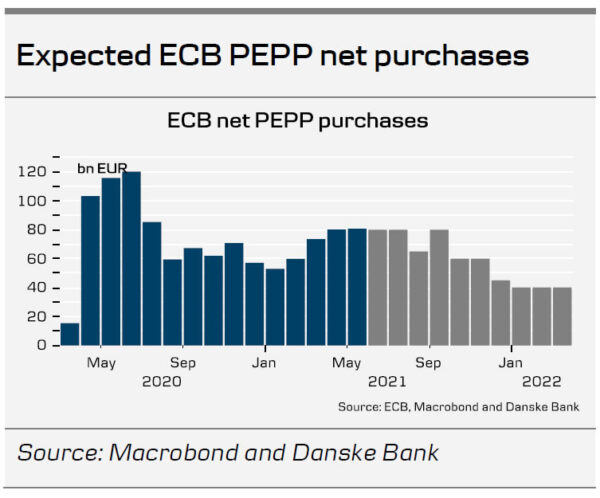

- At today’s ECB meeting the ECB maintained its ‘significant’ higher PEPP purchase pace in Q3. Given the relatively upbeat change in the growth and inflation assessment, this was a slight surprise to us.

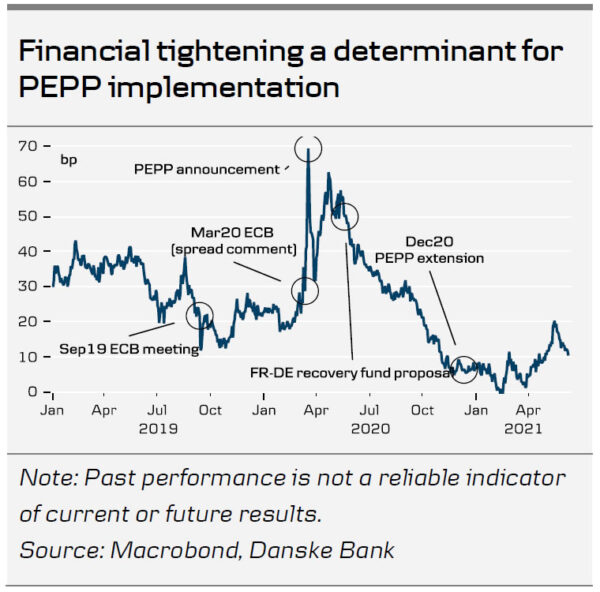

- President Lagarde mentioned the observed financial market tightening with reference to the bond market sell-off in May and the risk of spill-overs to financing conditions for households and non-financial corporations, which so far had remained broadly stable. To square this assessment with the ECB decision this makes us conclude, that ECB took the decision to maintain the significantly higher PEPP purchase rate from a risk perspective and not as much from a economic perspective.

- ECB fully changed the growth risk assessment to ‘broadly balanced’

- The staff proposal saw broad agreement, and the introductory statement had unanimous support amid GC members. This leads us to conclude that the dovish camp currently has the upper hand while divisions persist. A bigger ‘battle’ looms at the September meeting. The big question remains when markets will test this message of unity and low volatility hypothesis as it will become evident that a major PEPP discussion will take place in September, in the absence of adverse events.

- Extending the ‘significant’ purchase pace into Q3, with some slowdown due to seasonal factors, will either lead to a quick tapering in Q4 21 and Q1 22 or that ECB PEPP purchases may be conducted beyond March 2022 as well.

- Amid the US CPI figure released at 14:30 CET that also had to be digested by markets, EGB yields were broadly unchanged during the press conference. The staff projections caused a mildly positive reaction in the FX space.

Erring on the side of caution despite brighter economic outlook

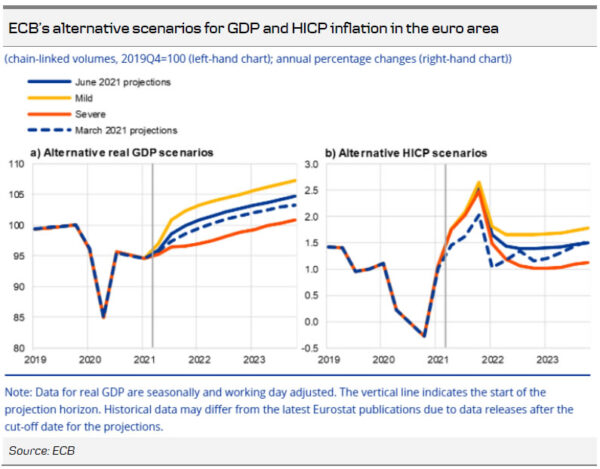

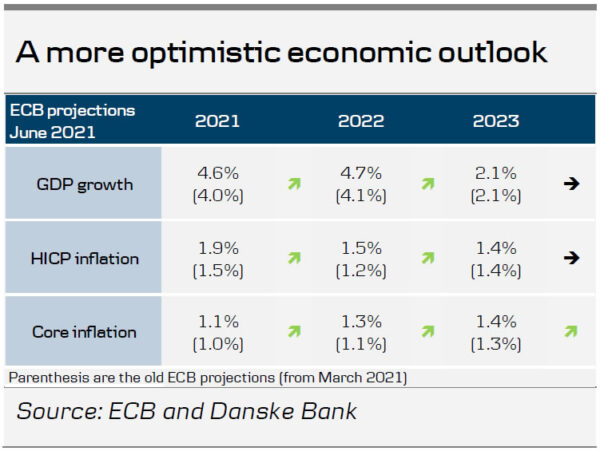

President Lagarde presented a more optimistic economic outlook given the progress on the vaccination campaign and substantial additional fiscal policy measures (NGEU and US packages). Both the growth and inflation projections for 2021 and 2022 were revised up significantly, accompanied by higher core inflation forecasts. ECB expects a further acceleration in economic activity in H2 21 on the back of a pick-up in consumer spending, strong global demand and accommodative fiscal and monetary policies. Growth risks are now seen as broadly balanced, but uncertainties remain regarding the course of the pandemic and how the economy responds after reopening.

A gradual increase in underlying inflation pressures is envisioned in the coming years, not least owing to supply constraints and strengthening domestic demand. That said, ECB still sees headline inflation increases during 2021 as transitory, with HICP remaining below target in 2022 and 2023. For a more sustained rise in price pressures, a tighter labour market and higher wages remain the missing ingredients. We agree with the ECB on that point and see few evidence that core inflation is about to return to the highs preceding the Global Financial Crisis on a sustained basis (see Research Euro Area – Mind the inflation gap, 8 June)

FX: ECB optimism well priced in

In line with our expectation, ECB optimism came through in forecasts on growth and inflation. As often has been the case, such optimism is mildly positive for EUR/USD as well. Overall though, the short-term outlook will likely continue to be that spot remains in the recent range of 1.20-1.24 and measures of volatility are also coming lower too. The next focus for spot will turn to FOMC and PMIs which do have the scope to take spot to end-point of these intervals (in both directions). Looking ahead, we continue to expect EUR/USD to move towards 1.15 in 12m.