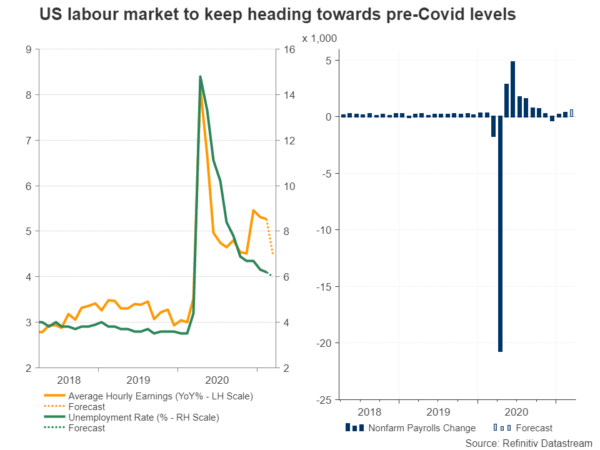

The latest monthly Nonfarm payrolls report will probably show on Good Friday at 12:30 GMT that the relaxation of lockdown restrictions, the drop off in covid cases, and the progress in the vaccination program have enhanced the recovery in the US labor market even without Biden’s latest fiscal boost. While the data may be overstating the continuous employment improvement, it could raise volatility in the dollar during a low liquidity day.

US employment to pick up steam in March

The US economy is said to have almost doubled February’s job growth in March, with employment expected to advance by 639k when the data come out on Friday compared to 379k seen previously. More importantly, the pickup in jobs is forecast to have pressured the unemployment rate lower to 6.0%, suggesting that although there is still a large slack in the labor market, economic conditions are moving in the right direction.

Jobs data likely overstating the unemployment rate

From the first glance, the above results could be another boon for the US economy and for Biden’s presidency, as eurozone nations are grappling to meet their vaccine targets.

On the flip side, the participation rate has been stable since July despite the upward-trending job numbers, likely providing some warnings that misclassification errors may be understating the real unemployment numbers. It is likely that millions of people are not actively seeking a job, and therefore are not considered as unemployed, as the uncertainty around the virus development, the disappearance of employment opportunities, and the virtual schooling, which forced some parents to stay at home, have likely pushed this group of people out of the labor force. Hence, the headline unemployment rate may be an incomplete guide to the trajectory of the labor market, somewhat explaining the Fed’s decision to maintain its policy accommodative at current levels until it meets its target of full employment conditions.

The US is a step ahead

Undoubtedly the global economy is not out of the woods yet, as no one is certain when and if the vaccines will fully contain the virus and its new variants. However, relative to other rich economies, the US is a step ahead, with investors pricing in that the faster vaccines get put into arms, the sooner it will emerge from lockdown measures and the sooner will the stimulus be scaled down, especially if the rise in inflation overshoots the Fed’s limits.

Moreover, investors are aware that the combination of the current accommodative monetary policy and the additional $1.9 trillion fiscal support could produce stronger economic readings in the coming months. Therefore, another upbeat report on Friday may not be a big surprise, though given the low liquidity during the Easter holidays in the US and Europe, the NFP report may generate sharp volatility in the US dollar after months of muted impact if it deviates significantly from forecasts.

US dollar reaction

The ADP private employment report on Wednesday could provide some clues about what to expect from the official NFP release, while on the same day Biden will unveil his new infrastructure plan, likely promising more hiring for Americans. The latter may trigger some selling in the greenback and stocks before the NFP announcement if the President endorses corporate and income tax increases to help him pay for his new bill. Still, a potential hike in taxes may not be bad news for the dollar, or at least it could generate only a mild selling since any tax increases may only partially repeal Trump’s tax cuts while easing some concerns about the mounting debt levels.

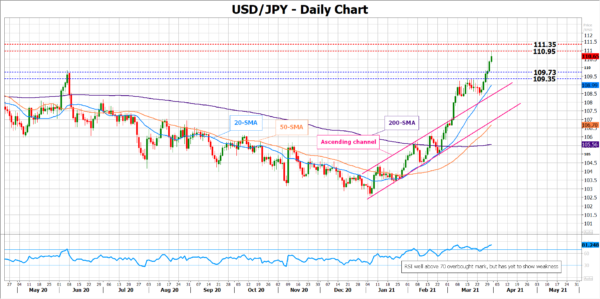

Looking at dollar/yen, the pair is marking its second week of gains, unlocking a new one-year high of 110.96 on Wednesday. The pair seems to be trading in the overbought territory according to the RSI but the indicator has yet to reverse to the downside, keeping the short-term bias on the upside. Should the price overcome the 110.95 – 111.35 resistance region, the rally could face another key obstacle within the 111.70 – 112.20 zone.

On the downside, the 109.73 – 109.35 region may act as immediate support ahead of the 20-day simple moving average (SMA) seen around 109.00. Lower, the surface of the broken ascending channel may again attempt to provide a safety net to balance stronger selling pressures.