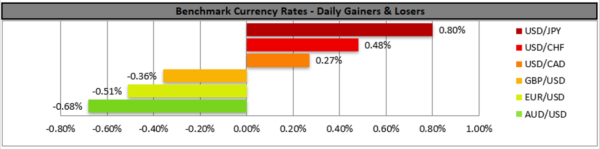

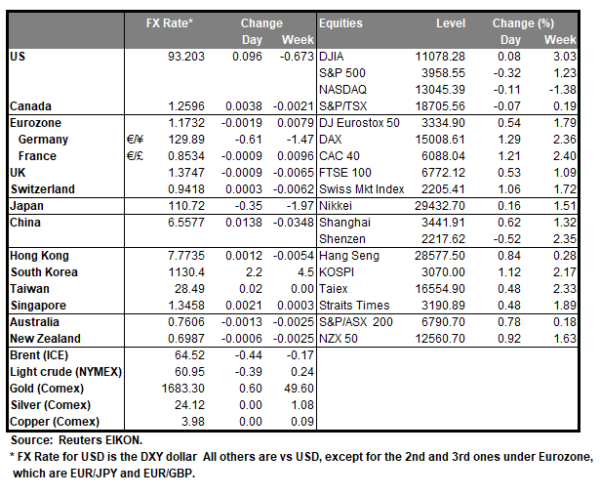

The USD tended to gain against most of its counterparts yesterday, while at the same time US stockmarkets were on the retreat as well as gold. Fundamentally, Biden’s $3-4 trillion infrastructure plan is eyed by the markets and the US President is expected to outline how the US is planning to fund it. It should be noted that the plan is in addition to the $1.9 trillion stimulus allready provided and another injection of cash in the US economy could boost its recovery, while the US President does not seem shy to increase the corporation tax rate in order to fund it, if necessary. Given the lack of high impact financial releases we expect the fundamentals to play the key role regarding the direction of the markets today.

USD/JPY as expected in yesterday’s report continued to rise and broke the 110.30 (S1) resistance line, now turned to support. We tend to maintain our bullish outlook for the pair as long as it continues to be guided by the upward trendline incepted since the 24th of March and which has steepened its slope since yesterday. Please note though that the RSI indicator below our 4-hour chart remains above the reading of 70 maybe implying that the pair is overbought, and a correction lower is possible. Should the pair continue to find fresh buying orders along its path we may see it breaking the 111.65 (R1) resistance line and aim for the 112.80 (R2) resistance barrier. Should a correction lower come into play and a selling interest be displayed by the market, we may see USD/JPY breaking the 110.30 (S1) line and aim for the 109.25 (S2) support hurdle.

AUD retreats despite boost of China’s manufacturing sector

The Aussie was unable to resist the strengthening of the USD yesterday, yet stabilised during today’s Asian session as data from Australia and China outperformed market expectations substantially. Characteristically Australia’s building approvals reached a stellar 21.6% mom for February, while China’s manufacturing PMI for March 51.9. It should be noted that China’s strong factory recovery tends to boost economic recovery, as Beijing has set a growth target of over 6% this year. It should be noted that China is the largest recipient of Australian exports of raw materials such as iron ore and copper and the expansion of economic activity could have a positive ripple effect on the prices of these goods as more demand may come into play. We may see the Aussie being fundamentally affected by the market sentiment, yet AUD traders may also be eyeing tomorrow’s financial releases.

AUD/USD seems to have stabilised after resurfacing above the 0.7600 (S1) support line. For the time being we tend to maintain a bias for a sideways movement between the 0.7665 (R1) and the 0.7600 (S1) levels, yet the RSI indicator below our 4-hour chart is between the readings of 50 and 30 providing an advantage for the bears. Should the bears actually take charge, we may see AUD/USD finally clearly breaking the 0.7600 (S1) support line and aim for the 0.7545 (S2) support level. Should the bulls be in charge, we may see the pair aiming if not breaking the 0.7665 (R1) line, thus opening the way for the 0.7725 (R2) resistance level.

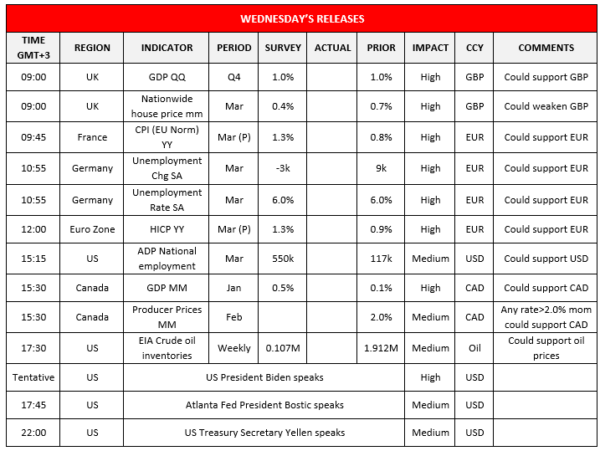

Other economic highlights today and early Tuesday:

On a busy Wednesday, we get during the European session, the UK GDP rates for Q4, UK’s nationwide house prices for March, France’s preliminary CPI (EU Normalised) rates for March, Germany’s unemployment data for March and Eurozone’s preliminary HICP rates for March. In the American session, we get the US ADP National employment figure for March, Canada’s GDP rates for January, Canada’s producer prices growth rate for February, while oil traders may be more interested in the release of the EIA crude oil inventories figure for last week. Also please note that besides the US President, also Atlanta Fed President Bostic and US Treasury Secretary Yellen are scheduled to speak. Tomorrow’s Asian session is also expected to be busy as we get Japan’s Tankan indexes for Q1, Japan’s Jibun Manufacturing PMI for March, Australia’s final retail sales growth rate for February, Australia’s trade data for February and China’s Caixin Manufacturing PMI for March.

Support: 110.30 (S1), 109.25 (S2), 107.90 (S3)

Resistance: 111.65 (R1), 112.80 (R2), 114.15 (R3)

Support: 0.7600 (S1), 0.7545 (S2), 0.7485 (S3)

Resistance: 0.7665 (R1), 0.7725 (R2), 0.7785 (R3)