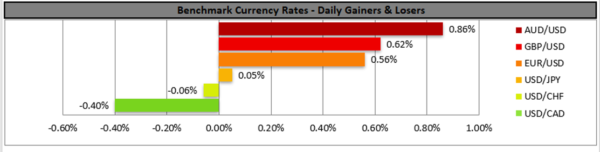

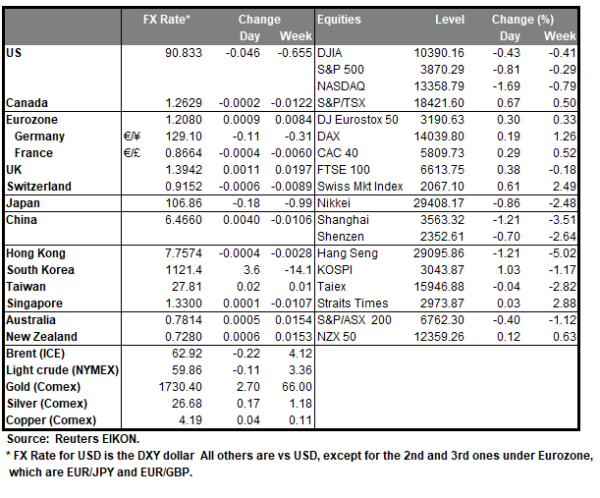

The USD tended to edge lower against a number of its counterparts, while US stock markets sent out mixed messages at yesterday’s session. At the same time commodity currencies tended to gain against the USD benefited by the improved market sentiment. It should be noted that US President Biden sounded optimistic regarding the US vaccination program as he stated that the US will have enough vaccines for every US adult by May. The statement was made after Johnson & Johnson and Merck agreed to join forces in making the vaccine. Also, US yields continued their retreat lower after their considerable surge last week which may have also weakened the USD. Today, we tend to focus on US financial releases besides the fundamentals, while also a number of Fed officials scheduled to speak could grab the market’s attention.

USD/CAD retreated testing the 1.2610 (S1) support line yesterday. Given that the pair has broken the upward trendline guiding it since the 25th of February on Monday and the downward motion continues, we tend to maintain a bias for a bearish outlook for the pair. On the other hand, we must note that the RSI indicator below our 4-hour chart is at the reading of 50, implying a rather indecisive market. Should the bears actually maintain control over the pair’s direction, we may see it breaking the 1.2610 (S1) support line and aim for the 1.2520 (S2) level. Should the bulls take over, we may see USD/CAD aiming if not breaking the 1.2700 (R1) resistance line.

Oil prices continue to weaken

WTI prices continued to drop for a third straight day, as investors worry that OPEC could ease the production cuts at their Thursday meeting. OPEC is expected to ease production cuts by 1.5 million barrels per day (bpd), and Saudi Arabia to end its own voluntary cut of 1 million bpd. However, Reuters has reported that it has seen an OPEC document calling for “cautious optimism”, implying that the easing may not be as deep. Should the easing be lighter than the market expectations, we may see oil prices getting some support. We must note that yesterday, API showed a substantial increase of oil inventories in the US, of 7.356 million barrels, which surprised the markets. On the other hand, the roll-out of vaccination programs supports hopes for increased demand, while oil traders may also focus on the weekly EIA crude oil inventories released today, as the market positions itself for OPEC’s meeting tomorrow.

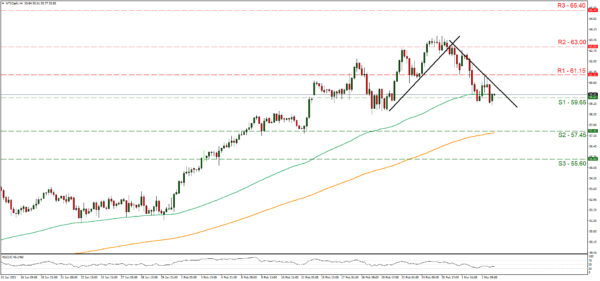

WTI dropped yesterday, continuously testing the 59.65 (S1) support line. We maintain a bearish outlook for the commodity’s prices as long as the downward trendline incepted since the 25th of February, continues to guide the commodity. It should be noted that the RSI indicator below our 4-hour chart is below the reading of 50 reminding us of the presence of the bears. Should the commodity’s prices come under a selling interest, we may see the price action retreating below the 59.65 (S1) support line and aim for the 57.45 (S2) level. Should on the other hand a buying interest be displayed, we may see WTI prices, aiming if not breaking the 61.15 (R1) resistance line.

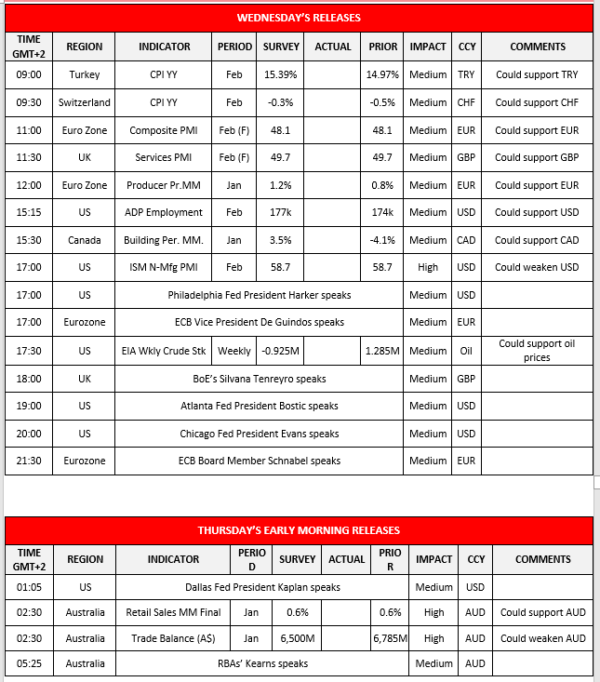

Other economic highlights today and early Tuesday:

Today during the European session, we Turkey’s and Switzerland’s CPI rates for February, Eurozone’s and UK final composite and services sector PMIs for February, and Eurozone’s producer prices growth rate for January. In the American session, we note from the US the ADP national employment figure for February, Canada’s building permits for January, the US ISM non-manufacturing PMI for February and as mentioned the EIA crude oil inventories figure for the past week. As for speakers we highlight UK’s Finance Minister Sunak and note Philadelphia Fed President Harker, ECB Vice President De Guindos, BoE’s Tenreyro, Atlanta Fed President Bostic, Chicago Fed President Evans, ECB’ board member Schnabel in the American session and in tomorrow’s Asian session Dallas Fed President Kaplan and RBA’s Kearns. Also, in tomorrow’s Asian session, we get Australia’s final retail sales rate and trade data, both for January.

Support: 1.2610 (S1), 1.2520 (S2), 1.2400 (S3)

Resistance: 1.2700 (R1), 1.2800 (R2), 1.2875 (R3)

Support: 59.65 (S1), 57.45 (S2), 55.60 (S3)

Resistance: 61.15 (R1), 63.00 (R2), 65.40 (R3)