- Risk aversion hits stock markets, breathes life back into dollar

- Yen shines as US yields decline, oil under pressure, gold cools

- Fed minutes today could decide if this volatility episode lasts

Pandemic-style worries haunt markets

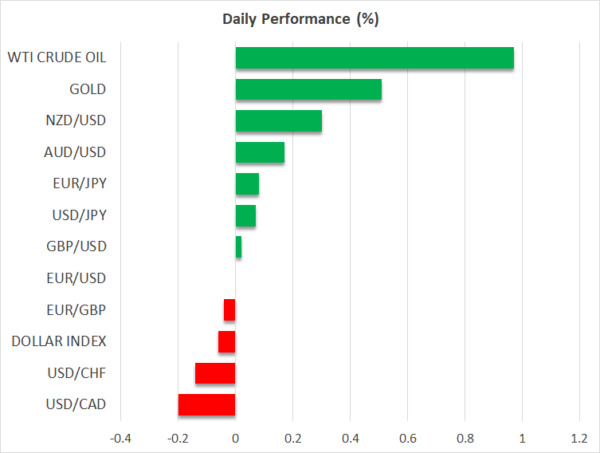

It was an explosive session across financial markets on Tuesday as risk aversion made a rare comeback. The underlying theme was fear, but with a pandemic-style flavor. Investors essentially slashed their exposure to assets that are linked to the real economy and looked for shelter in safe havens.

This dichotomy was crystal clear in the equity market, where ‘old economy’ stocks took a hit even as several tech titans managed to power to new record highs, highlighting the defensive nature of tech plays during this crisis. When markets are worried about economic growth, digital stocks usually shine while traditional stocks get hammered.

Across the risk spectrum, the US dollar shined bright alongside the Japanese yen as traders sought protection. But the dash for safety was even clearer in the bond market. Treasury yields fell substantially as money managers bought bonds to hedge their exposure to riskier assets. This is usually a bad sign.

When investors are willing to buy an asset that’s guaranteed to lose them money just for safety, they are typically afraid something big is coming. The catalyst behind all this mayhem wasn’t entirely clear, although the disappointing ISM services survey definitely added fuel to the moves, perhaps by intensifying worries that we’ve already hit ‘peak growth’.

Does the bond market smell something?

There are several potential explanations for what’s happening. The optimistic take is that this was just a weird day of summer trading, where one worrisome piece of data ignited a general flight to safety and a short squeeze in bonds. Everyone was betting on higher yields driven by Fed normalization, which is done by shorting bonds. If several shorts were forced to cover, then bond yields implode and that spills over into everything else.

The more gloomy view is that economic growth will cool soon and inflation isn’t sticking around. Infrastructure spending might not be powerful enough to move the needle, and the long-term deflationary forces of aging populations and technological advancements could ultimately reign supreme, like in the past decade. Lower inflation would imply fewer Fed rate increases.

Admittedly, the short squeeze explanation seems way more realistic. If so, then all the havoc might quiet down soon as position squaring runs its course.

Oil drops, gold fights on, FOMC minutes eyed

In the commodity sphere, oil prices got knocked down as the cautious mood in the broader market joined forces with worries that the divisions within OPEC might lead some producers to stop complying with their supply quotas. The negotiations continue, with the Biden administration also lobbying for a deal that stabilizes energy markets.

Meanwhile, gold prices were trapped between opposing forces. The decline in real yields initially boosted bullion but most of the gains evaporated as the dollar stormed higher. That said, the bulls are still in the driver’s seat as the yellow metal continues to push higher today, capitalizing on another decline in yields but a stable dollar.

As for today, the minutes of the latest FOMC meeting could determine whether this volatility episode continues or fades out. This was the meeting when the Fed shocked markets by signaling it might take its foot off the accelerator soon, so traders will be looking for clues as to what kind of progress the Committee wants to see before taking the next step in the normalization process.

We’ve heard from almost every Fed official lately, so markets have a good sense of where the central bank stands. It wants to see a few more solid jobs reports before getting the ball rolling, likely by sending a strong tapering warning in August. In this sense, the outlook for the dollar remains promising.