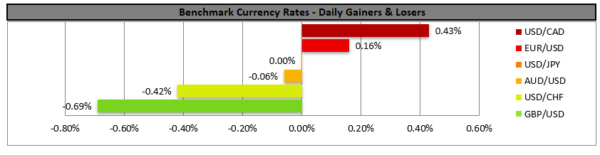

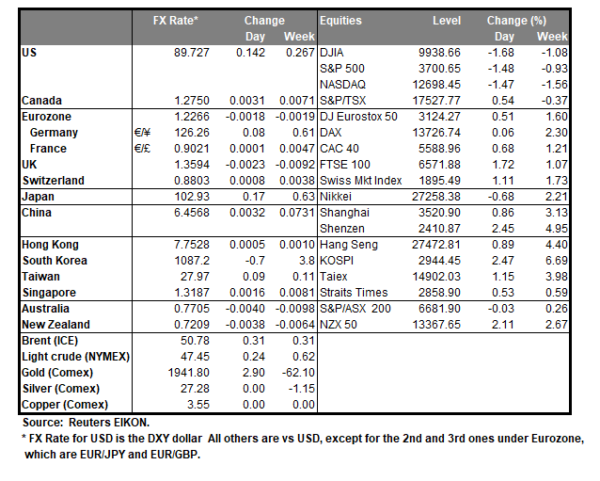

The USD tended to be on the rise against a number of its counterparts, given that uncertainty was at rather high levels and the greenback enjoyed some safe haven inflows. The dollar has seen some buying amid an increase in new COVID infections while also a new variant of COVID 19 which was originally located in South Africa, tended to worry scientists, as it may be more resistant to current vaccines being rolled out. At the same time the elections in the state of Georgia, for two Senate seats which are to be held today, could be determining the balance of power in the Senate and should the Democrats win both seats, they will have control over the total span of both US legislating bodies providing Biden considerable leeway. If Democrats manage to gain control over the Congress and given the election of Biden in the White House, that could enable the new administration to rollout possibly additional fiscal spending, boosting the US economy and hence ease market worries somewhat. Should market worries continue to be on the rise though. we may see the greenback strengthening further while financial data releases could also generate some interest today.

USD/CAD jumped yesterday testing the 1.2800 (R1) resistance line, probably also caused by a CAD weakness due to the current uncertainty in the oil market. As the pair broke the downward trendline incepted since the 28th of December, we switch our bearish outlook in favor of a sideways motion initially, albeit a correction lower could be in play after the jump. Should USD/CAD find fresh buying orders along its path, we could see it breaking the 1.2800 (R1) line and aim for the 1.2875 (R2) level. If a selling interest is displayed, we could see USD/CAD breaking the 1.2700 (S1) support line and start aiming for the 1.2610 (S2) level.

GBP weakens as Johnson orders new lockdown

The pound weakened against the USD, EUR, JPY and CHF yesterday as worries rose after the UK government ordered a new lockdown over England. As reported by the BBC, people in all of England and most of Scotland must now stay at home except for a handful of permitted reasons, while schools have closed to most pupils in England, Scotland and Wales, while Northern Ireland will have an “extended period of remote learning”. The new lockdown for England is expected to last until mid-February, while Scotland’s lockdown is to be reviewed at the end of the month and UK’s PM Boris Johnson characteristically stated that the coming weeks are to be the “hardest yet”. On the other hand, it should be noted that vaccination in the UK is ongoing and has been bolstered after the UK approved also the AstraZeneca vaccine, creating some hopes for a possible quicker return to a relative normality.

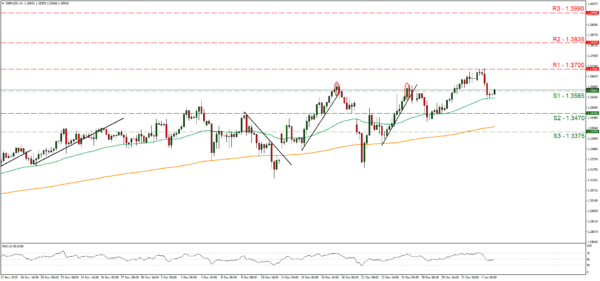

We see the new lockdowns weighing on UK’s economic outlook possibly delaying its rebound and should market worries intensify, we may see the pound weakening. On the flip side, the vaccination as noted above tends to provide a way out of the crisis and could support GBP. GBP/USD dropped from the highs of the 1.3700 (R1) resistance line yet was able surface above the 1.3585 (S1) support level. Despite the wide drop we still tend to maintain our bullish view for cable as the upward movement remains intact for the time being. Should the bulls actually maintain the initiative over cable, we could see the precious metal aiming if not breaking the 1.3700 (R1) line which was yesterday’s highs, thus opening the way for the 1.3835 (R2) barrier. Should the bears be in charge, GBP/USD’s prices, could break the 1.3585 (S1) support line and aim if not break for the 1.3585 (S2) support level.

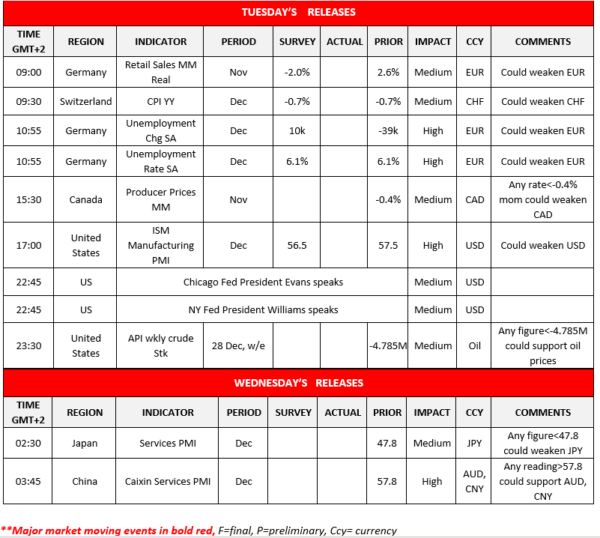

Other economic highlights today and early Tuesday:

Today during the European session, we get Germany’s retail sales for November, Switzerland’s CPI rates for December and Germany’s employment data for December. In the American session, we note Canada’s producer prices growth rate for November, yet the star is expected to be the US ISM manufacturing PMI for December and later we get the US API weekly crude oil inventories figure. During the Asian session We note Japan’s and China’s Services PMIs for December. As for speakers please note that Chicago Fed President Evans and New York Fed President Williams are scheduled to speak.

Support: 1.2700 (S1), 1.2610 (S2), 1.2520 (S3)

Resistance:1.2800 (R1), 1.2875 (R2), 1.2955 (R3)

Support:: 1.3585 (S1), 1.3470 (S2), 1.3375 (S3)

Resistance:1.3700 (R1), 1.3835 (R2), 1.3990 (R3)