What looked like a technical collapse in crypto prices on Tuesday turned into an improbable turnaround with bitcoin finishing higher. In FX, last week’s US dollar rally continued to unwind with a growing chorus of Fed speakers underscoring patience before making any moves on a taper. Ashraf cautions us to watch the renewed outperformance of Tech stocks vs cyclicals –which could mean yields may not be rebounding above 1.53/4% anytime soon, raising questions about growth and inflation.

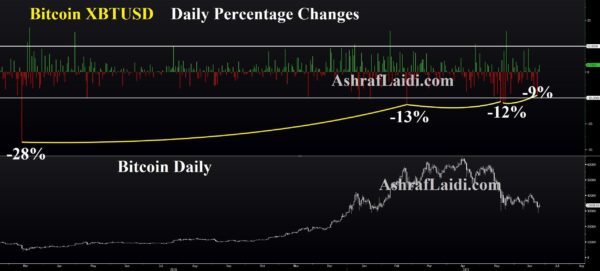

Even by the wild standards of the crypto market, Tuesday’s move was impressive. It looked grim for bitcoin early in New York trade as it broke through $31,000 and then cascaded down to $28,800 in a quick but orderly move.

As headlines flashed that it had wiped out all the gains for 2021, it came back to life. Evidently there were buyers waiting for a dip below $30,000 and they pounced. That was followed by a FOMO rally that took it to $34,200 at the time of writing.

The pain elsewhere was larger and the bounces haven’t been as impressive. That may be a hint that flows are traveling from alt coins into bitcoin. If that’s the case, it may only be a temporary respite. That said, price action can turn into its own fuel for a rally.

Overall, the breaks of some key support levels throughout the market aren’t a great sign. There is a chance for a false breakout and reversal here but that would be a rare feat. We will be watching very closely and staying nimble in the days ahead.

One slight tailwind for crypto has been the continued decline of the dollar. We’re watching AUD/USD very carefully as it re-tests the break of the 200-day moving average and the prior lows of the year, which are now resistance.