- The ECB delivered broadly as expected by increasing its PEPP envelope by EUR600bn to EUR1,350bn until June 2021. At the same time, it announced that it had decided to reinvest the PEPP holdings at least until end-2022.

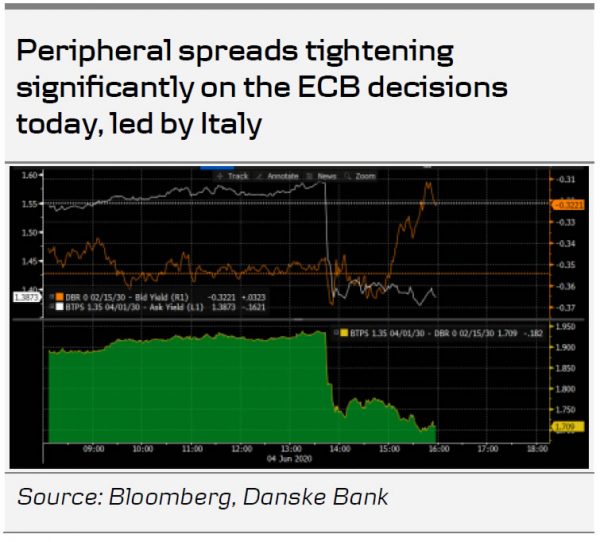

- Markets reacted with risk on, led by Italy tightening 20bp.

PEPP was increased…

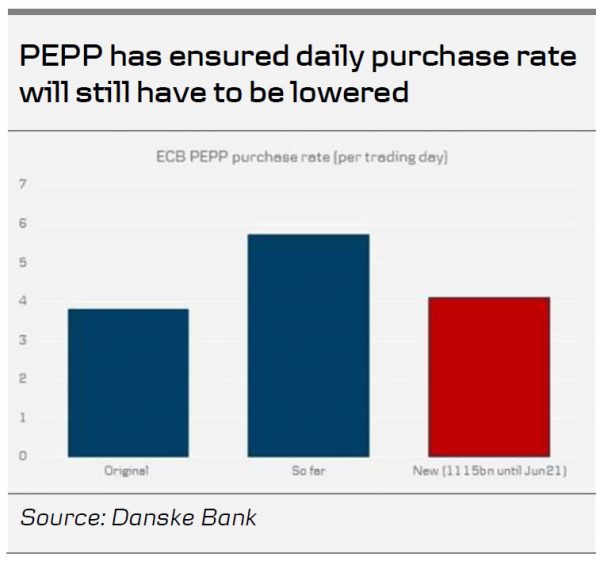

At the monetary policy meeting ending today, the ECB decided to increase the PEPP envelope by EUR600bn to EUR1,350bn, which was slightly more than our estimate and consensus of EUR500bn. Overall, the ECB delivered as we expected as outlined in ECB Research – PEPP’in it up, 28 May. With the new increased envelope, the PEPP would be exhausted in late February 2021, if the ECB does not lift the envelope again, or the purchase rate will have to slow down.

Looking ahead, with the larger PEPP envelope, we do not expect the ECB to announce further measures at the current juncture. During the press conference, Christine Lagarde was relatively balanced in her assessment, albeit acknowledging the downside risks to the -8.7% growth forecast for 2020 (see later in this document). Today’s decision was on a broad consensus, while there was unanimity to do something.

Lagarde’s answer to questions on the German constitutional court ruling was as expected, as she referred to the European Court of Justice ruling on the PSPP legality and to the GCC ruling being addressed to the Bundestag.

…and markets liked it

Fixed income markets reacted positively on the slightly higher than expected package, most notably led by Italy, where we saw the BTP-Bund spread tightening by 20bp.

We now have more ECB easing but a stronger EUR. In our view, this is arguably so as these actions indeed cap macroeconomic tail risks. Thus, the decline in uncertainty becomes a propellant of FX strength.

To keep the rally in EUR/USD going, the global investment environment needs to continue to favour a rotation towards ‘undervalued’ assets. As a simple rule of thumb, look to the world’s canary in the coalmine to gauge this. Simply put, we need at least one of DAX, TRY, ZAR or BRL to continue to rise some 1-2% a day to further support EUR but this may stick with us a while longer. Indeed, currently, we do not see much standing in the way of going to 1.14 – helped by speculation of a Brexit compromise – even if the latter is unlikely to be delivered near term, in our view.

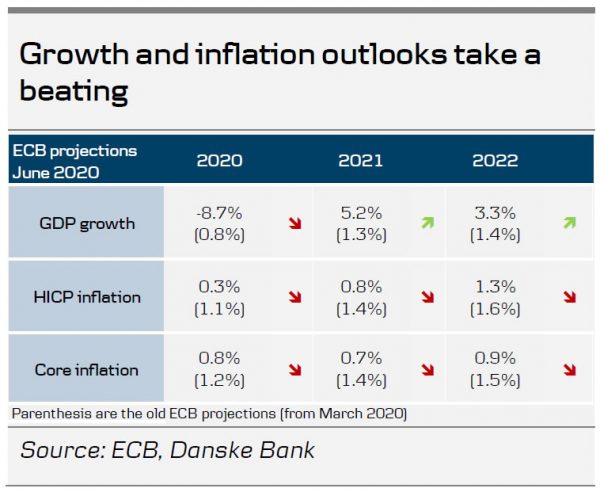

Dire economic outlook stipulates PEPP extension

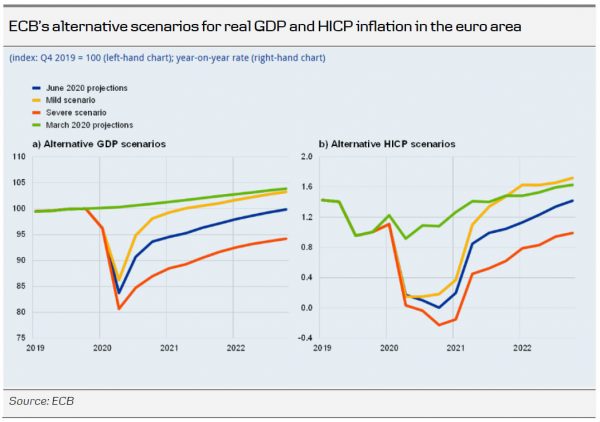

As expected, the new ECB staff projections painted a dire economic outlook, with marked downward revisions in the inflation and GDP forecasts, which, according to Lagarde, were an important trigger for the PEPP extension. Although there have been some improvements in high frequency data, these remain tepid in light of the significant decline in activity registered, according to Lagarde. Following a GDP contraction of -8.7% in 2020 in the baseline scenario, the ECB expects the euro area economy to expand by 5.2% in 2021. This scenario is more negative than our expectation of a contraction of -6.7% in 2020 (see The Big Picture – Reopening, recovery and risks, 2 June) but both the ECB and we still expect a gradual euro area recovery to unfold in H2 20. That said, risks remain skewed on the downside and the ECB’s adverse scenario could see GDP falling by -12.6% in 2020 and depressing HICP inflation to a mere 0.9% in 2022 due to significant labour market slack.

The ECB expects weaker demand to exert downward pressure on inflation, which will be offset only partially by upward pressure related to supply constraints. Although the ECB revised the HICP and core inflation outlook markedly lower over the whole horizon, not least due to a stronger effective euro and lower oil prices feeding into the forecast, it remained on an upward sloping trajectory, with core inflation reaching 0.9% by 2022. We broadly agree with the ECB that anti-inflationary forces are maintaining the upper hand in the near-term but, in our view, the unprecedented monetary/fiscal easing could limit the damage to labour markets and cost-push inflation in some industries leaves room for a reflation spiral to emerge eventually (see Euro Area Research – The road to recovery, 14 May).