The Japanese yen has been demolished lately, thanks to the Bank of Japan’s reluctance to join the global tightening party. There are growing whispers that Japanese authorities are about to intervene in the FX market, but this doesn’t seem like a realistic option yet.

Bulldozed

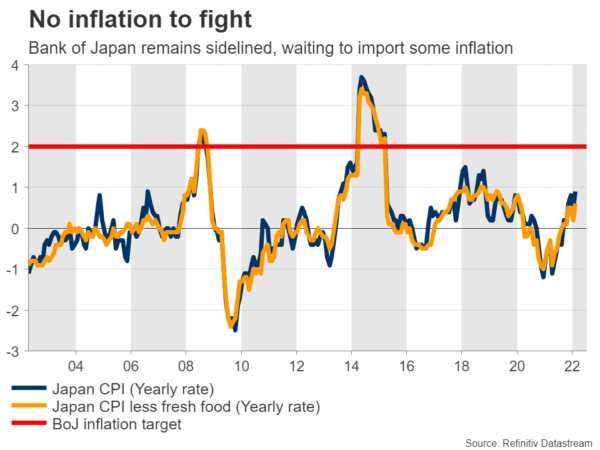

The yen has taken a heavy beating lately. Central banks around the world are raising interest rates to combat inflation, yet the Bank of Japan refuses to play this game. That’s because there isn’t much inflation to fight. The yearly CPI rate remains under 1%, defying the global inflationary storm.

In fact, if it wasn’t for the chaos in supply chains and roaring commodity prices, Japan would probably still be trapped in deflation. The BoJ knows this, so it is happy to lag behind every other central bank. With any luck, they might manage to import some inflation from abroad and hopefully break the deflationary mindset that’s tormented Japan for decades now.

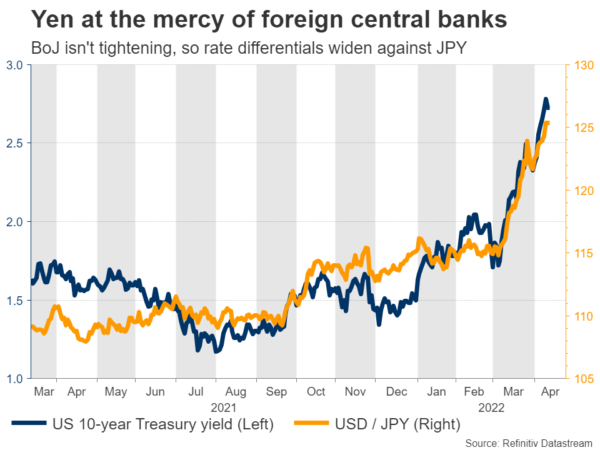

But for that to happen, the yen needs to suffer. Not only has the BoJ stayed away from signaling rate increases, it has doubled down on its yield curve control strategy, which keeps a ceiling on Japanese yields. This means that whenever foreign yields edge higher, rate differentials automatically widen against the yen since domestic yields cannot join the rally.

This dynamic has been on full display lately, with the yen losing 9% of its value against the US dollar so far this year. The nation’s reliance on imported energy and commodity products hasn’t helped either.

Intervention conditions not met

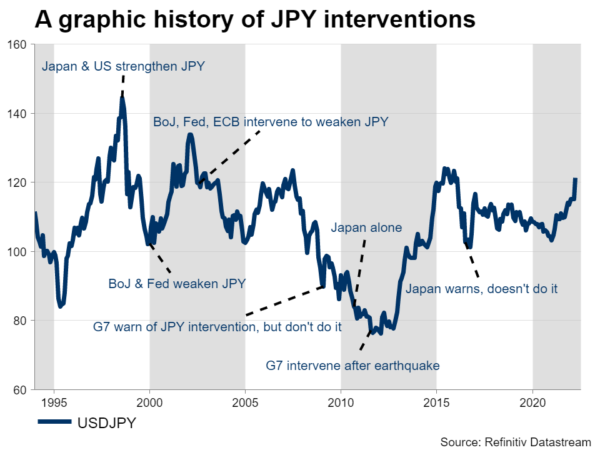

In a nutshell, the situation isn’t bad enough to warrant FX intervention yet. Past cases of intervention were typically coordinated with Europe and the US, calibrated to prevent excessive appreciation in the yen.

Now that the yen is falling, it’s questionable whether the Europeans and the Americans would play along. They would be weakening their own currencies for the yen to strengthen, exacerbating inflationary pressures in their own economies.

That’s highly unlikely, as the drop in the yen has been orchestrated by the BoJ and could help boost the export-oriented Japanese economy. So if there is intervention, it will likely be Japan doing it solo, burning through its FX reserves.

It seems that the ‘line in the sand’ is the 130 level against the US dollar. Several reports suggest the probability of intervention would rise dramatically if the yen crosses that level, although the speed of the move will also be crucial. A slow grind lower is not worrisome – a violent drop is.

The clearest sign that intervention is imminent would be Japanese authorities describing the yen’s moves as “one-sided” and “disorderly”. If that doesn’t do the trick, then expect to see ‘leaked reports’ that the BoJ is calling big interbank dealers to check yen quotes. These jawboning techniques are usually enough to stop market momentum without the need for action.

The final step would be a formal intervention warning from the finance minister. We are nowhere close to this stage.

What else can stop the bleeding?

One way to halt the yen’s downfall would be a ceasefire in Ukraine. Good news on the war would help cool commodity prices and by extension calm inflationary pressures, leading market participants to dial back their bets for aggressive rate increases by foreign central banks.

Money markets are currently pricing in another nine quarter-point rate increases from the Fed this year. If suddenly it seems like inflation is peaking, this number could be slashed down and US yields could fall back, sparking a relief rally in the battered yen.

Similarly, if China abandons its ‘zero covid’ policy, there would be less concern about distressed supply chains keeping inflation elevated, which may also lead investors to unwind some rate hike bets. Another way would be an implosion in global equity markets that sparks safe-haven demand for the yen.

Any of these events may be sufficient for a relief rally, but not a trend reversal.

Trend depends on BoJ

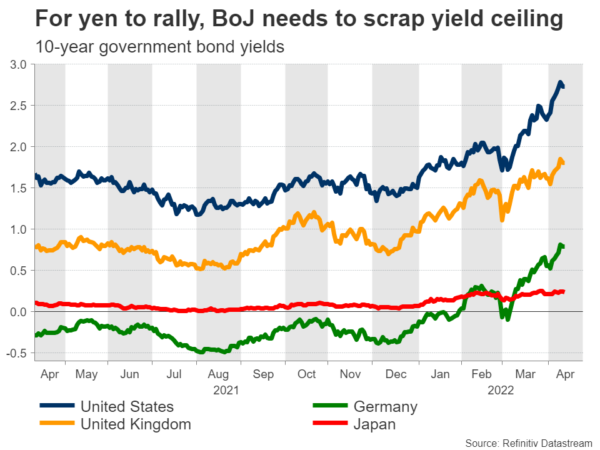

For a trend reversal, the Bank of Japan needs to turn the ship around and signal that it will tighten policy. Until that happens, the overall outlook for the yen remains negative.

The first step in the normalization process would be to widen the range in which Japanese yields are allowed to trade, essentially raising the ceiling. With the economy improving and inflation finally gathering some force, this can happen as early as this summer.

The next step would be to abandon yield curve control entirely and signal that higher rates are on the horizon. This is probably a story for year-end or early next year, but if it also coincides with ‘peak inflation’ in foreign economies, there might be a stunning reversal in the yen.

Until then, any recovery attempts could remain relatively shallow.