BoJ meeting, trade data and AU employment make the bulk of Asia data where attention will then shift to tonight’s ECB meeting.

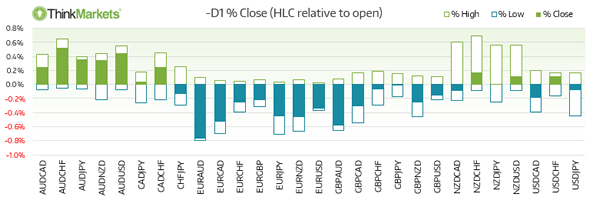

The Euro weakened overnight as traders booked profits ahead of today’s ECB meeting. The confusion following Draghi’s seemingly hawkish speech last month the ECB may use today’s meeting to tweak their message to calm the markets. Draghi sent the Euro above 113 at the end of June and ECB officials attempt to tame the run came to little avail as the Euro stopped just shy of 116 overnight. So they may use today’s meeting to tweak the message again and take the fun ot of the rally.

EURAUD remains out preferred Euro short as sentiment on AUD remains strong, it is the strongest G10 performer this year whilst Euro faces further profit taking over the near-term. AU employment is expected to soften slightly but unless it throws a curve-ball then AU should remain supported. If there is any concern to the AUD rally it may come from Guy Debelle’s speech tomorrow as the temptation to jawbone AUD may now be on his agenda.

The positive sentiment surrounding AUD is likely to help AUDJPY on its way to Y90 following today’s BoJ meeting. No major changes are expected on the policy front but a downgraded inflation outlook is viable. With household spending, wage growth CPI all disappointing, it is hard to justify their inflation forecast let alone a 2% target. Large speculators have also piled into Yen shorts in recent weeks whilst bulls remain on the sideline, making Yen the preferred short over the coming weeks.

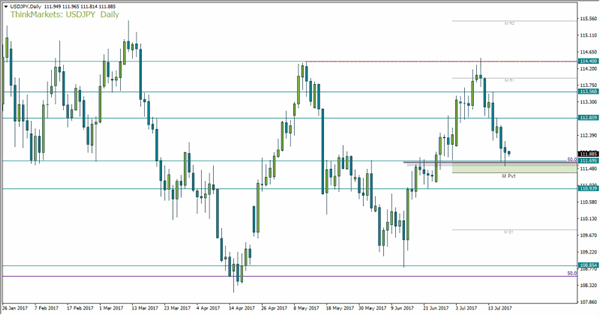

US data bucked the trend by beating forecasts overnight, seeing an improvement in building permits and housing starts. It helped slow the bleeding on the US Dollar index, although the weaker Euro probably provided the bulk of support. USDJPY found support at 111.55 and focus now switches to the BoJ meeting where a corrective rally is expected. The healthcare plan disappointment is largely priced in and Yen outflows are likely to persist as traders are currently net short the Yen by US$12.3bn (as of last week’s CFTC report).

The monthly pivot and 50% retracement provide a broad zone up support between 111.37 – 111.68, with yesterday’s bullish hammer respecting the upper part of the zone. If we are to see a break of yesterdays low, as long as we remain above the monthly pivot then we do see potential for an eventual upside move so. Bearish momentum on the lower timeframes is waning and the downside appears stretched.