The era of COVID-19 cheap money is over. Who is afraid of the Fed’s tightening cycle? Apparently not the stock market!

In a move aimed to fight the worst inflation in the US in 40 years, the Federal Reserve announced on March 16 a 0.25% increase in interest rates. It’s the first time in more than three years that the Fed raises the benchmark interest rate. The last increase was in December 2018. The 25 basis point hike brings the current interest rate to the range of 0.25%-0.5%. All of this was expected because markets have priced in this increase for a long time. However, the strange thing was the US stock markets’ reaction after the rate hike. Markets didn’t behave the way they are supposed to.

In theory, higher rates should make stocks less attractive, because higher rates mean higher borrowing costs for businesses and consumers, which lowers the overall spending. In turn, profits are affected, which is reflected in stock market prices. However, this time, investors have rebelled against this traditional wisdom, and have pounced on the stock markets. US markets jumped after the Fed announced its long-awaited rate hike and indicated the possibility of six more hikes this year. The S&P 500 closed that day 2.2% higher.

Why did US stocks rise after Fed’s rate hike?

- The US stocks have rallied because stocks usually reflect what’s best for the economy. And, raising rates now is the best solution for the economy. Investors are finally relieved that the Fed is taking action to fight the highest level of inflation in decades.

- The Fed surprised the market by indicating the possibility of raising rates in all the remaining six meetings, indicating that the US economy is strong and can withstand the tightening cycle.

- Signs that the conflict between Russia and Ukraine is beginning to enter the stage of resolution and settlement.

- Signs from China that it will ease its broad regulatory crackdown.

What does history say about raising rates and US stocks?

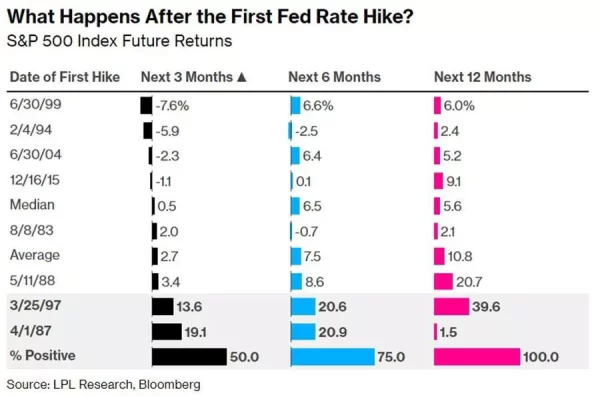

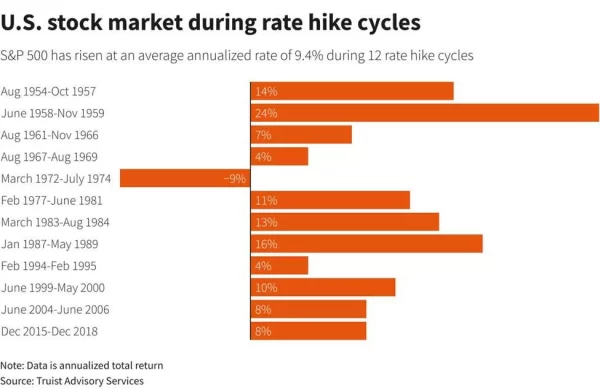

Over the past two years, the stock market has soared and stayed strong in the face of the worst global pandemic in a century, one of the most divisive presidential elections in US history, and the Capitol building under attack. Now stocks are facing Europe’s biggest ground war since World War II, and the fastest inflation since the 1980s. History indicates that US stocks are poised to face more volatility after a rate hike. This, however, does not mean that the bull market is over. In fact, in the previous eight tightening cycles, S&P 500 was higher a year after the first increase each time, according to LPL Financial.

Here’s a look at what history has to say about the US stock market when the Fed starts raising rates:

Finally, the free money from the Federal Reserve was such a wonderful gift to the stock market during the pandemic that they became addicted to it. Therefore, although the high rates may pose a challenge to the US stock market, it may be able to overcome it by the end of the year. Traders must manage this volatility carefully to profit from it.