- May retail sales grew 18.7% from April

- Sales rebounded across the board – online sales remained elevated from year-ago

- Preliminary estimate points to further growth (24.5%) in June; pace to moderate afterwards

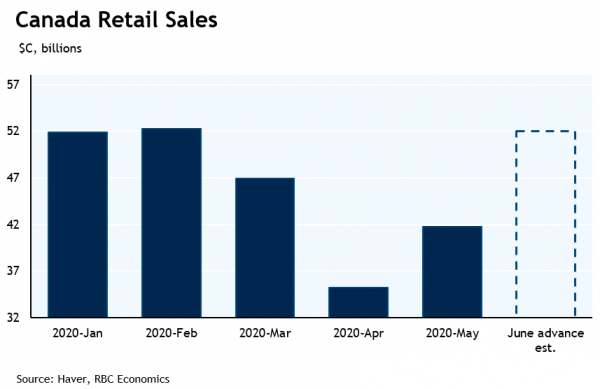

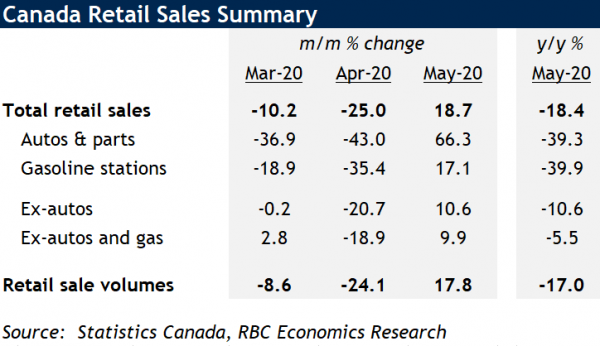

Retail sales recorded a sharp 18.7% rise in May, as more brick-and-mortar stores reopened amid lower virus case counts across Canada and a tick higher in consumer confidence from April lows. Statistics Canada noted 23% of retailers remained closed during May, down from one-third in April. The rebound was wide-spread across almost all sub-categories, though led by motor vehicle and parts sales. Early industry reports showed the momentum in auto sales continued well into June. Food and beverage sales (from stores) slipped lower relative to April, but remained 11.6% above a year ago as the pandemic kept diners at home. Heightened demand for online purchases has pushed e-commerce sales to account for well over 8% of overall retails sales, compared to just 3% a year ago. Overall e-commerce sales remained elevated in May, up 112.7% year-over-year, and that’s excluding sales made from foreign retailers.

The bounce back was not large enough to bring activity back to pre-COVID levels. Excluding price impacts, sale volumes declined by almost one third over March and April, and were still 18% below their February levels in May. But Statistics Canada also reported a preliminary estimate that (nominal) sales rose another 24.5% in June. That would leave the total in that month 2% above year ago levels. That is similar to trends shown by our own tracking of card purchases, as well as the bounce-back in retail spending observed in the United States to-date.

Initial data over May and June, including retail and home resale numbers, continued to point to a quicker-than-expected initial rebound in activity early in the economic recovery. This initial rebound was likely fueled by substantial government income support measures, and there is still a risk that those measures expire before labour markets are fully recovered. And some degree of safety protocols are likely to remain in place for an extended period, limiting overall services demand. For now, we continue to expect a sharper than expected initial rebound to be followed by more moderate growth beyond June.