The COVID-19 pandemic has already had a devastating impact on the US labour market and the next data to get the virus treatment are retail sales and industrial production. Both are due on Wednesday at 12:30 GMT and 13:15 GMT, respectively. The virus outbreak may have been dominating the headlines since January but the hard data for countries other than China have only now started coming in. Thus, can the latest bout of market optimism prevail, or will the dire numbers reignite fears of economic catastrophe?

Retail sales likely plummeted in March

As predictions mount that the forthcoming downturn will be the worst since the Great Depression of the 1930s, there can be no hiding from the bleak economic indicators that are about to flash on our screens. And given that the US consumer is considered to be the backbone of the American economy, the March retail sales report will be watched especially closely.

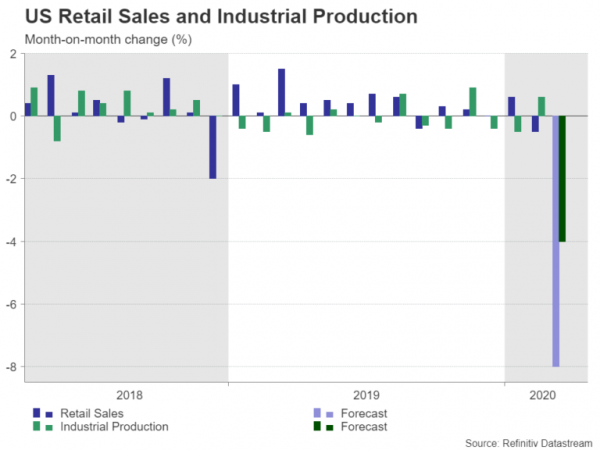

Consumer spending had already weakened unexpectedly in February, falling by 0.5% month-on-month, even before the coronavirus had started spreading rapidly in the United States. But with the country now the virus epicentre of the world and many states entering a lockdown, retail sales are projected to have plunged by 8% m/m in March.

The hit on industrial activity is also expected to have been significant, with production forecast to have dropped by 4% m/m versus a 0.6% rise in February. With no conclusive sign yet that the infection curve is flattening in the US, those numbers are only expected to get worse in the coming months.

Is the worst already priced in?

However, as far as the markets are concerned, it’s possible they’ve already bore the brunt of the virus impact and the flurry of fiscal and monetary stimulus announcements has made investors immune to more bad news. That means headline-grabbing figures might not have the effect on traders that was anticipated at the onset of the crisis. Optimism that the lockdowns will be eased over the coming month and that a vaccine for COVID-19 is just around the corner may also be putting a floor under the virus sell-off in risk assets.

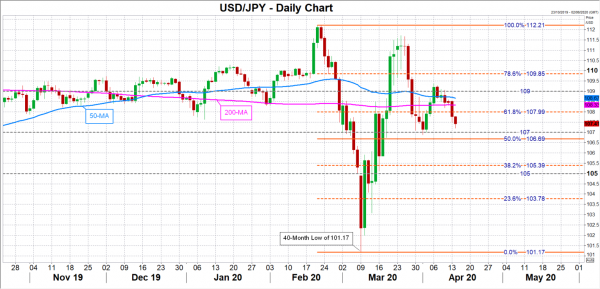

Assuming there is no new negative development and the upcoming reports are more or less in line with expectations, dollar/yen could settle in the 106.70-107 region, with the 50% Fibonacci retracement of the February-March down move being the bottom of that range. But reaction in the pair is likely to be limited from any surprises given the safe-haven status of both currencies.

To the downside, negative pressure could push dollar/yen to the 105 area, whereas better-than-forecast numbers could help the pair claw back above the 108 level towards its 50-day moving average.

Focus to soon shift to recovery phase

Going forward, though, as we head out of this crisis and attention shifts to the recovery phase, market reaction to the incoming data is likely to turn more volatile if investors begin to question the speed of the recovery, whether that’s due to fresh setbacks such as delays in finding a vaccine, or doubts about the economic response plans of the US and other governments.