- US stock markets set new records as Tesla goes into overdrive

- Euro falters ahead of ECB meeting, sterling comes back online

- Iran talks keep a lid on oil prices, gold cruises higher

Tesla goes ballistic

Wall Street started the week in good spirits. The heavy lifting was done by Tesla, which rose 12.6% to become a trillion-dollar company after it received a large order, propelling the S&P 500 to new records. The news sent the stock into an unreal ‘gamma squeeze’ as shorts were forced to cover and retail traders piled into short-dated options, forcing dealers to hedge their exposure by loading up the truck in Tesla shares.

But while Tesla was at the tip of the spear, it wasn’t alone. The earnings season continues to spread joy as the cataclysm in supply chains and energy markets doesn’t seem to have impacted corporate bottom lines for now. Investors are also pricing out the risk of higher corporate taxes, with the Biden administration instead favoring taxes on unrealized capital gains for billionaires to pay for its spending plans.

Still, this is probably a good time to take some chips off the table. The market could get another shot in the arm if the Democrats finalize a deal this week, but most of the good news seems priced in while the risks haven’t gone away. Inflation expectations continue to march higher, rate hikes are being brought forward, China is slowing, and the dual logistical/energy crises haven’t faded. The risk-to-reward profile isn’t very attractive here.

FX market feeling good

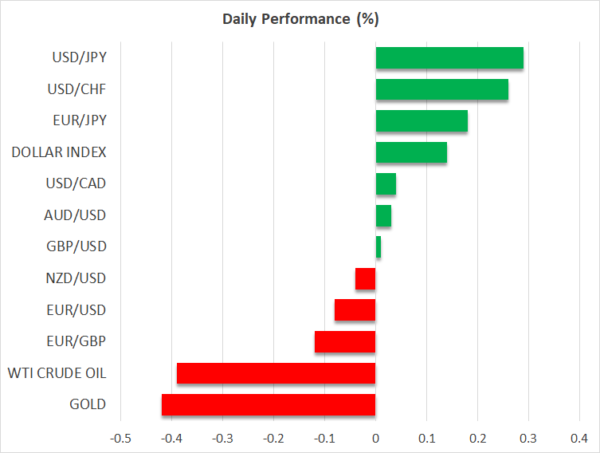

The earnings-powered optimism spilled over into the FX market as well, reenergizing the Australian and New Zealand. Another winner was sterling, which briefly reached new post-pandemic highs against the euro today, capitalizing on the cheerful mood in the equity arena and the blitz of positive headlines around new investment initiatives in tomorrow’s UK budget.

Speaking of the euro, the recent relief bounce seems to be over. Traders are looking ahead to Thursday’s ECB meeting, where the central bank could push back against market pricing for a minor rate increase next year. Eurozone inflation expectations have moved higher thanks to the energy spiral but the growth landscape remains fragile as the latest PMIs stressed. The ECB learned its lesson in 2011 when it raised rates prematurely to fight the ghost of inflation, only to pour fuel on the debt crisis.

The dollar was somewhere in the middle, outperforming the euro and yen but falling behind the commodity dollars and the pound.

Gold advances, oil takes a breather

In the commodity complex, gold continued its under-the-radar rally yesterday, defying the firmer dollar. Instead, bullion drew strength from the unstoppable rally in inflation expectations and a pullback in real Treasury yields.

The outlook for bullion is tricky here. On the bright side, inflation worries are running rampant and traders are looking for hedges. That’s mainly why inflation swaps are going higher. However, if inflation does stick around, the Fed and other central banks will try to hammer it back down. On balance, the risks still seem tilted to the downside as the Fed-powered dollar may be what tips the scales.

Meanwhile, some news that Iran and the European Union will continue top-level talks on reviving the nuclear agreement took the wind out of oil prices yesterday. But for now, the burning question is whether OPEC will stabilize the market at next week’s meeting by opening the supply taps wider, something it has resisted so far.

As for today, the spotlight will fall on consumer confidence numbers from America as well as earnings results from Google and Microsoft.