With the euro slicing through some crucial support levels lately, there will be a lot of attention on the upcoming PMI business surveys from the euro area. The show will start with the French data at 07:15 GMT Monday. Overall, the Eurozone economy is healing but the outlook for the euro looks bleak, with the ECB likely to be left behind in the central bank normalization game.

Reopening boom

The Eurozone is finally coming back to life. Virus restrictions have been eased dramatically thanks to widespread vaccinations, enabling consumers to enjoy a summer spending spree. Unemployment is on a steady decline, demand is strong, and inflation has even surpassed the European Central Bank’s elusive target.

That all sounds great, but unfortunately, this is mainly a reopening boom. When an economy exits a lockdown, it typically enjoys a strong spell of growth that ultimately fades after a few quarters. We are in the middle of this process right now, so the risk is that growth begins to slow down heading towards year-end.

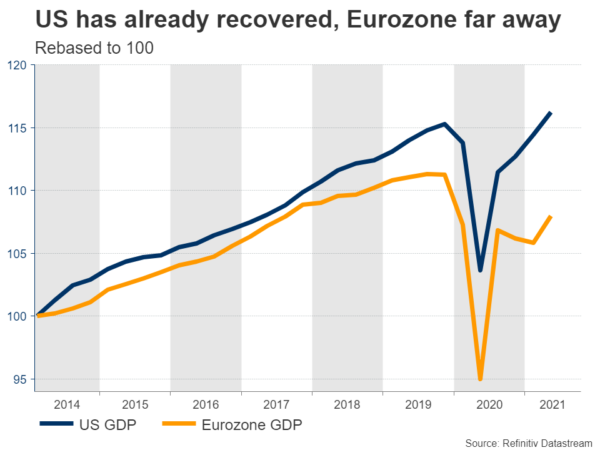

And while the European recovery has been solid, it pales in comparison to America’s. The US economy is now bigger than it was before the crisis hit, turbocharged by multi-trillion spending packages from Congress. In contrast, the Eurozone economy isn’t expected to recover all its losses until next year.

Optimists argue that more government help is on the way in Europe. The Recovery Fund money has finally started to be distributed to member states, which will hopefully help economies like Italy and Spain to heal their wounds. Unfortunately, this recovery package is way too small to make a real difference and there isn’t much political appetite for any more, with government debts ballooning already.

Data could reflect Delta worries

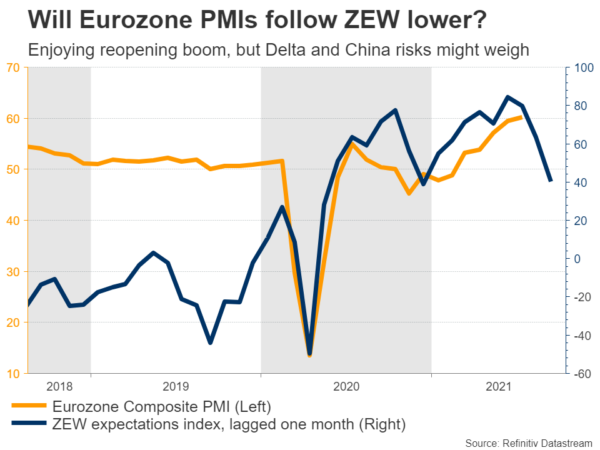

Turning to the upcoming PMIs for August, forecasts point to a slight retreat. The Eurozone manufacturing index is expected to tick down to 62.2 from 62.8 previously, while the services PMI is anticipated to hold steady at 59.8.

The only data that has been released so far for August has been Germany’s ZEW survey of investor sentiment, where the forward-looking expectations index fell sharply as fears over the Delta outbreak and a slowdown in China intensified.

If those concerns are reflected in the PMIs too, there could be a pullback in the composite index from its recent highs. That would signal that growth is cooling down, even though it remains positive.

Euro could struggle amid ECB/Fed divergence

In the big picture, the euro doesn’t look particularly attractive. The Eurozone economy is doing better, but when compared to America, it is still lagging behind. And the US Congress is already working on a new multi-trillion spending package, whereas the European Union is still trying to distribute the recovery funds it agreed to last year.

All that is increasingly reflected in monetary policy. The Federal Reserve is preparing to dial back its asset purchases soon and it could raise interest rates next year already if the US recovery stays on track. On the other hand, the European Central Bank just committed to maintaining negative rates for several years.

Over time, this central bank divergence could allow US yields to rise faster than their European counterparts, making the dollar more attractive from a relative interest rate viewpoint.

The chart tells a similar story, with euro/dollar slicing through 1.1700 this week to carve out new lows for the year. If the pair manages to close the week below this crucial level, that would solidify a bearish bias, potentially opening the door for 1.1610 next.

On the flipside, if the bulls retake control and push the market back above 1.1700, the next region to provide resistance may be around 1.1750. Another push higher would then turn the focus towards 1.1805.