Key Highlights

- The Aussie Dollar corrected from the 0.8142 level against the US Dollar towards 0.7950.

- A crucial bullish trend line with current support at 0.7945 on the 4-hours chart of AUD/USD prevented further declines.

- The Reserve Bank of Australia (RBA) minutes from the 5th Sep 2017 meeting pointed concerns over the rise in the Australian Dollar.

- Australia’s House Price Index in the June 2017 quarter rose 1.9% (QoQ), less than the last +2.2%.

AUDUSD Technical Analysis

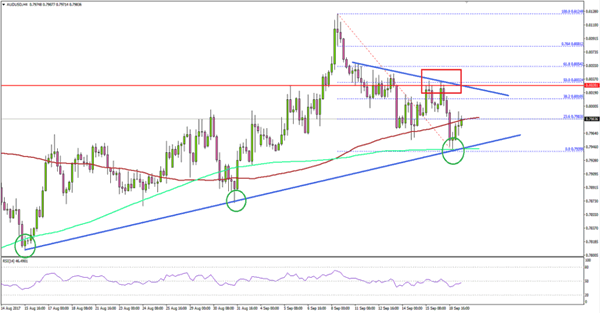

The Aussie Dollar gained heavy bids earlier this month and moved above 0.8100 against the US Dollar before correcting lower. The AUD/USD pair is currently above 0.7950 and eyeing further upsides.

The last drop from the 0.8124 high in AUD/USD found support near 0.7940 and the 200 simple moving average (H4). Moreover, a major bullish trend line with current support at 0.7945 on the 4-hours chart acted as a barrier for further declines.

The pair is currently recovering and testing the 23.6% Fib retracement level of the last decline from the 0.8142 high to 0.7939 low near 0.7990.

A break and close of 0.8000 would open the doors for a run towards a bearish trend line on the same chart. Above 0.8030, the pair could even head towards 0.8080. On the downside, the 0.7950 level remains a crucial support zone.

RBA Meeting Minutes and House Price Index

Today in Australia, the Reserve Bank of Australia (RBA) minutes from the 5th Sep 2017 meeting were published. The main point to note was about the Australian Dollar, as minutes pointed out concerns over the recent rise in AUD.

The minutes mentioned:

The appreciation of the Australian dollar over the course of 2017 had, in large part, reflected a broadly based depreciation of the US dollar. Forward indicators suggested that the improvement in labour market conditions was likely to continue.

Furthermore, the House Price Index for the June 2017 quarter was released by the Australian Bureau of Statistics. The forecast was slated for a rise of around 2% compared with the previous quarter.

The actual result was neutral, as the House Price Index increased 1.9%, less than the last +2.2%. In terms of the yearly change, there was a rise of 10.2%, similar to the last +10.2%.

To sum up, the AUD/USD pair might trade higher towards 0.8040-50 as long as the trend line support at 0.7950 and the 200 SMA (H4) are intact.