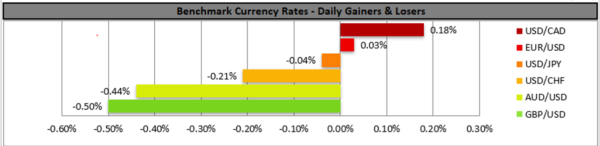

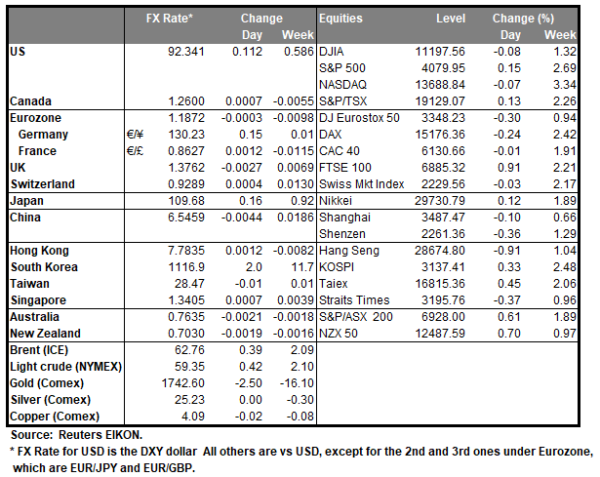

The greenback remained near a two-week low level against some of its counterparts yesterday, following US Treasury yields which also tended to drop given also that the minutes of the Federal Reserve’s March policy meeting provided little new to affect the market’s direction. Fed policymakers seemed to remain rather cautious about the risks opposed by the pandemic despite the US economy recovering somewhat faster given the substantial fiscal stimulus and the bank seems to continue to keep a loose monetary policy until a rebound was more secure. On the other hand, reports state that White House, U.S. companies could agree on 25% tax rate, which would imply a corporation tax rate hike, in order for Biden to be able to fund the infrastructure plan. It should be noted that the corporation tax rate had dropped to 21% from 35% after a generous cut by former US President Trump in 2017. Stock market action remained rather muted, with indexes sending out mixed signals, while at the same time gold prices dropped slightly. We may see markets turning their attention to the weekly initial jobless claims figure, yet fundamentals are to play the key role for USD’s direction, especially we highlight Fed Chairman Powell’s participation in the IMF seminar.

AUD/USD dropped yesterday from the highs of the 0.7665 (R1) resistance line to the lows of the 0.7600 (S1) support line, without being able to break it. As the pair’s price action broke the upward trendline characterising its movement since the first of April, we switch our bullish outlook in favour of a sideways bias initially. Please note that the RSI indicator below our 4-hour chart is at the reading of 50, implying a rather indecisive market for now. Should the bulls gain the initiative over the pair’s direction, we may see AUD/USD breaking the 0.7665 (R1) resistance line and aim for the 0.7725 (R2) level. Should the bears take over, we may see AUD/USD breaking the 0.7600 (S1) support line and aim for the 0.7545 (S2) level.

EUR retreats slightly

The common currency seemed unable to benefit from USD’s weakness yesterday given also the slow vaccination process in the continent. On the fundamental side the news that Germany’s Chancellor Merkel is backing the idea of a “short national lockdown” to curb the expansion of the virus, could be among the negatives for the common currency. While on the positives Moderna is on track to meet April vaccine deliveries, which could support Europe’s vaccination program somewhat. Eurozone’s final composite PMI reading for March was proved to be even better than the preliminary release, implying a faster expansion of economic activity for the area. We tend to see the slow vaccination progress in Europe weighing on the common currency, yet financial releases could affect its direction.

EUR/USD stabilised even dropped somewhat distancing itself from the 1.1905 (R1) resistance line during the late American session yesterday. Given that the pair’s price action has broken the upward trendline characterizing its movement since the 5th of April, we temporarily switch our bullish outlook in favour of a sideways movement bias. It should be noted though that the RSI indicator for the 4-hour chart remains just below the reading of 70, reminding us of the presence of the bulls and providing them with a slight advantage. Should EUR/USD actually find fresh buying orders along its path, we may see it breaking the 1.1905 (R1) resistance line and aim for the 1.1990 (R2) level. Should a selling interest be displayed by the markets we may see the pair breaking the 1.1830 (S1) support line and aim for the 1.1760 (S2) level.

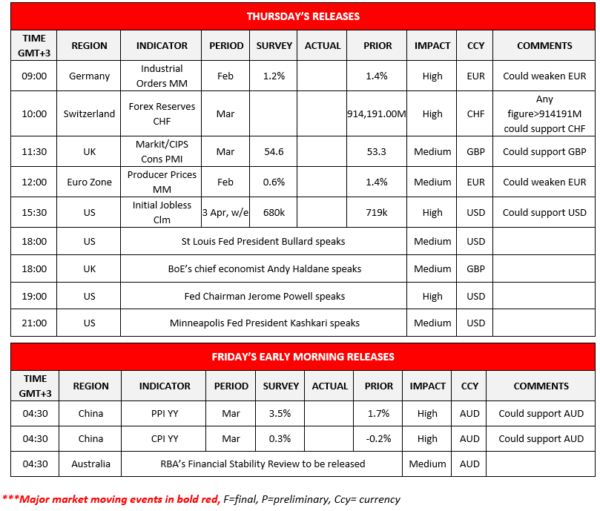

Other economic highlights today and early Tuesday:

In today’s European session we note from Germany the industrial orders for February, from the Eurozone the producer prices for February and the UK the construction sector’s PMI reading for March. In the American session we get the weekly US initial jobless claims figure, while St Louis Fed President Bullard, BoE’s chief economist Andy Haldane, Fed Chairman Jerome Powell and Minneapolis Fed President Kashkari speak. During tomorrow’s Asian session we get China’s inflation measures for March.

Support: 0.7600 (S1), 0.7545 (S2), 0.7485 (S3)

Resistance: 0.7665 (R1), 0.7725 (R2), 0.7785 (R3)

Support: 0.7600 (S1), 0.7545 (S2), 0.7485 (S3)

Resistance: 0.7665 (R1), 0.7725 (R2), 0.7785 (R3)