The Federal Reserve publishes the minutes of its March 15-16 policy meeting on Wednesday (18:00 GMT) and investors will be parsing them for any clues about how quickly the balance sheet will be reduced. US data on inflation and the labour market have only strengthened since the March meeting, adding pressure on policymakers to consider a 50-basis-points rate hike at the next one. But more worryingly, key parts of the yield curve are inverting. So will the Fed rock the boat when markets are jittery?

Paying the price of being behind the curve?

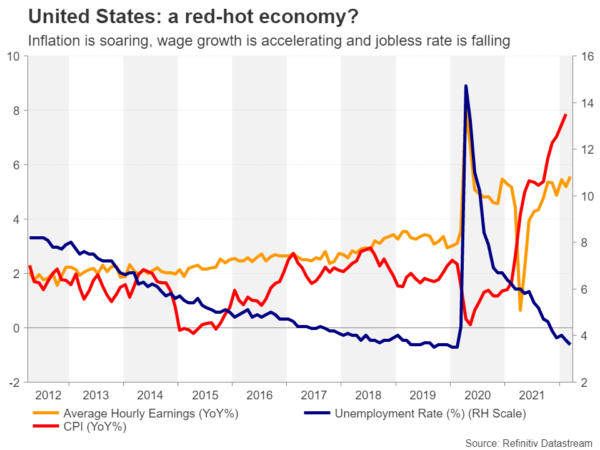

A tight labour market and red-hot inflation are normally a recipe for very high interest rates, but in this cycle, the Fed has only just started lifting borrowing costs. Not only that, it’s doing so from rock bottom levels. Policymakers hesitated about removing stimulus sooner because they were still worried about the pandemic’s ripple effects. They thought that once the pent-up demand petered out and supply disruptions proved to be short-lived, inflation would fall back.

That hasn’t happened. In fact, the inflation headache has only gotten worse: the supply-chain issues have yet to be resolved, the Ukraine crisis has generated an even bigger price shock than the pandemic as commodity prices have skyrocketed, and now there’s a real risk of a wage-price spiral as average hourly pay has started to creep up.

The US economy can withstand higher rates

One bit of good news for the Fed is that the American economy is roaring. Moreover, the outlook hasn’t deteriorated as much as it has for other economies like the Eurozone’s because the United States won’t be as badly affected from the surge in energy prices and the Western sanctions against Russia. That gives the Fed quite a bit of scope to raise rates without pushing the economy into recession.

Another ‘advantage’ for the Fed is the fact that a lot of the supply-related price pressures in the US were directly exacerbated by excess demand in the economy. So although many of the supply shortages will likely persist for some time, weaker demand should nonetheless offset a sizeable chunk of the upside cost pressures, meaning that tighter policy should be effective in at least partially bringing down inflation. The same can’t be said for the European Central Bank as most of the price increases in the euro area are being driven by external factors.

Fed setting the stage for 50-bps hike

The Fed’s wake-up call on inflation has been on full display in recent weeks after a string of FOMC members came out in support for more aggressive tightening. Dovish-leaning Chair Powell has also hinted he is open to a 50-bps move at the next meeting in May, sending rate hike bets sharply higher.

The FOMC had upped its rate hike projections for the rest of 2022 to six at the March gathering and it’s looking very likely the median dot plot will be revised further up in June. But before then, the spotlight is on the May meeting when a decision on reducing the balance sheet is expected.

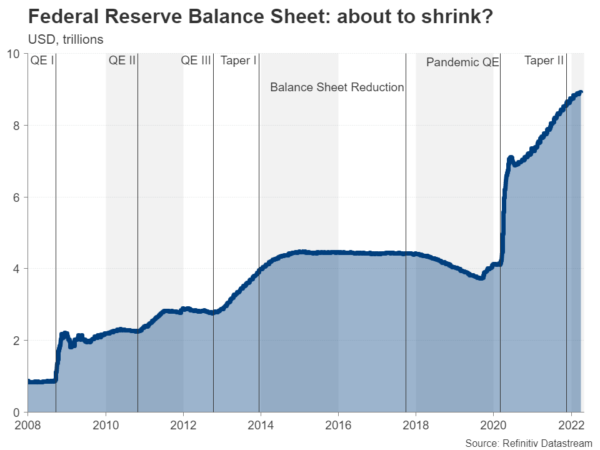

Attention will soon shift to balance sheet

The last time the central bank decided to shrink its bond holdings they set a pace of $50 billion a month. However, policymakers have hinted that they would like to see a much faster balance sheet runoff this time round. So are the markets headed for a nasty shock in May and will there be any indication of a much larger-than-anticipated pace of reduction in the minutes?

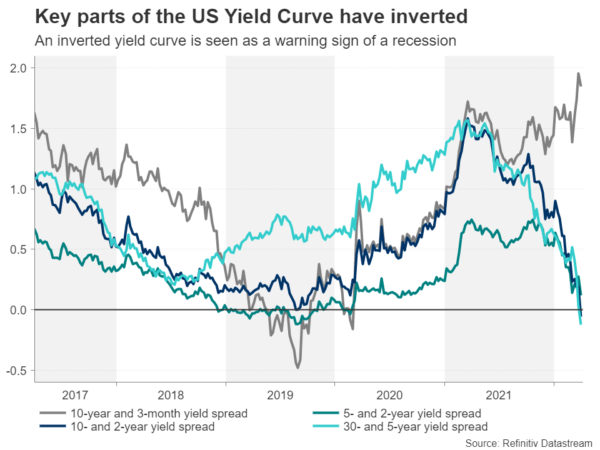

There is a case to be made for shrinking the balance sheet very rapidly as this would ease some of the burden of monetary tightening on interest rates. The other argument is that it would help steepen the yield curve, which is something that could be used to allay fears of a recession. The 10-year/2-year and 30-year/5-year parts of the yield curve have inverted in the past week, amid growing concerns the Fed will overtighten.

Are markets complacent about QT?

Nevertheless, the Fed will probably prefer not to go too fast on quantitative tightening, allowing it to put the process on autopilot so that it can focus its efforts on guiding investors through the rate increases. The main risk for the markets is that they haven’t completely, if at all, priced in the impact of quantitative tightening. Quite possibly, the impact will only be known once the Fed has put its plan into action.

But at a time when there is so much uncertainty about the inflation outlook and the fallout from the war in Ukraine, any surprise giveaways from the balance sheet discussions in the minutes could spark quite a bit of volatility in the bond and stock markets.

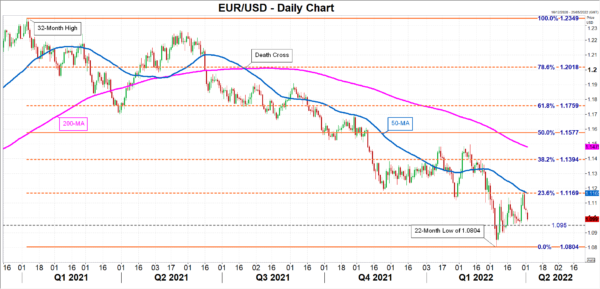

Euro can’t catch a break from the bullish dollar

As for the US dollar, hawkish minutes could provide yet another boost, pushing euro/dollar towards the $1.0950 level. Breaching this support would pave the way for the 22-month low of $1.0804 set in March.

However, if there are no unexpected revelations in the minutes and policymakers even express some doubts about the outlook due to the looming squeeze on consumers from the energy crisis and the elevated geopolitical tensions, euro/dollar might just be able to bounce back. Initially, the pair could claw its way up towards the 50-day moving average at $1.1165, which is also the 23.6% Fibonacci retracement of the January-March downtrend. Higher up, the 38.2% Fibonacci of $1.1394 would be the next big test for dollar bears.