The USD retreated somewhat against a number of its counterparts yesterday, as the market sentiment tended to improve after the uncertainty caused by the buying frenzy displayed by retail traders aligning on Reddit. Despite market worries easing on the issue, we still see them persisting as the overall effect is still present in the markets and may spill over from the stock markets to other markets as well, with the ripple effects ever present. On the flip side, US Stock markets ended the day in the green territory in a clear sign that a more risk on approach may have been adopted by the markets. It should be noted that a delay in the roll out of vaccines globally, may cause some market worries for the pace of a possible global economic rebound, with market worries focusing on Europe. It’s characteristic that EU leaders are mulling a possible drug export quota or controls in order to lift the vaccination process back home. Should the market sentiment continue to be on the positive side we may see the USD weakening further, while traders may also eye today’s financial releases.

Dow Jones rallied yesterday, breaking consecutively the 30375 (S2) resistance line and the 30650 (S1) resistance line, both now turned to support, even reaching as high as the 30950 (R1) resistance line, before correcting lower. We may see some stabilisation taking place before the index decides on the direction of its next leg. Should the buying interest be renewed we may see the index reversing course once again, breaking the 30950 (R1) and aiming for the 31290 (R2) resistance level which marks an all time high. Should the correction lower be extended and turned into a clear selling interest , we may see the index breaking the 30650 (S1) support line, aiming for the 30375 (S2) support level.

Pound gains on risk on sentiment

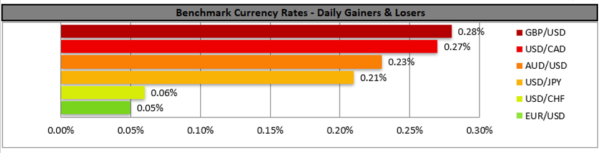

The pound tended to be on the rise against the USD, EUR, JPY and CHF yesterday, as the risk on sentiment may have spurred the pound’s bulls. The number of new daily Covid cases is on the rise over the past two days, yet the intense vaccination process may be easing market worries somewhat. Also on the bright side, a new Covid vaccine seems to show a 89% efficacy in the UK trials as reported by BBC and is the first to show it is effective against the new variant of the virus discovered in the UK. Also on GBP’s fundamental front it should be noted that UK businesses have grievances for extensive red tape on exports. Overall though should market optimism be maintained we may see the pound marking further gains and vice versa.

GBP/USD rose yesterday breaking the 1.3700 (S1) resistance line, now turned to support, yet corrected lower during today’s Asian session, testing the prementioned level on the down side. We maintain our bullish outlook as long as upward trendline incepted since the 24th of September, remains intact. However it should be noted that cable seems to find increased resistance in its ascent higher. Should the bulls actually maintain control over cable’s direction, we may see it aiming if not breaking the 1.3835 (R1) resistance line. Should the bears take over, we may see GBP/USD breaking the 1.3700 (S1) support line and for the 1.3585 (S2) support level

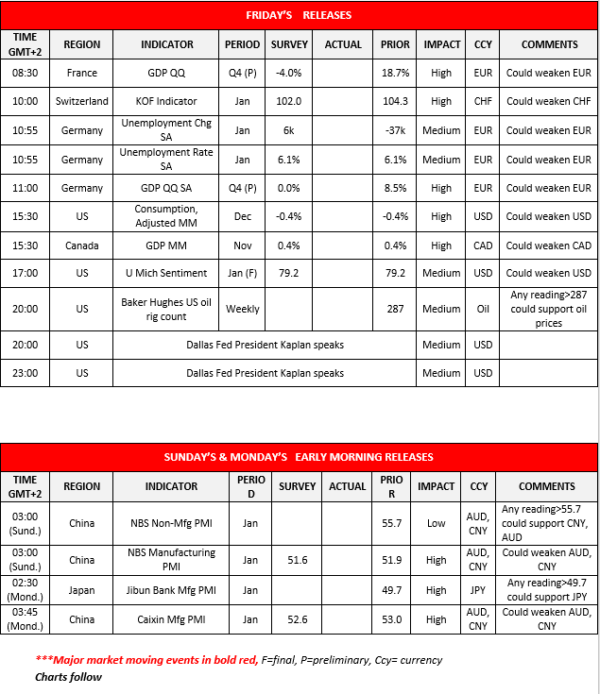

Other economic highlights today and early Tuesday:

Today during the European session, we get France’s preliminary GDP rate for Q4, Switzerland’s KOF indicators for January, Germany’s employment data for January as well as Germany’s preliminary GDP rate for Q4. In the American session, we note the US consumption rate for December, Canada’s GDP rate for November and the US final U.Michigan consumer sentiment for January while oil traders could be interested in the Baker Hughes US oil rig count. As for speakers, we note in the late American session that Dallas Fed President Kaplan is scheduled to speak. On Sunday we get China’s PMIs for January from the National Bureau of Statistics, while on Monday’s Asian session, we get the Caixin manufacturing PMI for January, while from Japan we note the Jibun manufacturing PMI also for January.

Support: 30650 (S1), 30375 (S2), 30065 (S3)

Resistance: 30950 (R1), 31290 (R2), 31620 (R3)

Support: 1.3700 (S1), 1.3585 (S2), 1.3470 (S3)

Resistance: 1.3835 (R1), 1.3990 (R2), 1.4145 (R3)