- Equity rally loses steam after strong weekly gains amid renewed virus jitters

- Talk of Biden tax increases also undermines risk appetite, lifting the dollar

- Poor data pull down pound and aussie but euro fares better after ECB stays put

Virus outbreaks, recession fears cap risk rally

The stimulus-led stock market rally faltered on Friday as investors paused for breath after sharp gains in a week when US President Joe Biden formally took office, reaffirming expectations of higher spending and borrowing under a Democratic administration. However, profit taking wasn’t the only reason stocks were nursing losses as worries about a recession in Europe, a new Covid outbreak in China and higher taxes in the United States spoiled the cheery mood that had prevailed for much of the week.

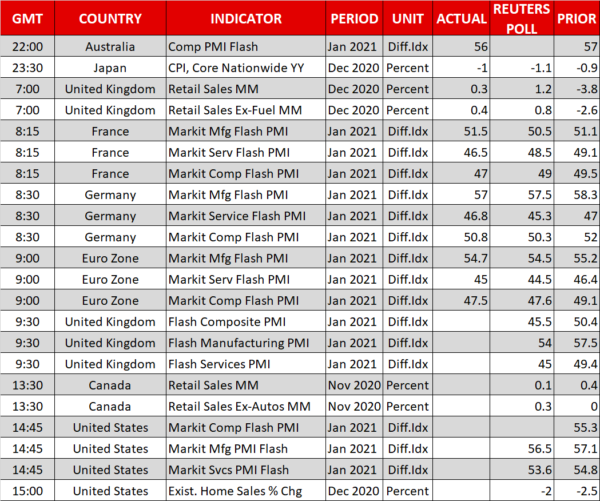

A warning by ECB President Christine Lagarde that the Eurozone could be headed for a double-dip recession, combined with flash PMI data suggesting that business activity in the bloc contracted for the third straight month in January underscored the near-term economic risks from the latest virus wave. But it’s not just Europe and America that are still grappling with high infection rates as the recent outbreak in China appears to be escalating, with more districts going into lockdown.

In the US, the weekly jobless claims continue to point to a slowing recovery, while disappointing retail sales numbers out of the UK and Australia for December have only added to the downbeat tone today.

On Wall Street, the S&P 500 and Dow Jones ended Thursday more or less flat, as speculation that the Biden administration could start raising taxes later in the year gave investors something else to contend with. The Nasdaq Composite stood out as it closed about 0.55% higher on expectations of a bumper earnings season for tech stocks.

But shares in Asia and Europe were mostly down today, with US futures also in the red.

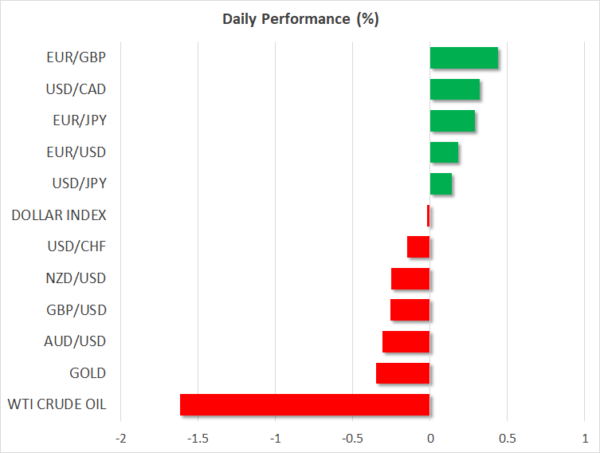

Dollar advances but perked-up euro slows it down

The US dollar regained some footing on Friday but was still on course for hefty weekly losses against its rivals. Hopes of more large fiscal packages from a Democratic-controlled Congress, combined with rising debt, have pummelled the greenback since November’s presidential election. And whilst today’s corrective moves are being partly driven by risk-off trades, the safe-haven Japanese yen was mixed, suggesting this was just a temporary setback in the risk rally.

The euro was a surprise outperformer as it held on to yesterday’s gains after Lagarde dispelled suggestions that keeping Eurozone yield spreads in check amounted to yield curve control in her post-meeting press briefing. Investors were also sceptical about the ECB’s easing bias after Lagarde said the downside risks were “less pronounced”.

Whether the dollar’s latest turnaround is able to gather further momentum or not could depend on what President Biden talks about in his address at 19:45 GMT on the administration’s response to the economic crisis.

Pound, aussie and loonie pare gains, kiwi is week’s winner

The pound and the commodity dollars all pulled back on Friday, falling by about 0.5%, except for the New Zealand dollar, which was down by a lesser 0.3%. The kiwi is on track to be the week’s biggest gainer against the US dollar, though the others are not far behind. Stronger-than-expected inflation numbers for Q4 further diminished the odds of negative rates in New Zealand overnight.

Data misses in the UK and Australia weighed on the respective currencies. The UK’s services PMI crashed in January to the lowest since May 2020 even as Prime Minister Boris Johnson signalled the lockdown is unlikely to be eased anytime soon. Yet the pound’s losses were no greater than its peers, as investors are eyeing Britain’s impressive vaccination programme where almost five million people have now received their first jab.

The loonie, meanwhile, could also find it easy to resume its uptrend soon after Bank of Canada Governor Tiff Macklem yesterday said the Canadian economy may not need “as much quantitative easing stimulus over time”.