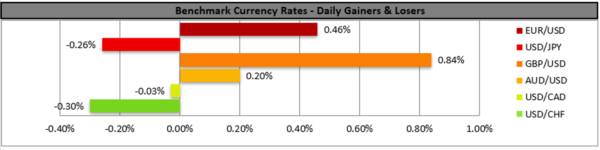

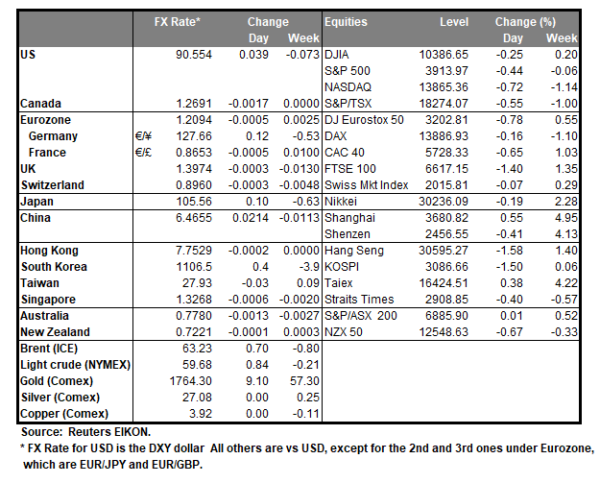

The USD nursed losses against a number of its counterparts yesterday and its ascent seems to have come to a halt for the time being. Employment data released yesterday, showed that in the last week the number of initial jobless claims rose instead of dropping as expected and dented the optimism of the markets for a quicker recovery of the US economy. At the same time financial data showed that economic activity in the wider Philly area weakened, albeit not as much as expected, and the number of housing starts dropped. Nevertheless, we still see the case for a solid economic recovery given the high fiscal stimulus planned and the intense roll out of vaccines in the US. Today we expect traders to focus on the release of the preliminary PMI readings for February in the US and other regions such as the EU.

EUR/USD rose yesterday breaking the 1.2050 (S1) resistance level now turned to support and continued higher to aim for the 1.2100 (R1) resistance line. The pair stabilised just below the R1, and for our sideways bias to change in favour of a bullish outlook, we would require it to break the 1.2100 (R1) resistance line, so that the pair’s price action continues to mark higher peaks and troughs. Please note that the RSI indicator below our 4-hour chart seems to remain near the reading of 50, implying a rather indecisive market. Should the pair find fresh buying orders along its path, we could see it breaking the 1.2100 (R1) resistance line and aim for the 1.2150 (R2) resistance level. Should a selling interest be displayed, we may see EUR/USD aiming if not breaking the 1.2050 (S1) support line on its journey southwards.

Pound’s strengthening regains momentum

The pound’s strengthening regained momentum as the sterling ascended against the USD, EUR, JPY and CHF as bulls were in charge. The intense vaccination program carried out in the UK strengthens hopes for a quicker economic recovery and a return to some sort of normality. It should be noted that Johnson’s government is planning the exit from the country’s third national lockdown boosting the market’s confidence for the pound while at the same time the prospects for UK’s financial sector after Brexit seem to smoothen out. On the monetary front, BoE policymaker Saunders’s comments weakened further the prospect of negative rates and strengthened the pound. Today we expect pound traders to focus on the release of the retail sales growth rate for January as well as the preliminary PMIs for February, with focus being on services.

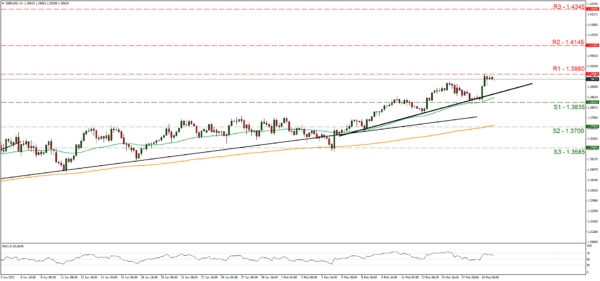

GBP/USD rallied yesterday from the lows of the 1.3835 (S1) support line to the highs of the 1.3990 (R1) resistance line. We maintain a bullish outlook for the pair as the upward trendline which steepened on the 4th of February remained intact and was able to push the pair higher as cable’s price action tested it. It should be noted that the RSI indicator below our 4-hour chart is above the reading of 50, yet remains below 70, which provides an advantage for the bulls. On the other hand, it should be noted that the pair has reached a record high level since late April 2018, which could create some doubts among pound traders for any further gains technically speaking. Should the GBP/USD remain under the spell of the bulls, we may see it breaking the 1.3990 (R1) line and aim for the 1.4145 (R2) resistance hurdle. Should the bears take over, we may see GBP/USD breaking the prementioned upward trendline and aim if not break the 1.3835 (S1) line.

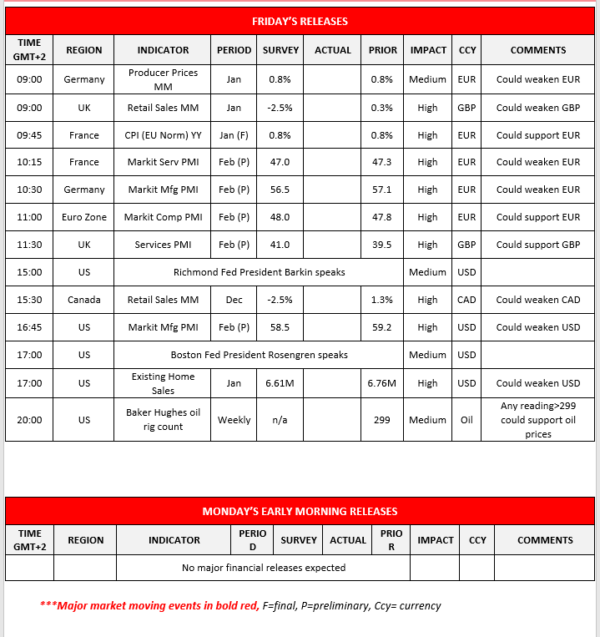

Other economic highlights today and early Tuesday:

Just before the end of the week, with another pact day we highlight the release of February’s preliminary PMIs for Germany, France, Eurozone, UK and the US. Other than that, in the European session, we get from Germany the PPI rate for January, UK’s retail sales growth rate also for January and France’s final CPI (EU normalized) rate also for January. In the American session, we get Canada’s retail sales and from the US the existing home sales for January and the weekly Baker Hughes oil rig count. As for speakers we note that Richmond Fed President Barkin and Boston Fed President Rosengren are scheduled to speak in the American session today.

Support: 1.2050 (S1), 1.2000 (S2), 1.1950 (S3)

Resistance: 1.2100 (R1), 1.2150 (R2), 1.2220 (R3)

Support: 1.3835 (S1), 1.3700 (S2), 1.3585 (S3)

Resistance: 1.3990 (R1), 1.4145 (R2), 1.4345 (R3)