The Eurozone economy is losing power. A recession has become a real possibility and the upcoming PMI business surveys on Friday will tell investors exactly how high that risk is. The French TV debate between Macron and Le Pen on Wednesday could also be crucial for the euro, which remains under heavy pressure.

Losing steam

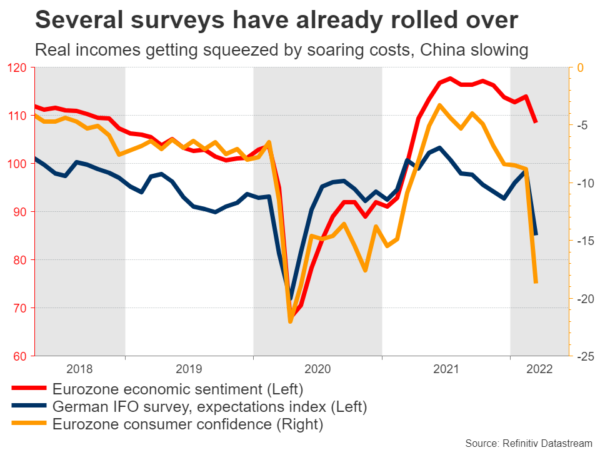

The invasion of Ukraine was a game-changer for the European economy. Energy and food prices went berserk in the aftermath, raising the cost of living for consumers. That ultimately means people have less money to spend on everything else, which is bad news for economic growth.

Then there’s the slowdown in China to consider. With major Chinese cities going into lockdown, demand for European exports has started to fade, dealing a second blow to the economy.

The third and final strike comes from the European Central Bank itself. Inflation continues to spiral upwards, so the central bank has its hands tied. It needs to raise interest rates to cool inflationary pressures, even if that means dampening growth further.

PMI disappointment?

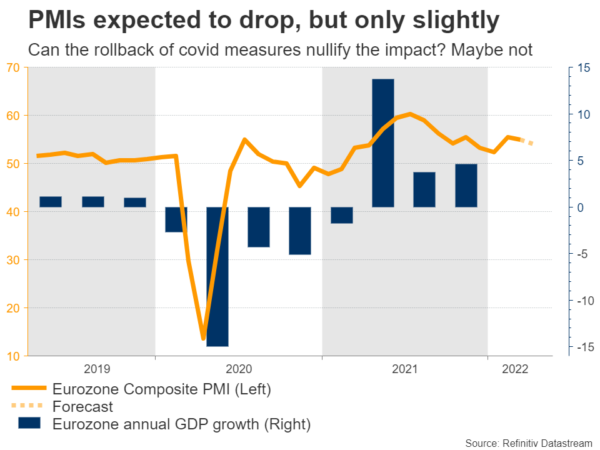

Economists expect the PMIs to take a hit in April, but only slightly. The composite index for the Eurozone, which blends the manufacturing and service sectors, is forecast to decline to 53.9 from 54.9 previously. Any number above 50 signals expansion in the economy.

The logic seems to be that the continued rollback of covid measures across Europe helped nullify the impact for businesses – that’s what happened back in March. However, this might be a miscalculation.

The war continues to drag on, energy prices keep pushing higher, many companies are complaining that supply chain problems have worsened, and the hit on demand will be clearer by now. Several surveys have already rolled over and the PMIs could follow suit.

Adding everything up, there is scope for worse-than-expected numbers on Friday. In that case, euro/dollar could head lower for another test of the 1.0755 zone. A break would solidify the downtrend, turning the spotlight towards 1.0725 next.

French election another risk

The French presidential TV debate on Wednesday will also be crucial ahead of the second round of voting on Sunday. Opinion polls are running at 53% for Macron against 47% for Le Pen, so the race is tight and the debate could make a real difference.

Le Pen doesn’t want to take France out of the European Union or the euro anymore, but her new policies would essentially paralyze the bloc from the inside. She wants to slash contributions to the EU budget, tighten immigration laws, and she would almost certainly block any further economic integration steps like Eurobonds – policies that Macron championed.

Therefore, if opinion polls tighten any further after the debate, that could keep the euro under pressure heading into the weekend as investors ramp up hedging. Of course, the opposite is true as well – a strong performance by Macron like back in 2017 could spark a relief rally in the euro. In that case, euro/dollar could encounter initial resistance around the 1.0950 region.

In the bigger picture, it’s just difficult to be optimistic about the euro until the outlook for economic growth improves. Any relief rallies could remain relatively shallow until there is some good news around Ukraine that helps cool energy prices down.