECB, from both Christine Lagarde last Thursday and Robert Holzmann this morning, we need a strong commitment in terms of action from the ECB to contain this situation with significant spread widening.

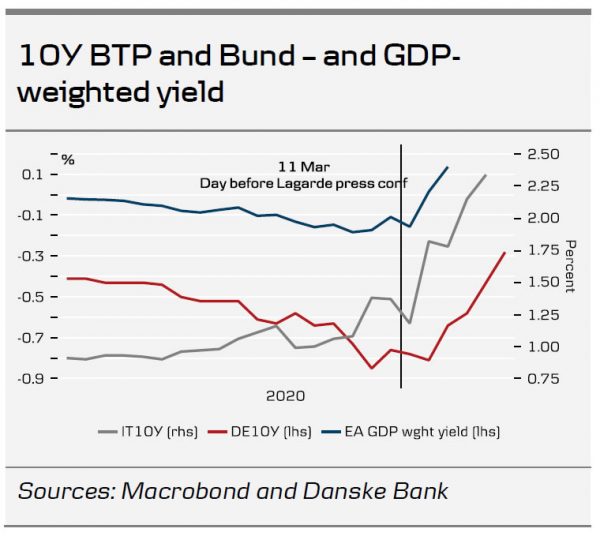

Since the press conference where Lagarde made her by now famous quote, ‘we are not here to close spreads’, Italian 10Y yields have more than doubled to 2.75% and German Bunds have risen almost 50bp to stand at -27bp. BTP prices are in freefall (yields up). Market liquidity has dried up completely in certain market segments, where bid-ask spreads have widened substantially and monetary policy transmission is broken. As such, we believe the ECB needs to step in urgently and do ‘whatever it takes’. We argue for a QE scale up with ISIN limits, more flexible QE implementation or an SMP programme when the BTP-Bund spread hits 350-400bp in coming days. We see the flexible capital key implementation as too restrictive in the current environment.

In short, to respond to the Italian surge in yields, fragmentation in the government bond market and repair the transmission of monetary policy, we expect the ECB to present a QE envelope of at least EUR500bn. We believe such a bold commitment would be enough to contain the credit risk associated with the government bond market. In our view, ISIN limits should rise to at least 40% and more likely 50%. We do not expect the ECB to commit to a monthly pace at this stage, with a view to implementing the package no later than in the coming year. The communication style is likely to be similar to last week’s QE communication.

How to address the Italian situation?

With the situation rapidly evolving in Italy and European government bond (EGB) markets, we need the ECB to step up its efforts to contain the credit element across the EGB. In particular, we believe Italy and the ECB should essentially ask themselves how they can remove the credit risk from Italy. Therefore, we believe any measure should be targeted at this but formulated in accordance with the price stability mandate (which is currently irrelevant if monetary policy transmission does not work). We do not cover all the elements in the table above but mention a few highlights.

Increase in APP volume

Last week, the ECB announced an additional EUR120bn envelope to address the surge in the credit element on the back of COVID-19 concerns. Unfortunately, the size of the package is very underwhelming given the situation. If we assume that ECB will implement 60% of the EUR120bn in the PSPP programme by year-end, this would allocate only EUR13bn extra to Italy on top of normal APP purchases, which, in our view, is not enough to contain the situation. In our opinion, a scale up of QE would be an easy solution but with ISIN limits binding, this would require a lifting of these too. This said, increasing QE volume would not target the problem at hand, as only around 18% of PSPP purchases would go to Italy (capital key).

Lifting ISIN limits

In our view, lifting ISIN limits would be a relative easy fix and a strong signal. The ECB has already lifted ISIN limits on CAC holding bonds on a case-by-case basis from 25% to 33%. We believe lifting this again could and should be done, as it would serve as a signal to markets that the ECB would buy a significant volume ahead and ensure its presence in markets. Right now, we estimate that the ECB can buy German bonds until early 2021 (assuming no increase in issuance but with the limited proposals of additional funding, it would not alleviate the ISIN limit pressure). In our view, lifting ISIN limits to, for example, 50% would not be as forceful as deviating consciously from the stock capital key.

Capital key and flexible implementation

The guiding principle of ECB QE purchases has been the stock capital key. This means that on a monthly basis, we observe different purchase patterns. However, the ECB has committed to holdings reflecting the stock capital key. This is a quite restricting factor in this case, as even if the ECB has called for flexible implementation, this means any front loading of purchases would mean the ECB buying less paper from the jurisdiction at a later stage. A permanent deviation from the capital key would solve much of the problem concerning implementation. However, this would face significant pressure, as the capital key has served as the foundation of the PSPP programme.

Outright monetary transactions

Outright Monetary Transactions (OMT) are the ECB’s ultimate tool. However, this also comes with rigidities. From an implementation point of view, the ECB would buy the bonds of the country and put them on the balance sheet. This may entail unlimited purchases and as such is very powerful. However, the OMT focuses only on the short end of the curve (1- 3Y area) and, therefore, would not put downward on the entire curve.

Another drawback of the OMT is that it assumes that Italy would have to ask for a programme with the EC/ESM via an ECCL or full programme. An Enhanced Conditions Credit Line as well as a full programme would come with a lot of stigma for markets and as such come with a risk of losing complete market access. Ireland, Portugal, Cyprus and Greece were all without market access for between 1Y 9M and 3Y when they were under the full programme. Spain did not lose market access during its bank recapitalisation package.

Securities Market Programme (SMP)

The ECB’s SMP programme which was ‘intended to ensure depth and liquidity in malfunctioning segments of the debt securities markets and to restore an appropriate functioning of the monetary policy transmission’ during the sovereign debt crisis was used by Italy, Spain, Portugal, Ireland and Greece. It did not use the purchases to change the monetary policy stance and, as such, they worked as a tool to address malfunctions in the government bond market (transmission mechanism). The purchases were sterilised. We believe this programme is very suitable in the current situation. However, with the creation of the OMT in 2012, the SMP terminated. Therefore, the political will to restart it may not be there but this programme was intended for situations such as this.

Yield curve cap

Introducing a cap on EGB yields would be a serious step one in the path to a ‘full-scale’ Bank of Japan (BoJ) crisis mode. Such a measure is unlikely to be a complete mirror of the BoJ’s yield curve control, where it targets a specific level/range on the 10Y JGB. The ECB could still take control of the yield curve for governments to a greater extent than QE by introducing a yield curve cap. Such a cap would imply that the ECB ensured that all yields on EGBs would be below a specific level. In order to carry out such a measure, the ECB would have to deviate from the foundation of the currency union, namely the capital key. In our opinion, such a move would be highly effective in the markets and ensure favourable financing conditions across the euro area. That said, such a measure could also be in breach of Article 123. See ECB Research – Guns (and not bazookas) dominate ECB’s crisis arsenal, 9 January 2019, for more reflections.

The more adventurous – changing haircuts

Treating Italian and, for example, German bonds as the same credit quality in ECB operations would be a strong signal (and not as now depending on rating to assess the haircut). This would allow investors to access liquidity operations (which are now done at the deposit rate until June) by posting Italian bonds as collateral. However, we believe this would face significant political resistance and would essentially serve as a kind of debt mutualisation from an ECB operational aspect.

All ratings – the strong backstop

Currently, the ECB is buying only bonds that are rated investment graded by one of the four major agencies. As the COVID-19 repercussions could lead to rating downgrades from all agencies for Italy, which has been hit significantly, an ECB commitment to buy government bonds irrespectively of the rating would serve as a strong backstop. However, this would lead to Greece being included in the QE programme, as it is currently facing worse yields than Italy.

Liquidity operations – collateral

In our opinion, the ECB’s liquidity operations announced last week (see Flash ECB Research – Targeted response but not general easing, 12 March) are already very generous. Banks can access LTROs with maturity until June this year at the deposit rate. Furthermore, with the TLTRO terms eased, banks can finance themselves at a rate that is lower than the deposit rate (dual interest rates). We believe it is unlikely the ECB would ease the terms in rate. However, we see a probability of the ECB expanding the pool of collateral that may be posted, to include loans such as those used for housing.

What’s next for the EU – the case for euro corona bonds or helicopter money

There has been much debate on the case for joined euro corona bonds after Angela Merkel was reported to be open to the idea according to Bloomberg last night. This morning, the Financial Times reports that she may not be as open to the idea after all and that she favours a ‘realistic’ initiative. Any risk-sharing instrument (which could be issued by the EIB, ESFM) in this situation would be highly welcome. Emmanuel Macron had apparently supported Italian PM Giuseppe Conte in the idea of corona bonds but making them backed by the ESM. In our view, the ECB would buy EU corona bonds should they be issued.

Helicopter money has long been an academic exercise, which in principle should boost euro area demand and in turn spur growth. Political resistance to giving money to euro area inhabitants is very high, unlike the US’s initiatives last night. The ECB would technically be able to ‘sterilise’ the measure but, in our view, resistance to it would be too high to implement. Helicopter money is the last and, in our view, least likely (but also very effective) bullet in the ECB’s arsenal in normal times but in the current situation this may not even be the preferred way to target the spread widening/malfunctioning of the transmission mechanism.