FFor the 24 hours to 23:00 GMT, the EUR rose 0.37% against the USD and closed at 1.1313.

On the macro front, Euro-zone’s Sentix investor confidence rose to -18.2 in July, less than market expectations for rise to a level of -10.9 and compared to a reading of -24.8 in the prior month. Meanwhile, retail sales jumped 17.8% on a monthly basis in May, as many countries started easing restrictions in containment area and more than market expectations for rise of 15.0%. In the prior month, retail sales had recorded a revised fall of 12.1%. Separately, Germany’s factory orders climbed 10.4% on a monthly basis in May, less than market expectations for a rise of 15.0% and compared to a revised drop of 26.2% in the prior month.

In the US, the ISM non-manufacturing PMI climbed to 57.1 in June, more than expectations for a rise to a level of 50.1 and compared to a reading of 45.4 in the earlier month. Additionally, the Markit services PMI rose to 47.9 in June, compared to a level of 37.5 in the previous month. The preliminary figures had recorded an advance to 46.7.

In the Asian session, at GMT0300, the pair is trading at 1.1311, with the EUR trading marginally lower against the USD from yesterday’s close.

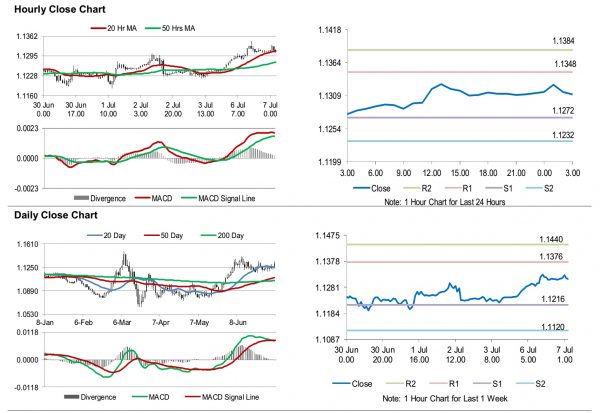

The pair is expected to find support at 1.1272, and a fall through could take it to the next support level of 1.1232. The pair is expected to find its first resistance at 1.1348, and a rise through could take it to the next resistance level of 1.1384.

Moving ahead, traders would keep a watch on Germany’s industrial production for May, slated to release in a few hours. Later in the day, the US IBD/TIPP economic optimism for July and the JOLTS job openings for May, would keep investors on their toes.

The currency pair is showing convergence with its 20 Hr moving average and trading above its 50 Hr moving average.