The British pound declined sharply on Thursday and early Friday as investors reacted to the surprise outcome of the Bank of England (BOE) decision. In the statement, the Federal Reserve announced that it would maintain interest rates at a historic low even as inflation surged. The bank expects that inflation will keep rising in the near term, with its October target being at about 4%. It will then peak to a decade high of 5% in the coming year. Notably, unlike the Federal Reserve, the bank decided to maintain its quantitative easing policy. Still, some analysts believe that rate hikes will not have an impact on inflation since prices are rising because of supply and energy issues.

The price of crude oil remained under pressure even after OPEC maintained its supply guidance. In a meeting, OPEC+ members said that they will boost oil output by about 400k barrels per month in line with the previous guidance. This happened even as the cartel is being pressured by Joe Biden, who believes that it is to blame for prices. The situation is ironic since the Biden administration has been increasing its regulations on oil and gas companies. OPEC+ believes that higher oil prices will help them recover faster. It also believes that their profits will help them invest more in clean energy sources.

The key economic data to watch today will be the US non-farm payrolls (NFP) data. Economists polled by Reuters expect the data to show that the US NFP rose from 194k in September to about 400k in October. Still, these estimates have been off in the past two months. Meanwhile, the unemployment rate is expected to decline to 4.7% while wages will rise by 4.9%. Other important data to watch will be the latest Canadian jobs numbers. The data is expected to show that Canada added 50k jobs, and the unemployment rate fell to 4.7%.

USDCAD

The USDCA staged a bullish breakout after the hawkish interest rate decision by the Fed. The pair rose to a high of 1.2463, which was the highest it has been since August 13. It also rose above the narrow channel where it has been in the past few days. The pair is also slightly above the 25-day moving average. Therefore, since the pair has formed a bearish flag pattern, there is a likelihood that a pullback will happen.

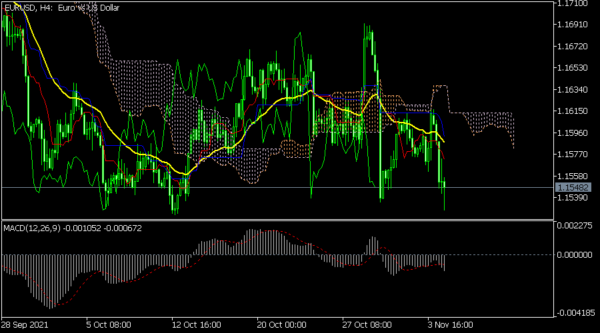

EURUSD

The EURUSD pair declined to a multi-month low as investors continued to reflect on the latest Fed decision. The pair is trading at 1.1545, which is slightly above its lowest level in the overnight session. It is below the Ichimoku cloud and the short and long-term moving averages. Therefore, the pair will likely keep falling as bears target the next key support at 1.1500.

GBPUSD

The GBPUSD pair crashed hard after the latest BOE decision. It declined to a low of 1.3472, which was the lowest it has been since the first week of October. It is along the lower line of the Bollinger Bands and below the short and longer-term moving averages. Therefore, the pair will likely keep falling as the divergence between the BOE and the Fed widens.