Key Highlights

- The British Pound formed a bottom near 1.2773 against the US Dollar, and currently trading above 1.3000.

- The GPP/USD pair broke a major resistance area near 1.3000 on the 4-hours chart to open the doors for more upsides.

- German Factory orders in July 2017 posted a decline of 0.7% (MoM).

- Today, the BoC Interest Rate Decision is lined up and the central bank is likely to keep rates at 0.75%.

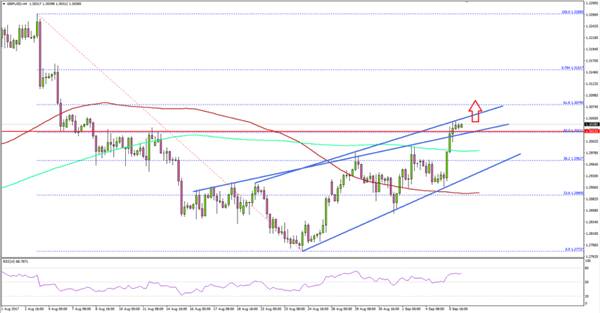

GBP/USD Technical Analysis

The British Pound started a sharp correction from 1.3265 starting August 2017 against the US Dollar. The GBP/USD pair recently formed a bottom at 1.2773 and preparing for further gains.

The pair during the upside broke a few important resistances like 1.2850, 1.2900, 1.3000 and 100 simple moving average (H4). There was also a break above a major contracting triangle at 1.3010 on the 4-hours chart.

A breach of the 50% Fib retracement level of the last decline from 1.3268 high to 1.2773 low also signifies a trend change. At the moment, the pair is attempting a close above a connecting resistance trend line at 1.3050.

Once there is a proper close above 1.3050, the pair might trade to 1.3100 or even 1.3150.

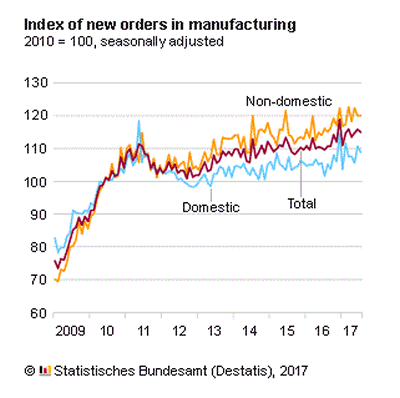

German Factory Orders

Today in the Euro Zone, the Factory orders report for July 2017 was released by the Deutsche Bundesbank. The forecast was lined up for an increase of 0.3% in orders compared with the previous month.

However, the actual result was disappointing as there was a decline in orders by 0.7%. Similarly, the yearly change in orders posted +5%, lower than the forecast of +5.8% and also less compared with the last +5.1%.

The report added that:

In July 2017 the manufacturers of intermediate goods saw new orders fall by 0.4% compared with June 2017. The manufacturers of capital goods showed decreases of 0.7% on the previous month. For consumer goods, a decrease in new orders of 3.0% was recorded.

Overall, the result could impact the market sentiment for both EUR/USD and GBP/USD. Having said that, the GBP/USD pair is likely to stay above the 1.3000-1.2960 support area in the near term.

Economic Releases to Watch Today

US Services PMI for August 2017 – Forecast 56.8, versus 56.9 previous.

US ISM Non-Manufacturing Index for August 2017 – Forecast 53.3, versus 53.9 previous.

BoC Interest Rate Decision – Forecast 0.75%, versus 0.75% previous.